[ad_1]

One thing to start: Donald Trump’s plan to take his media business public is in jeopardy after shareholders failed to approve a motion that would allow their blank-cheque acquisition company to keep pursuing a deal with the former US president in the face of scrutiny from federal prosecutors.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

Thoma Bravo dips out on Darktrace

-

Citi gains a legal edge on Revlon’s creditors

-

Russian oligarchs’ unhappy year

Thoma Bravo emerges in London, then goes dark

US private equity group Thoma Bravo planted its flag in London on Tuesday by announcing the opening of a local office from which the $122bn in assets buyout group will globalise its dealmaking operations.

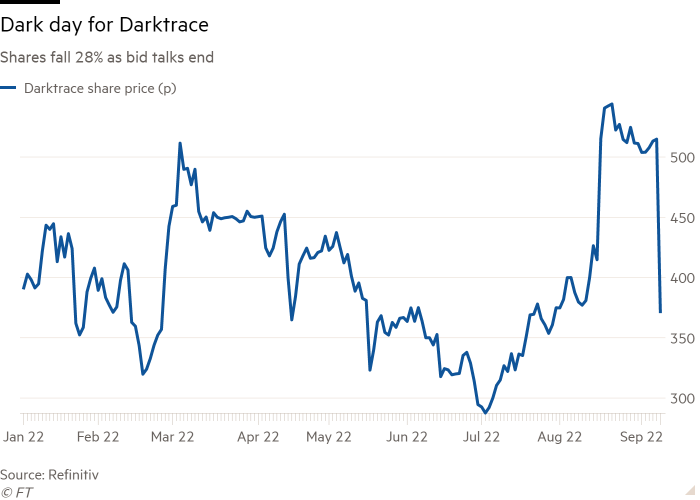

Yet, two days later it pulled the plug on a takeover of Darktrace, one of the most prominent UK technology listings in recent years, which emerged as a notable takeover target this summer in a subdued M&A market.

Thoma Bravo’s exit from the bidding process sent Darktrace’s shares cratering 30 per cent on Thursday and marked an inauspicious debut on the European dealmaking scene for the US private equity firm.

The collapse, which will certainly raise some eyebrows around Thoma Bravo’s strategy, might have raised even more questions had it moved forward.

Why?

Darktrace, which specialises in artificial intelligence-based software to protect companies from cyber attacks, has been one of the UK’s more polarising companies because of its ties to Mike Lynch, the British software entrepreneur.

The Autonomy founder has been charged with 14 counts of conspiracy and fraud linked to Autonomy’s $11.6bn sale to Hewlett-Packard in 2011.

Lynch, who has denied any wrongdoing, stepped down as a director of Darktrace in 2018 but continued to serve on the company’s advisory council until 2021.

Darktrace has also attracted scepticism about its products and accounting. UK hedge fund ShadowFall, which has a short position in the company, has said it overestimates its potential customer base and underspends on research and development compared with peers.

Darktrace acknowledged an accounting mistake in its second-quarter results published on Thursday.

Thoma Bravo has been quiet on its reasons for cutting bait. But the firm, which is the most active buyer of software companies worldwide, remains interested in downtrodden European markets like the UK.

“[The] launch of a London office represents a significant step forward in our ability to partner with some of the best software companies in the world,” said founder Orlando Bravo.

US-based buyout groups such as Apollo Global have abandoned a string of deals in London like pharmacy chain Boots and Pearson, underscoring the challenges of getting deals in the UK done.

The emergence of Thoma Bravo will have London bankers salivating, nonetheless.

Thoma Bravo has done deals at a furious pace in recent years, privatising about a dozen public companies since 2020. It has just raised a further $25bn in new investor money that will increasingly be directed to the UK.

Finders aren’t necessarily keepers

Last month, a group of optimistic minority investors in Revlon sought to convince debt holders of the distressed cosmetics company that it was due to be the next Hertz.

That’s to say that the unexpected jolt in its share price in late June, less than a week after it filed for bankruptcy, was more than just a meme stock-like phenomenon. But the temporary surge has proven to be just that.

Revlon’s drama returned on Thursday when a US appeals court ruled in favour of Citigroup in its effort to claw back about $500mn of its own money that it wired to the cosmetics company’s lenders by mistake, DD’s Sujeet Indap and the FT’s Josh Franklin report.

The feud stemmed from a $900mn term loan administered by Citi on behalf of Revlon. In August 2021, the Wall Street bank accidentally repaid the full principal balance instead of making only an $8mn intended interest payment.

The lipstick and mascara maker had been in the midst of contentious debt restructuring that pitted various creditors and the company against each other. While holders of $400mn of the loan quickly returned the money to Citigroup, funds including Brigade Capital Management and HPS Investment Partners refused to send the cash back.

A federal judge sided with the hedge funds last year, ruling that they should be able to keep the money on the guise that they had no reason to believe the payment was an accident.

But the 2nd Circuit US Court of Appeals in New York rejected that reasoning, writing that Brigade, HPS and the other lenders “are not shielded from Citibank’s claims for restitution”, and that they were aware of “red warning flags consisting of facts suggestive of accident or mistake”.

The case will now be sent back to the lower court to redecide based on its new guidance.

Revlon, which has struggled to keep up with savvier social media-driven rivals or adapt to the post-pandemic beauty market that favours higher-end brands, now faces the prospect of footing the bill for the returned funds.

The ongoing legal saga could also spell trouble for New York billionaire Ron Perelman, whose 83 per cent stake in Revlon could diminish in value if the bankruptcy case goes south.

The tabloid-famous debt financier has parted with his oceanfront East Hampton estate and pieces from his vast art collection among other assets as Revlon’s financial situation worsens.

Oligarchs play the blame game

It has never been a worse time to be a Russian oligarch. Villas have been seized, superyachts have been auctioned off, and a Premier League football club has fallen upon new ownership.

One might presume that the sanctions preventing Russian tycoons from maintaining their fortunes in the west could motivate a “palace coup” against the Kremlin.

But that isn’t the case, our FT colleagues Max Seddon and Polina Ivanova found while reporting this Big Read.

Through interviews with seven sanctioned Russian oligarchs and other sources, a picture emerged of a group of oligarchs embittered by both Putin and his western foes, which they believe have scapegoated them for events beyond their control.

Two notable Russian businessmen challenging the sanctions against them are Mikhail Fridman and Petr Aven. Together they built a London-based empire after selling their stake in oil major TNK-BP to state-run giant Rosneft for $14bn in 2013 and forming investment firm LetterOne.

“The guys are really pissed off and frustrated,” said a senior banker, who knows the two oligarchs well. “They are energetic people and fighters but it’s a very difficult fight.”

The view that oligarchs have little sway against Putin’s regime isn’t unheard of. “There are two kinds of oligarchs in Russia,” said Michael McFaul, a former US ambassador to Moscow. “There are the 1990s oligarchs, and we’re all very proud when we sanction them and their yachts get taken. But let’s be clear: those guys have zero influence over Vladimir Putin.”

The other kind, McFaul added, hold business interests that are too intertwined with Putin’s affairs to challenge his authority.

Many oligarchs hold similar fears. “They say they are scared of being poisoned, but what they are really worried about losing is their money and reputations,” said a senior Russian businessman.

Job moves

-

Addy Loudiadis is stepping down as chief executive of Rothesay, a pensions insurance specialist she co-founded within Goldman Sachs 15 years ago. She will be replaced by Rothesay managing director Tom Pearce.

-

Shopify has named Morgan Stanley banker Jeff Hoffmeister as chief financial officer, succeeding Amy Shapero, who is stepping down in October.

-

Francisco Partners has hired Ashley Evans as a partner focusing on software investments. She was a managing director at Carlyle Group.

-

Latham & Watkins has hired Alejandro Ortiz as an M&A and private equity partner in Madrid. He joins from Linklaters.

-

Law firm Pallas Partners has hired a team from Boies Schiller & Flexner including Duane Loft, who will lead its new practice in New York, and Melissa Kelley, who joins as counsel.

Smart reads

Shifting the narrative A potential deal between Vice and Saudi Arabia-backed MBC has raised ethical questions following the 2018 murder of Saudi journalist Jamal Khashoggi, and the US digital media group’s efforts to distance itself from the kingdom at the time, the New York Times reports.

Constructive criticism The UK Treasury has historically played the role of saviour when Britain endures a financial rough patch. In this Guardian long read, scholar Aeron Davis argues that it deserves more scrutiny.

Inside the Bed Bath & Beyond tragedy In the weeks before he fell to his death from a high rise New York building, the ailing retailer’s CFO Gustavo Arnal was battling intense stress. His discussions with the company about taking a break were left unresolved, the Wall Street Journal reports, as some board members did not want to swap executives amid a restructuring.

News round-up

EY bosses approve radical break-up of Big Four firm (FT)

Banks try to offload $15bn of Citrix buyout debt to ‘gun-shy’ investors (FT + Lex)

Deloitte revenues hit record on back of tech consulting boom (FT)

Melrose to spin off auto business in GKN break-up (FT + Lex)

Steve Bannon indicted for alleged fundraising fraud (FT)

Evergrande crisis deepens after lender seizes headquarters (FT)

Morrisons’ takeover of McColl’s ‘will not harm majority’ of rival firms (The Guardian)

Lloyd’s of London expects £1.25bn hit from Ukraine war (FT)

Kim Kardashian/buyouts: TV star swaps social capital for the real thing (Lex)

Recommended newsletters for you

[ad_2]

Source link