[ad_1]

On June 24, 2022, Roe vs. Wade was overturned through the Dobbs vs. Jackson Women’s Health decision. This decision will undoubtedly have both short- and long-term negative economic impacts on the individual, state and national levels. It is important for advisors to have a holistic understanding of these implications, as well as the resources available to help you guide your clients through this sensitive and emotionally charged time. This guide is designed to help you to first understand the economic impact, and then to effectively communicate the resources and investment options available to your clients who are looking to take action in response to the reversal.

The Labor Market

Understanding how and why this decision will impact the national and state economies is an important first step to help you prepare you for a sensitive conversation with your client. Given how emotionally charged this topic can be, sticking to the facts, particularly when it comes to educating them on the economic implications can help facilitate a more productive conversation.

As birth rates across the country rise, two major trends will undoubtedly emerge:

1.More women will have to defer or forgo all together pursuing higher education; and

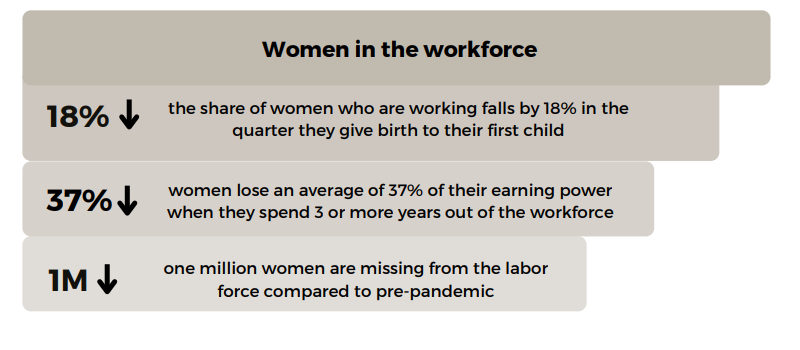

2. More women will drop out of the labor force entirely due to the high cost of childcare and lack of adequate maternity leave.

Women’s careers and their opportunities to become financially independent will be disproportionately effected as a direct result of the overturning of Roe vs. Wade.

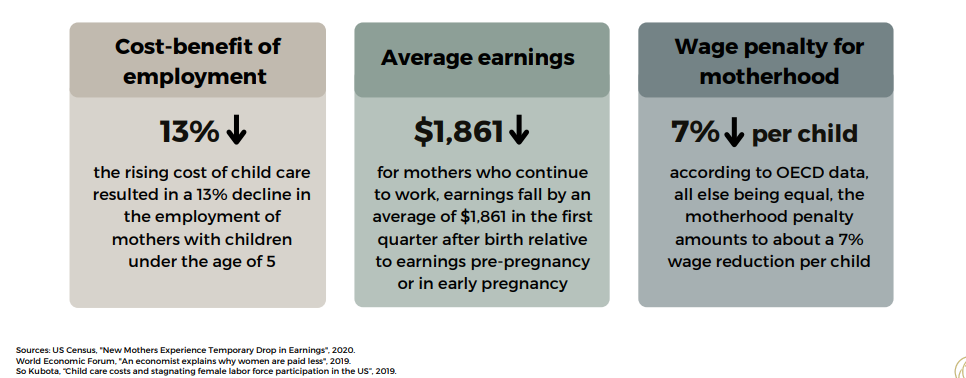

While one woman’s decision to stay home with children may not seem like a national financial hurdle, the gross economic impact of thousands of women leaving the labor force will most certainly be felt across the country. When individuals are unemployed or underemployed, they are not spending as much money. Ultimately, this shrinks consumer demand and reduces the need for businesses to invest in capital and labor to meet that demand. Add to that the gender wage gap and wage penalty for mothers who do return to the labor market, and the result is an economic slowdown.

Impact of Dobbs on State and National Economies

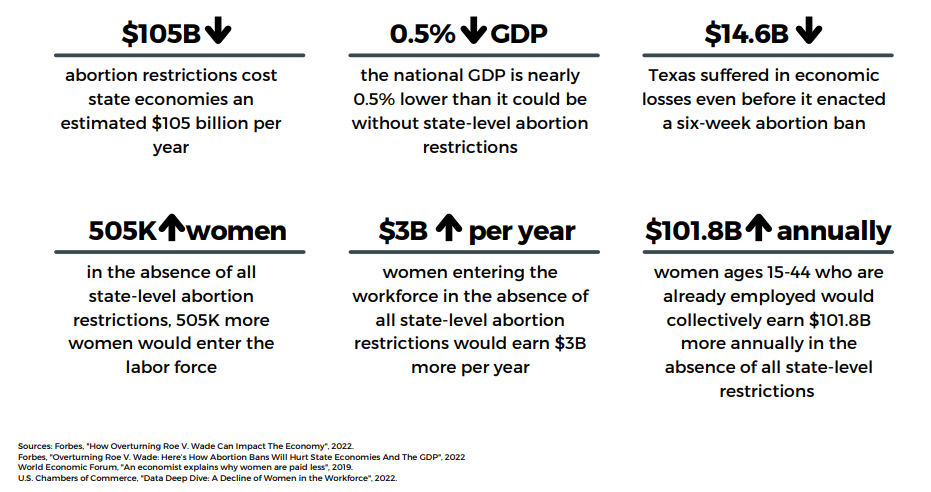

The decision to overturn Roe vs. Wade will have uncontested impacts on the overall economy. A study from the International Women’s Policy Center found state economies already lose billions due to abortion restrictions—an issue that’s now expected to grow exponentially.

Ultimately, the data shows that state-level abortion restrictions result in massive losses in revenue for larger businesses and may be devastating for small businesses in areas where bans are fully implemented. This is especially concerning during a time when women entrepreneurs are already struggling to get funding and small businesses are confronting business downturns as a recession looms. Advisors should inform their clients of this information in order to ensure that their clients are prepared.

Navigating This Sensitive Conversation with Clients

Advisors should spend some time preparing for this conversation, especially in the case of male advisors, because there is important positioning to consider before the discussion begins. When you’re ready to have this discussion with your clients, we recommend starting by asking them if they would like some resources around the topic. If you are a man, you can certainly be an effective ally for women in this debate because you can feel compassion for the position and responsibility women bear. Be wary that your viewpoint as a male may be considered suspect simply because of your gender. Prepare yourself for an emotionally charged conversation because – while this topic may be political or ideological for you – this is a very personal discussion for women.

Guidance for Private Clients Who Want to Act

Incorporating charitable giving is an integral part of a holistic approach to financial planning – both for your clients and your own practice. During such incredibly uncertain times, many individuals are feeling completely overwhelmed and quite frankly, helpless. For those clients that come to you asking what they can do in response to the reversal of Roe vs. Wade – charitable giving is a stable and safe option for them, that may also offer potential tax benefits. Even still, there are a lot of charities, non-profits, and foundations out there and picking one to donate to can be a difficult decision. If your client needs help deciding, Charity Navigator could be a good resource for you and your clients to look at together to decide where to donate funds to. Charity Navigator is an unbiased, non-profit that rates organizations based on their impact, financial stability, and accountability. These analyses can help ensure that the charity the client chooses reflects their values and the kind of long-term legacy they want to leave for others.

Finally, according to Giving USA Foundation, two-thirds of millennials believe that charitable giving is a natural expression of their own values and beliefs. This presents an excellent opportunity for advisors to engage in multigenerational conversations around charitable giving and begin to build relationships with the next generation.

Impact Investing

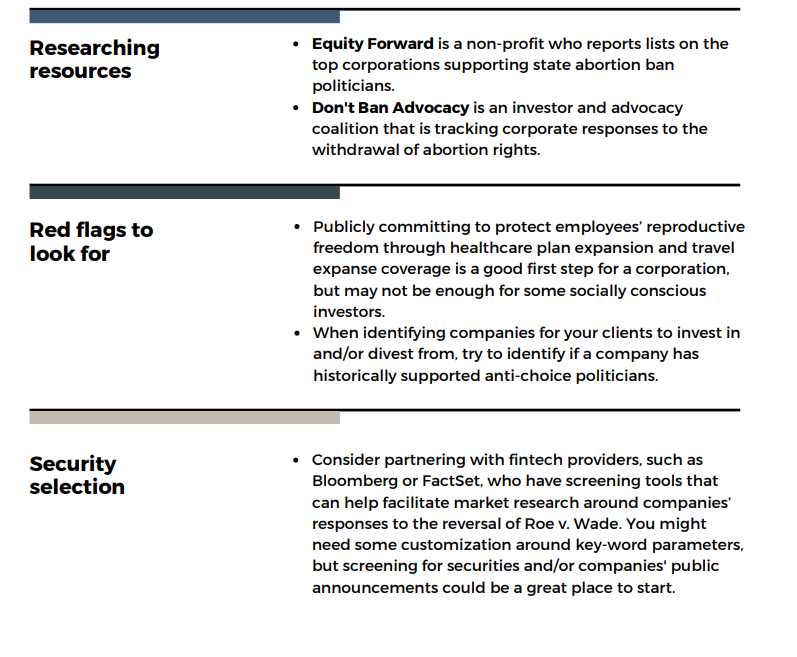

Abortion rights have moved up the priority list for socially responsible investors, both leading up to and in response to the Dobbs ruling. It takes a significant amount of work to ensure that the companies in an individual’s portfolio align with their values, which is why, as their advisor, you can play such an important role.

If your clients come to you asking what their options are for impact investing around reproductive rights, here are a few key considerations:

Ultimately, it may prove to be difficult to fully divest from companies that support/have supported antichoice politicians. With that being said, you can help your client customize their portfolio based on the ethical values that matter most to them, while still maintaining broad diversification and appropriate exposures. If you do engage with your clients in this capacity, the impact it will have on your relationship with them might just turn out to be invaluable.

Guidance for Business Owner Clients Who Want to Act

Some business owner clients may also turn to their advisor for guidance on how their company can provide support for their employees, and demonstrate their commitment to advancing diversity, equity and inclusion. In additional to the charitable giving options outlined above, here are a few options and considerations you can share with them:

Evaluate options through existing insurance provider. The main advantage of turning to your business client’s insurance provider, is that it will ensure employees maintain their right to privacy under HIPAA. Therefore, if their company has an employer-funded medical plan, abortion-related travel benefits could be included with the coverage and administered through the existing plan. Your client should look into their company’s healthcare provider and verify what coverage exists. In some states, it is illegal for health insurance to cover abortions thus companies will need to turn to other options. It is also possible that the current health insurance plan does not cover abortion-related care and is in a state that allows this access. In this case, your client can look into changing their company’s insurer or policy.

Consider direct reimbursement. Companies that either do not provide healthcare coverage due to primarily hourly, part-time workers, or independent contractors have the option of direct reimbursement. This may be the case for many companies such as rideshare or grocery delivery services. This option may take the form of reimbursement after the factor with cash advances for transportation. Under this scenario, an employer may be liable due to the collection of medical data. Therefore, businesses should take extra steps to ensure that there are privacy systems in place to protect their employees.

Partner with an outside organization. Partnership with an outside organization, for example Planned Parenthood, would involve sending an anonymous bill to employers. This offers a separation between the employer and the medical services being provided. If this is an option that a client is evaluating for their business, travel costs should also be considered.

The Convergence of Financial Planning and Values

Both the faces and the expectations of wealth management clients are evolving, requiring advisors to provide more personalized and holistic support, with a particularly heightened focus on individual values and trusted relationships. While conversations around sensitive topics like this may have seemed taboo in the past, intergenerational wealth transfers are on the move – and investors expectations are changing right alongside them. Engaging in these types of discussions enables you to build deeper and more authentic connections with your clients. After all – money is emotional and an advisor’s success will depend on their ability to demonstrate their commitment to helping clients live out their values through their portfolio and financial plans.

Lacy Garcia is Founder & CEO of Willow, a women-led company focused on raising the standard of financial care provided to women by financial service providers and employers.

[ad_2]

Source link