[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Senior Walt Disney executives led a rebellion against chief executive Bob Chapek in recent weeks, which resulted in his ousting and replacement with predecessor Bob Iger, according to people familiar with the matter.

The covert campaign to overthrow Chapek, which began in the summer, came after the outgoing chief lost the confidence of some members of his top team during a tumultuous 33 months at the helm of the media empire.

“A lot of people were approaching the board, Iger loyalists who felt marginalised” — One person with knowledge of the talks

Shares in Walt Disney rallied 6.3 per cent yesterday as investors wagered that Iger, one of America’s most celebrated media executives, could lift morale and boost returns at the company’s costly streaming unit. By yesterday afternoon, Iger had dismissed Kareem Daniel, a trusted Chapek ally who ran the group’s streaming strategy.

Disney executives began approaching the board, which is chaired by Susan Arnold, a few months ago to express concerns about Chapek’s leadership. Christine McCarthy, chief financial officer, was among the executives who complained, three of the people said. Disney declined to comment.

The final straw was Disney’s earnings release on November 8, during which Chapek reported the company’s streaming business had lost $1.5bn during the most recent quarter. Three days later, Chapek announced job cuts.

Five more stories in the news

1. Keir Starmer warns businesses of end to ‘low pay and cheap labour’ The Labour leader plans to tell the CBI conference in Birmingham today that the days of “low pay and cheap labour” from overseas must end, in his strongest comments on immigration to date. Both of the UK’s main political parties have rejected calls by companies for looser immigration rules.

2. ECB’s Holzmann backs 0.75 percentage point rise in December The European Central Bank needs to maintain the pace of rate rises at its next vote to convince the public that policymakers are “serious” about taming inflation, Robert Holzmann, head of the National Bank of Austria and member of the ECB’s governing council, told the Financial Times.

3. European football teams ditch rainbow armband plan A bid by the Netherlands, England and Wales to promote inclusion during the World Cup collapsed yesterday after the teams said Fifa threatened them with yellow cards. The teams had planned to wear rainbow-coloured armbands to oppose discrimination while playing in host country Qatar, where homosexuality is illegal.

4. Two Estonians accused of $575mn crypto fraud Sergei Potapenko and Ivan Turõgin have been arrested and charged in connection with what US prosecutors describe as a $575mn crypto fraud and money laundering scheme. The pair was indicted on accusations of defrauding hundreds of thousands of victims, according to the US Department of Justice.

5. Eskom warns of lack of funds to fuel South Africa’s back-up power plants The country’s struggling state electricity monopoly says it has run out of money to buy diesel for critical back-up power plants, forcing President Cyril Ramaphosa’s government to find emergency funding or risk even more severe rolling blackouts.

The day ahead

Economic indicators The OECD releases its latest Economic Outlook with projections for the world economy, the eurozone publishes November consumer confidence data and the UK has public-sector borrowing figures for October. (OECD)

Central banks Hungary and Nigeria have their monthly monetary policy committee rate-setting meeting. The African nation is projected to raise borrowing costs after reporting 21.1 per cent inflation last month. (Bloomberg)

Astana talks on Syria Delegations from Russia, Turkey, Iran, the Syrian government and Syrian opposition will gather in Kazakhstan’s capital to discuss humanitarian, socio-economic and political issues in Syria. Representatives from the UN, Jordan, Lebanon and Iraq will attend as observers. (Al Jazeera)

FTX bankruptcy hearing An initial hearing is scheduled in federal bankruptcy court before Judge John Dorsey, who has agreed to hear a motion to transfer some proceedings from New York to Delaware. FTX’s subsidiaries filed for bankruptcy after the crypto group was unable to meet billions of dollars of withdrawal requests from customers.

What else we’re reading

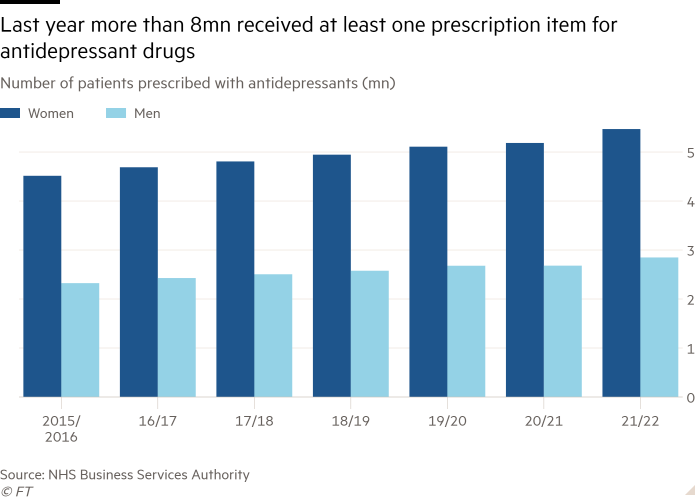

There’s a deepening mental health recession Employee assistance programmes face a swelling wave of complex mental health problems brought to them by people with nowhere else to turn. What’s behind the increase? Sarah O’Connor explores.

Saudi Arabia’s green agenda The world’s top crude exporter has for decades happily burnt billions of barrels of oil to fuel power plants, desalination units and industries at heavily subsidised rates. Now, investment in solar and wind might help the kingdom meet emissions targets — and pump more crude to sell.

Europe faces migrant influx The number of asylum applications is rising across the continent. As of August, applications in the EU, plus Norway, Switzerland, Iceland and Liechtenstein, were up 58 per cent compared with the same period last year, to 578,875, according to the bloc’s asylum agency. The influx is stoking fears of division among member states.

Can the UK improve its Brexit deal? After a period of dormancy, the debate over the shape of the UK’s post-Brexit trading arrangements has been suddenly reawakened with Rishi Sunak’s premiership. FT public policy editor Peter Foster looks at how the deal can be improved and what might be possible if a future government takes a different approach.

Iranians put jobs before pro-democracy protests Industrial action was instrumental in overthrowing the monarchy during the 1979 Islamic revolution. Workers this time around have responded cautiously to one of the largest and longest-lasting demonstrations in Iran’s history.

Books

From business and sport to audio books, our annual round-up brings you top titles picked by FT writers and critics — as well as FT readers’ best books of 2022.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link