[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

Governments and international organisations are stepping up financial support for Turkey and Syria as the death toll from this week’s earthquake surpassed 22,000 people, with millions expected to be displaced.

-

Japan is expected to appoint Kazuo Ueda, a respected monetary policy expert, as its new central bank chief, ending speculation among global investors over the successor to Haruhiko Kuroda, who oversaw a decade of policies designed to keep interest rates at ultra-low levels by buying vast quantities of government bonds. The yen climbed in anticipation.

-

Moldova’s prime minister Natalia Gavrilita quit, blaming a lack of support for her government as it struggles with the consequences of war in neighbouring Ukraine and efforts by Moscow to destabilise the country.

For up-to-the-minute news updates, visit our live blog

Good evening.

It is perhaps a sign of the times that news this morning of UK growth flatlining in the fourth quarter of last year was hailed by chancellor Jeremy Hunt as evidence that the economy was “more resilient than many feared”.

Output shrank more than expected in December, according to the Office for National Statistics, but GDP for the three-month period was unchanged, meaning the UK had, for now, dodged recession, defined as two consecutive quarters of negative growth.

It remains the only G7 member not to have recovered fully from the pandemic, in contrast with the US, which was up 5.1 per cent in the fourth quarter compared with 2019, and the eurozone, which was up 2.4 per cent.

One bright spot is London, where new data yesterday showed the capital powering ahead of other regions in England, thanks to growth in professional services, underlining the challenges ahead for the government in delivering on its promise of “levelling up” left-behind areas.

On the positive side, the outlook for inflation has improved since gas prices began to fall. Bank of England chief Andrew Bailey told a parliamentary committee yesterday that public sector workers needed to take this into account when asking for pay rises. The BoE predicts inflation will drop from 10.5 per cent to 4 per cent by the end of 2023.

House prices meanwhile are showing their most widespread falls since 2009 as soaring mortgage rates hit buyer demand. The average rate for new loans reached 3.67 per cent in December, the highest in a decade, according to BoE data last week.

All of which will be on Hunt’s mind as he prepares for his Budget on March 15.

Business lobby groups are calling on the chancellor to use his speech to pave the way for growth through tax breaks for investment and policies to tackle worker shortages. They have also voiced concerns that the forthcoming increase in corporation tax from 19 to 25 per cent will hit companies’ capital spending.

Brexit costs for business meanwhile continue to mount, especially in areas such as chemicals where companies now have to adhere to UK-badged regulations as well as existing EU rules, for no tangible gain. Not to mention the question marks still hanging over the broader regulatory landscape thanks to the government’s intention to “review or revoke” all leftover EU laws by the end of this year.

As UK chief political commentator Robert Shrimsley notes, the attempt by Hunt and his boss Rishi Sunak to emphasise fiscal prudence is not made any easier by noises off from Tory colleagues — especially those grouped around Sunak’s predecessor Liz Truss — pining for another dose of unfunded tax cuts, despite the last attempt ending in disaster.

Need to know: UK and Europe economy

Spurred by the decline in cash transactions, the UK government and the Bank of England have started work on the design of a “digital pound”. Read our explainer on how it might work and FT consumer editor Claer Barrett’s piece on whether it would be good for consumers.

European Commission chief Ursula von der Leyen said the EU would fight back against “massive” hidden handouts from China to its industries, as well as responding to the US threat of green energy subsidies. The finance chief of ArcelorMittal, Europe’s largest steelmaker, told the FT that Brussels needed to simplify the approvals process for investments.

German inflation hit a five-month low of 9.2 per cent, but the delayed data could lead to an upward revision to last week’s eurozone-wide figure of 8.5 per cent.

Russia said it would cut its oil output by 5 per cent or 500,000 barrels a day in response to the price cap imposed by the west. Top energy trader Pierre Andurand said Vladimir Putin had “lost the energy war”. Putin will deliver a state-of-the-union address on February 21, three days before the first anniversary of his invasion of Ukraine.

Join FT correspondents and guests at our subscriber webinar on February 23 from 1300-1400 GMT to mark the anniversary and what might happen next. Register for your free ticket at ft.com/ukraine-event.

Need to know: Global economy

China has pulled back from its participation in a subsea cable project linking Asia with Europe as tensions grow with the US over who builds and owns the infrastructure underpinning the global internet.

Hong Kong is pulling out all the stops to lure business back after three years of lockdowns in what it called “probably the world’s biggest welcome ever”. Attractions include set-up funds for international companies, visas for foreign graduates and 500,000 free airline tickets to encourage tourism.

Need to know: business

Adidas is facing €700mn in operating losses thanks to its pile of unsold Kanye West “Yeezy” sneakers. The group issued its fourth profit warning since July, laying out a worst-case scenario in which it would have to write off all the remaining inventory.

Disney is to cut 7,000 jobs, about 3 per cent of its workforce, as part of a cost-saving restructuring. The changes led to activist investor Nelson Peltz calling off his proxy fight against the company which was set to be one of the biggest corporate battles in recent years.

Credit Suisse reported its biggest annual loss since the 2008 financial crisis as investment banking slumped and clients pulled money from its wealth management business. Here’s our Big Read on a make-or-break moment for the bank.

The FT Magazine dives into the bizarre final hours of FTX and how Sam Bankman-Fried and his crew of millennial millionaires lost a $40bn crypto empire.

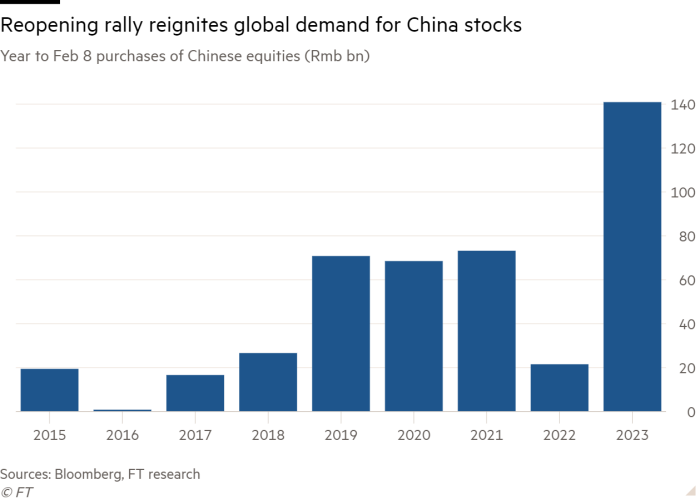

Global investors are betting big on China’s reopening, snapping up a record $21bn of Chinese equities since the start of the year. The trend has been fuelled by positive economic data published after the lunar new year holiday.

Science round up

The spread of antibiotic resistance has revived interest in the bacteria-killing viruses known as phages, first discovered and used to fight infection a century ago. Read more in our special report: Future of Antibiotics.

The inventor of the silicon technology behind solar power told the FT that combining other materials with the silicon could boost the efficiency of photovoltaic cells that convert sunlight into electricity from 25 per cent to more than 40 per cent.

The fusion energy industry called for more political support to build on last year’s breakthrough by US scientists that demonstrated the possibility of producing more energy from a fusion reaction than it consumed, dubbed “one of the most impressive scientific feats in the 21st century”.

New technology that uses fibre optics to find the causes of heart disease has begun testing at London’s St Bartholomew’s Hospital. The iKOr device measures blood flow around the heart and could eventually help many patients suffering from problems such as chest pains, whose cause cannot be identified with current techniques.

And finally, the European Space Agency is preparing for one of the most ambitious space projects ever, a 12-year mission to the outer solar system to investigate whether three of Jupiter’s moons might support life.

Some good news

University of California researchers have identified tiny organisms that not only survive but thrive during the first year after a wildfire. The findings could help bring land back to life after fires that are increasing in both size and severity.

Something for the weekend

The FT Weekend interactive crossword will be published here on Saturday, but in the meantime why not try today’s cryptic crossword?

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link