[ad_1]

(Bloomberg Opinion) — Walmart Inc. inched closer to a $15 minimum wage last month, drawing tepid praise from even some of its strongest critics. The largest US employer joined Macy’s Inc., CVS Health Corp. and Target Corp., all of which have raised starting wages in the pandemic era of labor shortages and soaring inflation. While $15 (or $14 in Walmart’s case) is just enough for a full-time worker with no children to live in the US county with the lowest cost of living, these are moves in the right direction.

Still, a crucial element missing in conversations around minimum wages and the retail industry is automation. Already in motion before the pandemic, automation has kicked into high gear since, with retailers turning to self-checkout, robotic sorting machines and automated customer service to run their businesses at a lower cost. For companies, that’s good news. But for retail workers, it’s complicated.

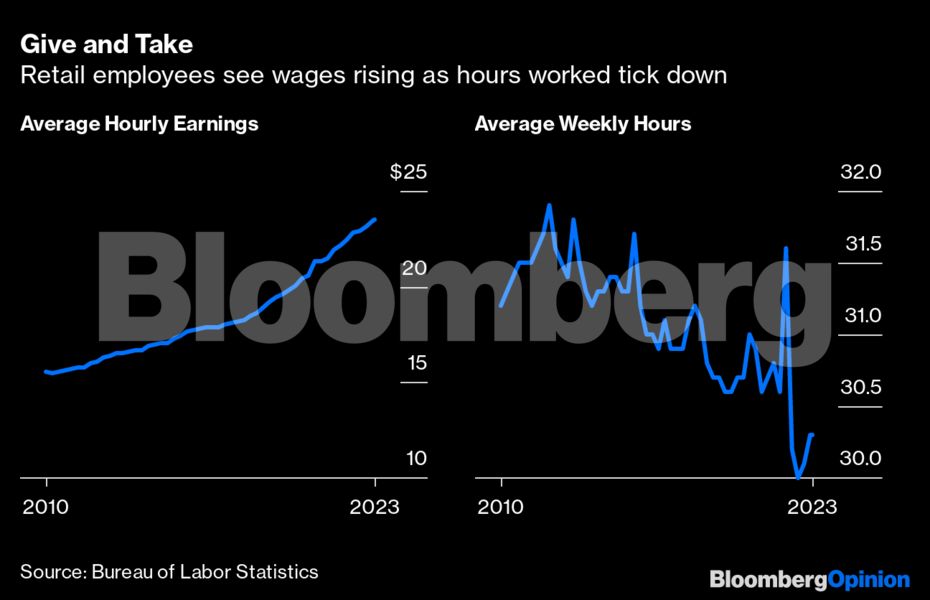

Short term, fewer low-paid workers will be needed because of cheaper and more efficient robots. And while starting wages may increase for those who remain, fewer hours will be available as companies look to control costs, which won’t necessarily translate into increased income. As the country recovers from the economic devastation of the pandemic, companies and policy makers have a long-term opportunity to invest in reskilling service workers rather than treating them as a cost that needs cutting and forgetting.

Historically, companies ramp up restructuring after large economic shocks with an eye toward labor-saving technologies. For instance, new firms popped up in the fallout of the great financial crisis that automated the tracking of freelancers, generating tax returns and others tasks across production lines. This time is no different. As retailers brace for a possible recession (mild or not) and recover from a period where service workers were in short supply, they are looking for ways to stave off future labor disruptions and keep their businesses running smoothly.

Walmart employs roughly 1.7 million workers and has made moves recently that suggest it is reorganizing its labor force. Chief Executive Officer Doug McMillon told investors at a conference in December that, while still years away, automated warehouses full of unmanned carts will one day move and sort products and may also unload store deliveries, “eliminating a lot of the hours that we invest in today in the back room of our stores.” With lower labor costs and added income from advertising and fulfillment services, “that’s when you have a more attractive income statement,” he said. Amazon.com Inc., which employs around 1.5 million people around the world and raised its average starting wage last fall to more than $19 an hour for most warehouse and transportation employees, is on track to use more robots than people by 2030, predicts Ark Investment Management CEO Cathie Wood, who invests in disruptive innovations.

Walmart and Amazon are not alone in their automation investments as they also raise wages. Macy’s has rolled out new semi-automated systems that reduce the amount of warehouse space needed to fulfill online orders. CVS uses Microsoft Corp. technology to automate its prescription and refill intake. With storelfilling most of its orders, Target depends on predictive inventory positioning tools to anticipate demand and is experimenting with automated sorting devices. Three of the five most automated jobs across corporate America are in retail, according to the most recent estimates from McKinsey & Co. published in 2019. Given what’s happened since, the industry stands to be disproportionately disrupted by automation.

We’re not in our robot apocalypse era — yet. Retailers have been relatively conservative in reducing their workforce compared to tech companies, for example, in recent months. Instead, they’re letting natural attrition do most of the work for them and using technology to fill the gaps. While retail has added jobs over the last two years from its plunge in March 2020, it has still lost nearly 400,000 jobs since its pre-pandemic peak in 2017.

So although hourly retail wages are rising, automation will reduce the avenues available to low-skilled workers, further increasing the gap between rich and poor. A 2021 International Monetary Fund analysis found that in previous post-pandemic eras inequality increased more for economies with high robot density and new adoption because automation often replaces the routine tasks done by lower-paid workers. More educated workers with higher incomes are likely to benefit because they’re building the robots, not losing job opportunities to them. ChatGPT and AI-enabled programs like it may well change that with time, but not yet.

This reshuffling of the labor force comes after pandemic shortages briefly infused workers with more power than they had in decades. Retail workers, fed up with angry customers and abuse in stores over masks and social distancing policies, left the industry in droves to search for better jobs. Companies added new benefits like paid sick leave, hazard pay and annual bonuses — benefits worker advocates had been pushing employers to offer for years. At the same time, public empathy helped fuel support for union efforts at Starbucks Corp., Amazon, Apple Inc., Target and Recreational Equipment Inc.

Now, the scales are tipping back in favor of retail employers and automation is only strengthening that position. Companies would be wise though not to discount their workers. Robots can’t completely replace people and resistance to automation can undercut the value of such transformations for companies. It’s also more effective — both on cost and in strengthening corporate culture — to retrain an existing employee than hire a new one.

Some retailers are heading that way. Walmart, for example, launched a global education program last year where associates can learn new job skills as part of their ongoing adoption of technology, build leadership skills, and work toward college degrees to advance their careers. Whether or not this will lessen automation’s blow to the retail workforce remains to be seen. But, there’s little question it’s a step in the right direction.

More From Bloomberg Opinion:

Want more Bloomberg Opinion? OPIN

To contact the author of this story:

Leticia Miranda at [email protected]

© 2023 Bloomberg L.P.

[ad_2]

Source link