[ad_1]

In early 2020, before the pandemic and the war in Ukraine, a small story revealed something important about the state of Britain. British Gas increased the minimum amount by which people could top up their prepayment gas and electricity meters from £1 to £5. This caused a backlash. Some customers just couldn’t afford £5 in one go. MPs got involved and British Gas reversed course.

When it comes to energy, the UK is really two different countries. There is the country in which people pay smoothed out bills, usually by direct debit, and there is the country in which people have to pay for what they use in advance. In the latter country, some have smart meters they can top up online, but many have “dumb” ones that have to be topped up at the Post Office or certain newsagents. You have to remember to top up before you go away so that your freezer doesn’t defrost. You also have to manage the seasonal peaks in how much energy you’ll need. In this country, if you owe money to your energy company, then each time you top up, a proportion of that money is taken to repay your debt. You also pay a slightly higher price for your energy than people on direct debits, because the companies say the system costs more to run.

Some people prefer prepayment meters because they can control what they are spending with no bills. Many others don’t like them and don’t want them — but their landlord insists, or energy companies have imposed them because of debt.

The number of people in debt to energy companies is rising sharply thanks to the energy crisis. Data from Ofgem, the regulator, shows the number of customers repaying a debt to their supplier in the second quarter of this year was 1.5mn and 1.1mn respectively for electricity and gas, the highest in more than 15 years. Energy companies are only supposed to move indebted customers to prepayment meters as a last resort and not if they’re vulnerable, but charities and Ofgem say they aren’t always doing the checks they should.

Amy Taylor, a debt adviser and chair of the Greater Manchester Money Advice Group, was on the phone last month with a scared woman with a baby and a disabled child. The woman was hiding upstairs from a man with a warrant to fit a prepayment meter. Taylor ended up in a four-way conversation to resolve the issue. “He had the supplier on speaker phone, the lady had me on speaker phone, it was a bizarre situation.”

The switch to prepayment doesn’t always involve someone at the door. If you have a smart meter, companies can switch you over to prepayment mode remotely. Ofgem recently chastised energy companies for switching people remotely “without full regard to the licence conditions, leading to serious detriment to these consumers”.

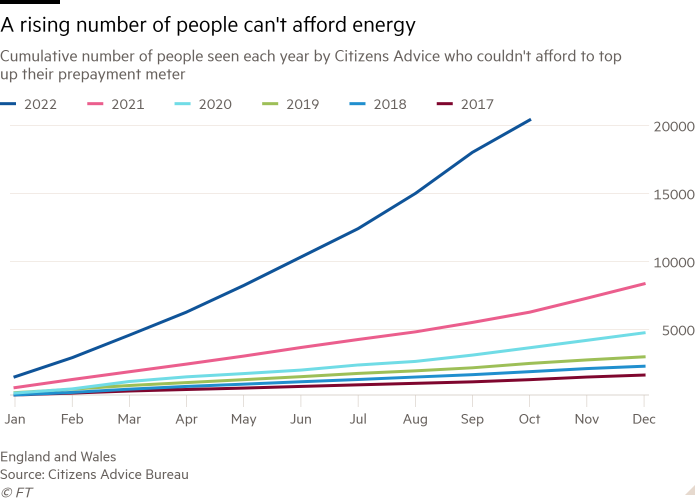

If people are getting into debt because energy is too expensive for them, expecting them to pay for that energy (at a slightly higher rate) and repay debt simultaneously seems unrealistic. Citizens Advice data shows a steep rise in people who can’t afford to top up their prepayment meter at all. The Fuel Bank Foundation, which provides emergency electricity and gas for people who are living without or will be in the next day or two, has seen a 75 per cent increase in referrals this year. Roughly half of those people are in work. “We’re seeing people who have very traditional kinds of jobs — nurses, people who work in schools,” says Matthew Cole, who runs the foundation.

What can be done? One idea would be a temporary debt repayment moratorium. Ovo, one supplier, has done this already, promising that “every penny put on the meter will go towards heating, not paying back debt this winter”. Citizens Advice, meanwhile, has called for a ban on moving people to prepayment over the winter. An even better idea would be to get rid of the system for everyone except those who prefer it. France, for example, has no prepayment meters. Rather than disconnect indebted customers there, EDF reduces power to a minimum 1 kVA — enough to provide light and keep the fridge and freezer on.

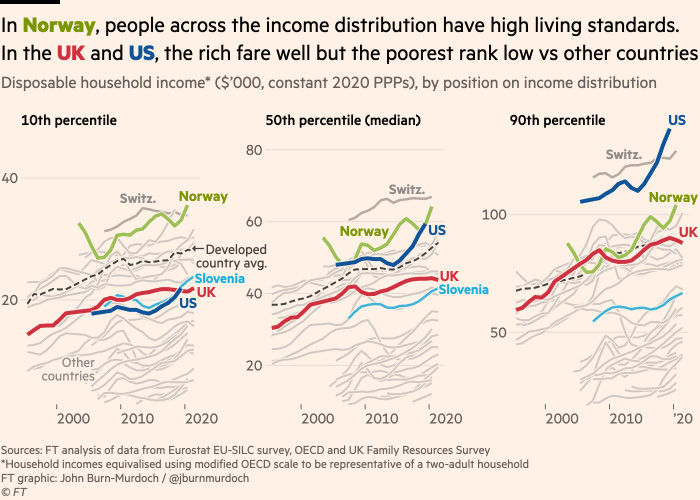

But there is a bigger picture here too. The typical incomes of the poorest fifth of the population were almost no higher on the eve of the pandemic than they were in 2004-05, according to the Resolution Foundation. The poorest fifth of households in Britain are more than 20 per cent poorer than their French and German equivalents. The country’s problems with a threadbare safety net have been laid bare by the crisis, but they weren’t created by it. It was always going to be a hard winter. It didn’t need to be this hard.

[ad_2]

Source link