[ad_1]

Mortgage borrowers face being stranded on the wrong side of a growing debt divide if they have to refinance a fixed-rate home loan this year, with younger homeowners set to be hit the hardest.

With millions of borrowers set to roll off fixed-rate mortgage deals during the course of 2023, the “lottery” of rising costs could plunge more middle-income households into financial difficulties, according to the Financial Resilience Barometer report from Oxford Economics and Hargreaves Lansdown.

Almost 90 per cent of the lowest-income households have poor or very poor financial resilience, but almost one-third of middle-income households now also fall into this category, showing how higher mortgage costs are pushing the squeeze further up the income scale.

“Younger borrowers are particularly exposed, because they’re likely to have stretched themselves to buy when prices were higher,” said Sarah Coles, senior personal finance analyst at Hargreaves Lansdown.

“To add insult to injury, at this stage in life they’re also less likely to have as much savings to fall back on, so ramping up mortgage repayments could mean they end up building a mountain of short-term debt.”

Some lenders are set to trim mortgage rates this week as the housing market slows, but they nonetheless remain at much higher levels than a year ago.

The average two-year fixed rate loan was 5.8 per cent at the end of 2022, according to price comparison site Moneyfacts, up from 2.4 per cent at the close of 2021.

The difference would add nearly £500 to monthly costs based on a typical £250,000 repayment mortgage, according to the Financial Times’s calculations.

Although the headline rate of inflation is expected to start to fall in 2023, economists warn that the cost of living crisis is far from over as low-income households remain less financially secure than they were before the pandemic.

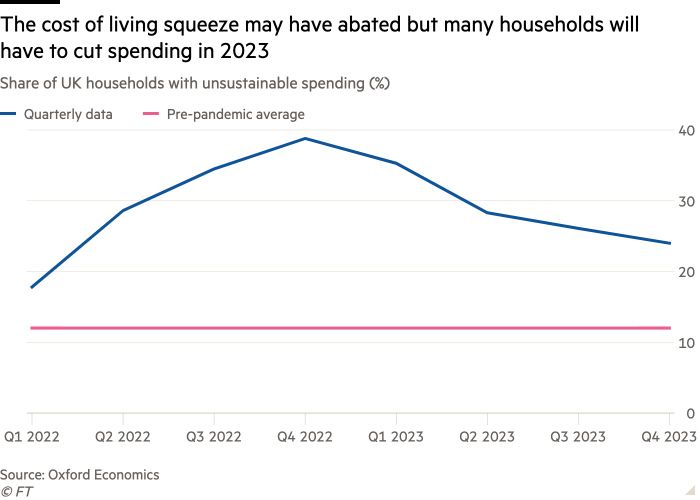

The last quarter of 2022 is expected to be the peak of the cost of living squeeze with nearly 40 per cent of UK households having to cut back, raid their savings or take on debt to maintain usual levels of spending, according to Oxford Economics.

By the end of 2023, this figure is expected to have reduced to 24 per cent of households. However, the report’s authors warned that households without savings to draw on were more at risk of falling into problem debt.

[ad_2]

Source link