[ad_1]

This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent straight to your inbox.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

We expected our last edition to spark some stimulating responses from Moral Money readers, and you didn’t let us down.

Friday’s lead article asked what could be the impact if the chief executives of big US companies had their annual pay cut to $1m, with the remainder distributed among their colleagues. To some readers, the thought experiment highlighted a pay disparity that has grown over the past three decades to unjustifiable levels.

“Were we doing a worse job?” asked Andrew Seth, who led Unilever subsidiary Lever Brothers in the early 1990s, referring to the more modest executive pay levels of that era. “I don’t think so.”

Another reader noted that the analysis understated how much of the pay pool was absorbed by executive teams, since many big companies have multiple senior managers on “similarly outlandish” incomes.

In contrast, London Business School’s Alex Edmans took issue with what he saw as “the irrelevance of CEO-worker pay ratios”. Edmans wrote that there was, in fact, some evidence to suggest a positive correlation between high pay disparities and company productivity, but that such findings have sometimes been ignored in favour of research that is more “politically acceptable”.

Still another reader worried that increased public disclosure of pay was having a perverse effect, by encouraging executives to compare packages. “A sense of entitlement sets in and one-upmanship. It has nothing to do with actual contribution or value to the organisation or society.”

Executive pay is set to remain a hot topic — not least at shareholder meetings, where asset managers are under pressure to show results from their engagement on environmental and social priorities. Read on for more on that theme, as well as a looming shareholder showdown at German power giant RWE, and a look at the green credentials of Asia’s tech titans. — Simon Mundy

After Engine vs Exxon, the next David vs Goliath battle brews in Germany

It was the 2021 “David-and-Goliath tale for Wall Street” that will go down as one of the biggest business stories of the year. Despite owning a minuscule 0.02 per cent of Exxon, start-up activist fund Engine No 1 won three board seats at the oil company earlier this year.

Now, a similar activist campaign is brewing in Germany. RWE, Germany’s largest electricity producer, is facing pressure from Enkraft, a small investment company outside of Munich.

Much like Engine No 1’s campaign at Exxon, Enkraft has been using a small stake in RWE to pressure the company to reduce carbon emissions and to focus on renewable energy.

The problem at RWE is its development of lignite, an especially dirty coal. This business division has caused RWE’s shares to underperform, Enkraft has argued, as many institutional investors have policies that they cannot hold coal companies. Additionally, RWE’s shares “significantly lag” EDP Renováveis, Iberdola and other renewable energy providers in Europe, Enkraft has said.

On a Zoom call with Moral Money this week, Enkraft’s managing director Benedikt Kormaier and adviser Thomas Schweppe drew parallels between their campaign at RWE and Engine No 1’s campaign at Exxon.

On one hand, you have the sustainability argument for RWE to divest from lignite, but “you also have a very clear value argument,” said Schweppe, adding that by spinning off the lignite business, RWE’s shares will probably rise. “Not only is it good for the environment, but it is also the very right thing for shareholders. So what are you waiting for?” he said.

Frustrated by RWE’s lack of urgency on the lignite issue, Enkraft is preparing to take its fight to a vote at the company’s annual meeting in April 2022. The company already has the necessary shares in RWE to file a proposal, and Enkraft is starting to hear support for its cause from some German asset managers, Kormaier and Schweppe said.

In a statement to Moral Money, RWE said it was already phasing out coal and would close another six lignite units by the end of 2022. The company said it was investing €50bn gross by 2030 on green energy.

This war of words shows that the battle between activists and carbon-intensive businesses will only heat up in 2022.

Hedge fund Elliott Management this month called for sweeping changes at Scottish energy group SSE, including the split of electricity networks and renewables divisions into two separate listed companies. Boardrooms must beware of the green-caped barbarians knocking at the gate. (Patrick Temple-West)

US asset managers lag European rivals in supporting ESG shareholder proposals, study finds

The world’s biggest money managers have been talking an increasingly impressive game when it comes to their environmental and social impact. But when it comes to using their votes to drive action, there is a marked transatlantic divide.

That’s one of the findings in a new report from London-based non-profit group ShareAction, which studied how 65 of the largest US and European asset managers handled shareholder votes on environmental and social issues.

European asset managers voted in favour of nearly two-thirds of these proposals, on average. In comparison, their US counterparts backed 39 per cent of such proposals. And the overall rate of support among the world’s six biggest asset managers — all based in the US — was even lower than the national average.

“Power not used is power abused,” Catherine Howarth, ShareAction’s chief executive, told Moral Money. “The world is entitled to expect better of institutions that control this share of the votes.”

Some individual asset managers showed rapid changes in voting behaviour since last year. Credit Suisse Asset Management backed just 16 per cent of ESG resolutions in 2020; this year that shot up to above three-quarters. And while global market leader BlackRock had a less impressive rate of 40 per cent this year, that was more than triple the figure from 2020.

BlackRock’s increased use of its voting rights has accompanied its growing investment to assess ESG issues — though it still voted overwhelmingly against resolutions on specific areas including high executive pay and public health. The rest of the biggest US asset managers had significantly lower rates of “yes” votes on ESG-related resolutions this year — notably Vanguard and State Street, at 26 and 32 per cent respectively.

When I raised these issues with Karen Wong, State Street’s head of sustainable investing, she said the focus on voting rates was too simplistic. “We don’t think it’s as black and white as that,” she said, highlighting the conversations that asset managers have with corporate management on these themes. “Oftentimes, you actually get more from the engagement conversation than just that one simple vote.”

But this argument is growing tired, Howarth argued. And after the welter of corporate climate commitments in recent months, she added, groups such as ShareAction will expect asset managers to start using their votes against the directors of companies who break their emissions pledges. “It’s just not good enough to be sitting on the sidelines, supporting management over and over again,” she said. (Simon Mundy)

Tips from Tamami

Nikkei’s Tamami Shimizuishi helps you stay up to date on stories you may have missed from the eastern hemisphere.

Asian technology companies are lagging their western counterparts on green commitments, a new report shows.

Greenpeace East Asia examined the climate actions of the top 30 technology companies on the continent. Sony, Japan’s tech giant, obtained the highest score, but the grade was nothing to be proud of: C+.

The consumer electronics and entertainment conglomerate has committed to achieving 100 per cent renewable energy by 2040, pledged to reduce emissions across its supply chain, and achieved a relatively high level of data transparency. However, it has made little progress in increasing its renewable energy use — which accounted for less than 10 per cent of the company’s total power consumption in 2020, Greenpeace East Asia said.

Samsung Electronics, Xiaomi, and Alibaba were among the lowest scoring groups in the ranking, all receiving a D or D-. The three companies have yet to announce global 100 per cent renewable energy pledges or greenhouse gas emission reduction targets. Xiaomi and Alibaba, two Chinese companies, also scored poorly on data transparency.

Among all the companies examined only half have issued net zero or carbon neutrality pledges. And only three companies — Japan’s Sony, Toshiba and Hitachi — have included supply chain emissions in their greenhouse gas reduction targets. Meanwhile, most big US tech companies, including Apple, Amazon and Microsoft, have already set Scope 3 targets. The last time Greenpeace conducted similar research on the US companies (in 2017), Apple and Google received an A grade while Microsoft and Amazon were rated B and C respectively.

Ruiqi Ye, climate and energy project manager at Greenpeace East Asia, said Asian companies have been slow with their climate actions due to “a lack of external pressure and incentives to switch to renewable energy in the region”. But the situation has changed rapidly since 2020, when the Chinese, Japanese and South Korean governments all committed to achieving net zero by mid-century.

Ye urged US and European investors to engage more with Asian tech companies. “Tech companies [in Asia] are open to having dialogues with investors,” he said.

Chart of the day

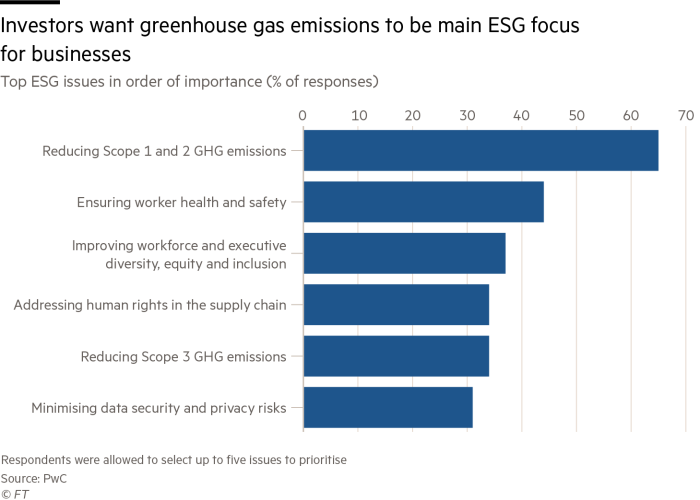

Investors rank reducing scope 1 and 2 emissions, or emissions that occur directly from an organisation’s production and the energy needed to power it, as the top ESG priority for businesses, according to a report by accounting firm PwC.

While investors are pushing the ESG fight forward, it is worth noting that outside the natural resources industry, a vast majority of businesses’ emissions come from their supply chain, or scope 3 emissions. When polled, investors rank reducing scope 3 emissions as the second lowest priority on the list.

Smart reads

-

MSCI, the giant index provider, has carved a lucrative niche for itself by rating companies on ESG scores. But a Bloomberg analysis found “there’s virtually no connection between MSCI’s “better world” marketing and its methodology” for ESG ratings. Bloomberg analysed MSCI ratings upgrades for S&P 500 companies and found “the most striking feature of the system is how rarely a company’s record on climate change seems to get in the way of its climb up the ESG ladder — or even to factor at all”.

[ad_2]

Source link