[ad_1]

Apps like Robinhood made investing in stocks easier, and Finvest wants to do the same thing for investing in U.S. Treasury Bills.

Shivam Bharuka, co-founder and CEO of Get Moving, started working on Finvest in 2023. With interest rates at such high levels, Bharuka wanted to take advantage of the environment — however, banks were giving pennies on the dollar, he told TechCrunch.

“With the high interest rates, you basically earn free money on idle cash through U.S. Treasury Bills. But, there is no easy way to buy Treasury Bills today,” Bharuka said. “You can buy them through the government website, Treasury Direct, which is an experience from the 1990s, or use the legacy brokerages like Fidelity or Charles Schwab. Those experiences are often opaque, and come with a clunky user experience. Most modern fintech apps also don’t enable you to invest in underlying fixed-income assets.”

He was part of the Winter 2023 Y Combinator cohort, however, Bharuka initially went in with a logistics-focused company for India. He ended up pivoting when he noticed the pain points associated with buying Treasury Bills.

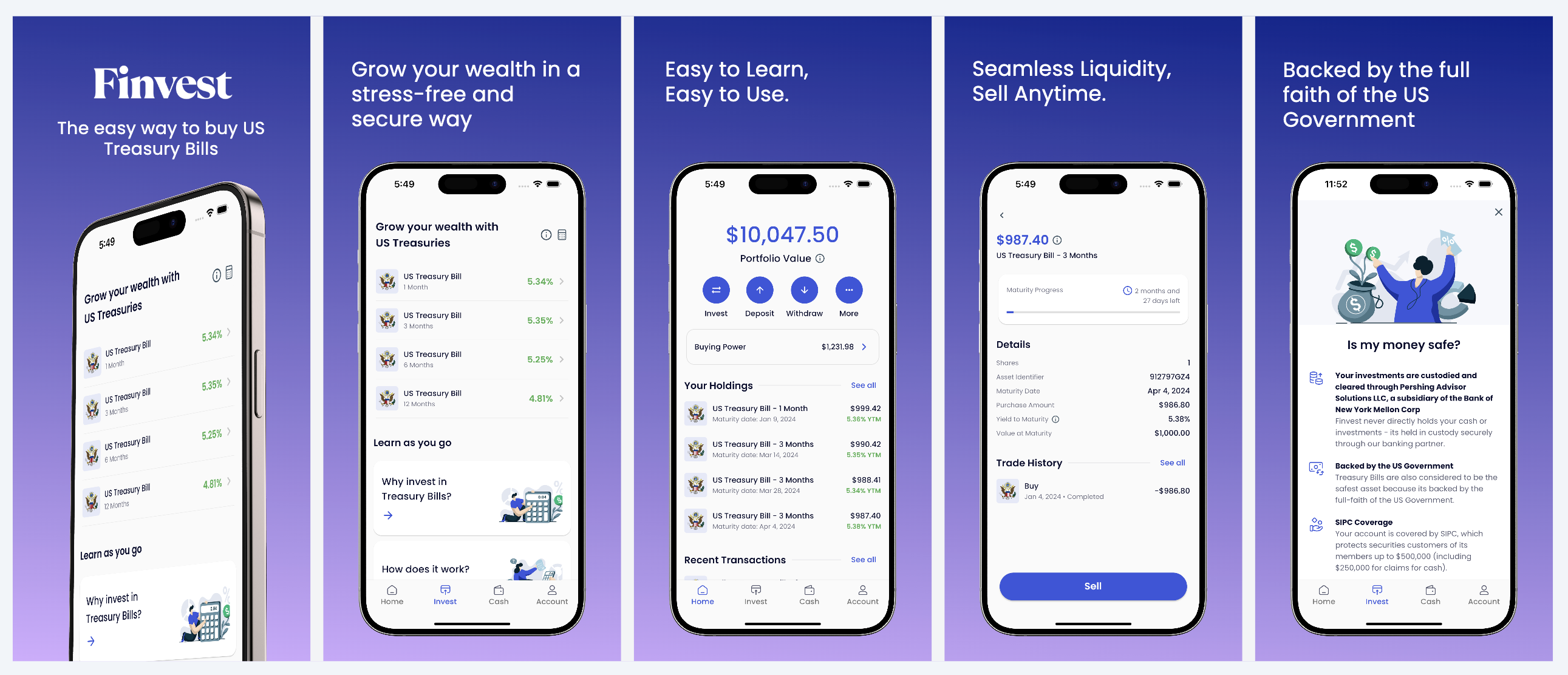

He and his team are developing Finvest to make the purchase, management and selling of U.S. Treasury Bills seamless. Pershing Advisor Solutions LLC, a subsidiary of the Bank of New York Mellon Corp., serves as the brokerage firm.

Finvest’s investment app features. Image Credits: Get Moving

Here’s how it works: After downloading either the iOS or Android app, users create an account, add a bank account and initiate a deposit. Typically, there is a one-day verification process for creating a brokerage account. However, Finvest enables the deposit to be teed up so that once the account is approved, the trade will start going through.

Finvest charges a flat management fee of 0.03% per month on the average daily market value of your Treasury assets and monthly management fees.

Bharuka is not alone in wanting to make this process easier. Zamp Finance, backed by Sequoia, provides a treasury management platform for better access to U.S. Treasury Bills. Finvest sweetens its offering with a high-yield cash management account that gives you a 4.4% yield, higher than most savings accounts.

The company is in its earliest stages, with Bharuka declining to say how many customers have downloaded the app, but did say that around $1 million in deposits were made since launching in December.

It also already grabbed $2.7 million in funding from an investor group that includes Bayhouse Capital, Unpopular Ventures, Y Combinator, Olive Tree Capital, Pioneer Fund, Fractal Ventures and a group of angel investors, including former Airbnb executive Oliver Jung.

Bharuka plans to use the funding to expand Get Moving’s engineering team and eventually add other asset classes to the Finvest app, for example, corporate bonds and municipal bonds.

“We’re also planning to launch this internationally as well,” he said. “We have been exploring this angle because there is a lot of interest to invest into treasuries, especially in Latin countries, like Argentina or Brazil, because their economic economies have not been that strong. They want to invest in a stronger economy, but there is no direct way to do it today.”

[ad_2]

Source link