[ad_1]

“I was in quite a lot of debt when younger and impulsive with my spending. I struggled with things people said around how to manage money and can remember arguments with my mum about it,” says business and leadership coach Ruth Kudzi, who found out last year that she has attention deficit hyperactivity disorder (ADHD).

“I studied accounting at university and knew there was a problem but didn’t want to confront it.” Today, she says that when using the financial services industry she “feels like a child or stupid, even though I have three degrees”.

Many investment firms, accountants and financial advisers fall short when it comes to serving clients with neurodevelopmental conditions such as autism, ADHD, dyslexia and dyscalculia (difficulties with numbers) — collectively described as conditions of “neurodiversity”.

The result is that many such people experience feelings of anxiety or confusion and are left in worse financial health. More than a quarter (27 per cent) of neurodiverse people admit to a lack of confidence in managing their money, compared with 18 per cent of other individuals, according to research by consultancy Newton.

There may be hidden financial costs associated with these conditions. The “ADHD tax” refers to the money lost from financial mistakes, forgotten bill payments or ill-considered spending by those with the condition. Sixty per cent of respondents living with ADHD in a survey for Monzo Bank by YouGov last year estimated that the disorder cost them more than £1,600 a year by affecting their ability to manage money.

There is a growing consensus among medical experts that companies need to do much more to cater for those who are in the neurological minority. Some companies are tackling the need to engage in new ways with these customers. But with a large range of conditions, each expressing themselves differently, the challenges of providing suitable financial services are daunting.

Thought and action

What are the difficulties for people with neurodiversity when it comes to money and financial planning? They may include low executive function (such as organisational and time management skills), dopamine-seeking brains, slower speed of thought and procrastination.

Neurodiverse people might not keep their paperwork in a logical place or order. The thought of navigating their numbers or even opening their bank statements can feel overwhelming.

Making websites more accessible

For most people their first point of contact with a financial firm is via a website or mobile app. But people who are neurodivergent might struggle with digital accessibility. One aid is for firms to follow the Web Content Accessibility Guidelines (known as WCAG), an internationally recognised set of recommendations for improving web accessibility.

Easing online navigation is at the heart of Zoe Portlock’s work. She is autistic, dyslexic, dyspraxic and has Irlen Syndrome, which means she needs to use purple lenses and screens. While the autism affects her risk appetite and money access needs, dyslexia and Irlen affect how she learns and communicates.

As accessibility lead at investment platform Hargreaves Lansdown, Portlock focuses on the website and mobile app, advising designers, developers, researchers, testers on creating accessible products and services.

White backgrounds and excessive motion on a website can be problematic so the website should allow users to adjust the shade or switch off animated features. Plus, Portlock advises using captions on video content, always making clear who is speaking and having separate transcripts.

“For people with autism, clarity of information is important,” she says, for example, always spelling out an acronym in full.

But problems with executive function can often be solved with the help of the right financial professional, or the right app to keep track of documentation. Reducing the number of bank accounts and credit cards, and unsubscribing to marketing emails, can help free up mental space.

Vix Munro, co-founder of neurodivergent-friendly finance app Mad about Money, suggests: “Use your bank apps to help with automated payment of bills and transferring money to savings every month. Challenger banks will send reminders that amounts are due to come out of your bank account.”

People with ADHD may have dopamine-seeking brains, making it difficult for them to resist immediate gratification, and leading to overspending or impulsive spending. A wait period before making a purchase can help. Consumers can “unsave” their credit card details on apps they use regularly, giving them the chance to reconsider a purchase.

Munro suggests: “Add friction such as a sticky note on a credit card. Or rate your purchase from 1-10. ‘How much joy does it bring me?’ Perhaps it needs to score 9 or 10 to go ahead.”

Slower thought processing can make choice feel like leaping a chasm, with some neurodiverse people struggling to know where to begin. But overthinking can lead to decision paralysis. Choosing one savings account over another or in which funds to invest a company pension are two examples. Some neurodiverse people say that when they open an insurance or motoring comparison website they can spend hours caught up in the detail of the options presented.

Dr Jenna Vyas-Lee, a clinical psychologist at London-based clinic Kove Minds, says: “Many people with ADHD need small bits of information, for example a 45-second video with the three things they need to know.”

Buying in help from a financial adviser or coach can be one solution. But it doesn’t always work. Gary Morris, principal of Morris Powell Financial Management, has an ADHD diagnosis. He says his neurodiverse clients may avoid interacting with him for long periods. “I have one client who I’ve realised is likely to have ADHD and will simply disappear for nine months at a time, only to apologise, re-engage and disappear. If you work with a professional and you’ve not responded for a long time, it becomes increasingly difficult to re-engage due to embarrassment.”

Many experts suggest people in this situation try “body doubling”, when they simply ask someone to sit alongside them. Their companion may be doing something entirely different but their mere presence can help the instigator focus on the financial task in hand.

Long-term planning may not always be easier than day-to-day finances. Katja Oakley-Bell has an autism diagnosis and works in the product team at wealth manager Quilter. She says sticking to an investment plan can be difficult too. She says: “In market downturns, people who are neurodiverse can be more at risk of panic selling.”

Resisting the ‘one size fits all’ approach

Awareness of neurodiversity is gradually improving. Medical and finance professionals say those in their late teens and early 20s are conscious of it and are keen to raise it with their employers and the financial firms whose services they use.

Edward Grant, the director responsible for vulnerability at wealth manager St James’s Place, says: “One issue is that people don’t know they are neurodiverse. Thirty years ago you didn’t know about it unless you were inclined to find out. But a number of younger advisers joining our academy have had diagnoses. So people are becoming more aware.”

Nevertheless, there remain big obstacles to improving access to financial services for the neurodiverse.

First, these conditions remain underdiagnosed. Between 15 and 20 per cent of the population are neurodiverse, according to a 2020 study by Dr Nancy Doyle, founder of Genius Within, a training and assessment company. But it’s impossible to pin down exact figures. In an ageing population, there are many who are unlikely to seek a diagnosis. Others cannot afford a private consultation or cannot obtain a diagnosis through the National Health Service, given the pressures it faces.

A second issue is that many are uncomfortable sharing their personal medical details. Dr Helen Read is a consultant psychiatrist specialising in ADHD, and founder of ADHD Consultancy, a diagnosis and treatment service. She says she is herself highly numerate but forgetful when it comes to numbers. “I have just changed my accountant for one who will give automated reminders of what I have to pay, to whom and when . . . It would be nice if all institutions did that regardless, so that you don’t have to advertise yourself as needing extra help.”

A third hurdle is that no two people with the same neurodiversity label, for example ADHD or autism, will present in the same way. Vyas-Lee says: “Some people with autism might be brilliant with spreadsheets. Others might not want to take risks and sit with lots of money in current accounts. You might have a profile that is avoidant and unmotivated, meaning you might not do anything with your money.”

Some financial services companies have made progress towards engaging with their neurodiverse customers. Wealth manager St James’s Place has been educating its employees, as well as setting an accessibility policy and content creation standards.

Some SJP partners place fidget toys on desks so clients can use them to focus or keep calm, or have covered overlays, to place over text to aid reading, laid out in the office for dyslexic people to use without having to talk about their condition. Fidelity, the investment platform, offers customers an alternative document format. Different colours can be selected to help dyslexics, who may have a preferred colour scheme for easier reading.

At Schroders Personal Wealth, the firm’s client-facing advisers will allow extra time for neurodivergent customers to process information and ensure important information is also provided in writing, often in advance of any meeting.

Some may not struggle so obviously with personal finances but would nonetheless benefit from help, Morris says. “Many neurodivergent [people] are successful entrepreneurs, business owners, having benefited from the upsides of a neurodivergent brain.”

Professionals with experience of neurodiversity say that in an ideal world employers and financial services would ask what people need. Kudzi says: “Not being able to speak to a real human is difficult.” But it has to be the right person. “Sometimes it feels like advisers are judgmental,” she says. In future, information gathering about an individual is likely to be tech-driven, Vyas-Lee says.

Regulatory relevance

Should financial firms be taking neurodiversity more seriously? The Personal Investment Management and Financial Advice Association (PIMFA) is the trade association for UK firms that provide wealth management, investment services and advice. It hosts annual diversity and inclusion awards, but has yet to address neurodiversity.

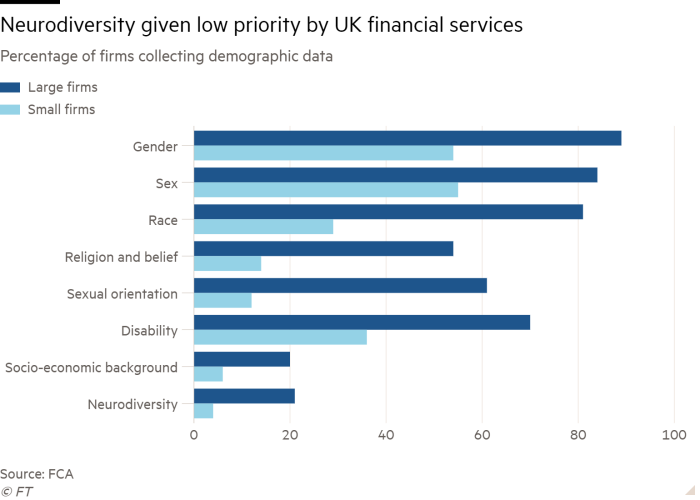

At the end of last year the Financial Conduct Authority found “very few firms have paid attention to neurodiversity” in their diversity and inclusion policies. However, neurodiversity isn’t yet one of the FCA’s key drivers of vulnerability.

The FCA says: “Our view of vulnerability is as a spectrum of risk. All customers are at risk of becoming vulnerable, but this risk is increased by having characteristics of vulnerability. These could be poor health, such as cognitive impairment, life events such as new caring responsibilities, low resilience to cope with financial or emotional shocks and low capability, such as poor literacy or numeracy skills.”

Nevertheless, its Consumer Duty rules specify that neurodiversity may be “a relevant consideration” as firms consider how to meet customers’ needs.

A cynic might say everyone struggles with financial affairs to some degree, so additional help may benefit everyone. But as Quilter’s Oakley-Bell says: “The key difference is the neurotypical are better with it, while the neurodiverse are at risk without it”.

In the short term it may seem expensive for firms to organise conversations to identify neurodiverse customers. But Vyas-Lee warns: “The fallout of not doing that will cost you.”

A gender disparity

Many neurodiverse women and girls struggle to get a diagnosis, or receive a diagnosis late in life, because of differences between how neurodiversity conditions express themselves in females compared with males.

Keren Miles-Perrott, 47, is one of a growing number of women recognising their neurodivergent traits in adulthood, after they have had a child or grandchild assessed. Working in the financial services industry as a communications director, she has not had a formal diagnosis, but has a family history of autism and ADHD.

She says: “There’s the irony that there are lots of us who hold down successful careers in fields requiring a degree of understanding of finance, economics, pensions and investments, but who live with neurodiverse brains that can make it challenging to organise our own finances.

“We might be dedicated, reliable, considered, creative employees who are fantastic at planning, organising and delivering high-quality work. We spot patterns and details. We love deadlines and work well under pressure. At home it might be a different scenario.”

Miles-Perrott struggles with planning her pensions and savings. She notes that neurodiversity presents itself in many different ways, some of which appear to be contradictory.

“This is partly why it’s so fascinating for me.” She says she is fortunate in her experience of neurodiversity, but others may face much bigger difficulties. “Some people are deeply affected by lack of access to information, accounts, accessible services. I am fortunate. Where is Consumer Duty and representation for those who can’t ask for better?”

Catherine Morgan, 42, is a financial planner who trains coaches at The Money Panel and financial equality campaigner at catherinemorgan.com. She has an ADHD diagnosis and says: “My primary challenge in managing money relates to my natural inclination towards spending rather than saving if I don’t utilise automated systems to guide my expenditure.”

Rather than being motivated by long-term goals, which seem to postpone gratification, her ADHD leads her to make impulsive financial choices and pursue the latest enticing opportunities.

“To counteract this, I’ve developed strategies to heighten my awareness during these dopamine-seeking moments,” she says. “This allows me to experience the thrill of impulsivity while staying within my monthly budget.

“By assigning every pound a specific role, utilising the visual budgeting features in my Starling bank app, and breaking down financial tasks into manageable weekly actions, I’m able to maintain control over my finances in a way that aligns with my neurodivergent tendencies.”

[ad_2]

Source link