[ad_1]

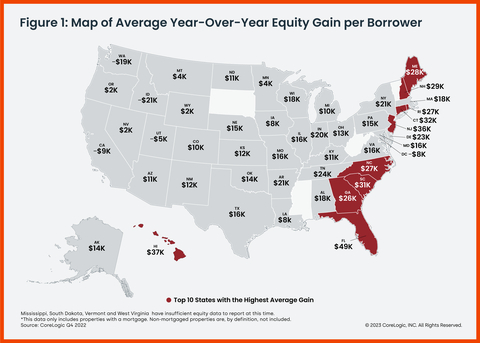

CoreLogic’s home price index slowed to a 5.5% annual rate in January – the lowest recorded since June 2020. CoreLogic estimates that 145,000 homes would regain equity if prices rose by 5%. However, if prices fall by 5%, 215,000 properties would fall underwater.

Negative equity, also known as underwater mortgages, increased 6% in Q4 to 1.2 million homes from the previous quarter but was down 2% year over year.

“Nevertheless, with 66,000 borrowers entering negative equity in the fourth quarter, the total number of underwater properties is now approaching levels seen at the end of 2021, which was the lowest since the Great Recession,” Hepp said.

“The new hot spots for equity declines are largely markets that have seen the most significant home price deceleration, including Boise, Idaho; the San Francisco Bay Area; cities in Utah; Phoenix and Austin, Texas.”

[ad_2]

Source link