[ad_1]

It’s not often interesting talking about boring term insurance, but my most recent article seemingly touched on something bothersome. When discussing why it’s essential to pay close attention to the contractual details of term insurance, I mentioned that many insurance companies have changed their policies regarding conversion.

Whereas most carriers allowed conversion to any product they offered the public at the time of conversion, many are now significantly shortening the conversion duration and/or limiting conversion to only policies no one would willingly purchase if they had a choice. It’s worth looking at these numbers.

We’ll assume a 30-year-old healthy male took out a $1 million 20-year term policy at the best preferred rate. When he did, he understood it (rightly or wrongly) to be convertible for the 20 years to any product the carrier offered, and that was the case by practice. By contract, the carrier could change this, and it did. Now, our insured is approaching age 50 and has a health issue that prevents him from getting new insurance on a favorable basis, or even at all.

Conversion Option

At preferred best, the insurance company offers a policy with an annual premium of $8,350. However, he’s now limited to a product the carrier developed specifically for conversion purposes. The annual premium for this product is $15,900.

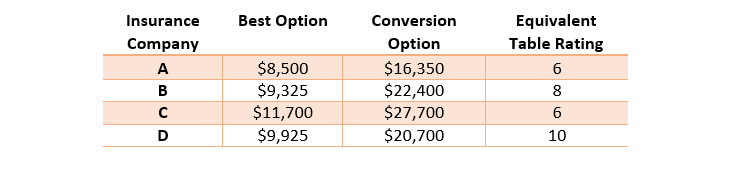

This table includes this option, along with three more.

On average, the products available for conversion have a premium more than double the premium of the competitive products the same carrier offers for new underwriting. The conversion premium for someone with the best possible preferred rating is equivalent six to 10 table ratings. Table ratings are for underwriting someone with health issues who isn’t preferred best, preferred, standard plus or standard.

Table ratings reflect extra mortality charges to compensate for the risk of death. Because each table rating represents roughly a 50% increase in mortality charges over and above standard mortality, the pricing for the conversion products for this individual with a super preferred rating (preferred best represents about 75% of standard mortality) is equivalent to someone with a 300% to 500% mortality charge. We’re talking about sliding down the rating scale a dozen spots!

This is bad enough for new term cases, as I’m sure most policy owners have no idea how this works. It’s an entirely different story for those who procured their term policies years ago with one understanding who are waking up to a different world order today as their insurance company is changing horses mid stream.

Maybe I’m old fashioned, but I find this despicable. Please make sure your clients understand. If conversion options are even a remote consideration (I’ll suggest this will be a bigger deal down the road than it seems it will be when a young, healthy individual is making these decisions), there are insurance companies that haven’t made these changes and offer their entire product line for conversion, by contract, and won’t change the deal.

Bill Boersma is a CLU, AEP and licensed insurance counselor. More information can be found at www.OC-LIC.com, www.BillBoersmaOnLifeInsurance.info, www.XpertLifeInsAdvice.com, via email at [email protected] or call 616-456-1000.

[ad_2]

Source link