Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One thing to start: For our US readers, we hope you had a happy Thanksgiving.

Fall of the house of Black

The stand out piece this week is the FT Weekend Magazine cover story by my New York-based colleague Mark Vandevelde.

The fall of the house of Black is a tragedy on Wall Street of Shakespearean proportions. It chronicles the downfall of billionaire Leon Black, the most feared man on Wall Street and a longtime friend of Jeffrey Epstein.

At the centre of the tale is a law that, in December 2000, New York became the first city in the US to pass. It allows survivors of violent sex crimes to sue their attackers in civil court, even if their allegations are not taken up by prosecutors working for the Manhattan district attorney. The law created an alternative path to justice, which enterprising lawyers have used to win billions in compensation for clients.

Enter stage right, Douglas Wigdor, a lawyer who measured in dollars is the undisputed legal leader of the #MeToo movement. Over the past 20 years, Wigdor has secured more than $1.5bn in compensation for clients, including some who were assaulted by Harvey Weinstein.

In 2021, Wigdor filed a lawsuit against Black on behalf of Guzel Ganieva, a Russian fashion model who claimed that the billionaire had mistreated her and damaged her reputation by accusing her of extortion. Black denies the allegations. He quit as chief executive of Apollo Global Management soon after they became public.

Read the full story here of how the legal system twisted one woman’s rape allegations into a fight over the reputations of two powerful men.

Dead cat bounce catches out hedge funds

Hedge funds betting on a decline in US and European stock markets have suffered an estimated $43bn of losses in a sharp rally over recent days, writes George Steer in London.

Short sellers, many of whom had built up bets against companies exposed to higher borrowing costs over the past year or so, have been caught out by a “painful” rebound in “low quality” stocks this month, said Barclays’ head of European equity strategy Emmanuel Cau.

That has come as the market has grown more confident that the US Federal Reserve’s cycle of rate rises is finally over. The rally, which has left Wall Street’s S&P 500 index on track for its strongest month since July last year, was sparked by Fed chair Jay Powell’s recent perceived reluctance to tighten monetary policy any further when he left rates on hold at the start of the month.

Weaker than expected US consumer price inflation data released on Tuesday last week then gave stocks a further boost, with the S&P 500 and the tech-heavy Nasdaq Composite indices both enjoying their best days since April.

Analysts said the upswing triggered a brutal “short squeeze” in which some hedge funds repurchased stocks to cover their negative bets, which helped push share prices even higher.

“It’s been a very tricky market this year but this short squeeze is really killing year end performance for a lot of funds,” said Cau. “No one was able to monetise the rally in garbage stocks.”

The past month’s “easing of financial conditions may have caused some dead cats to bounce”, said Barry Norris, chief investment officer at Argonaut Capital, referring to the rebound in lower quality stocks.

Funds suffered $43.2bn of losses on short bets in the US and Europe from Tuesday to Friday inclusive last week, according to calculations by data group S3 Partners, which do not take account of gains that funds may have made in other stocks they own. Bets against technology, healthcare and consumer discretionary stocks were among the most costly for hedge funds.

Indices tracking heavily shorted stocks have rebounded sharply from recent lows as market sentiment has rapidly improved. Goldman Sachs’ Very Important Short Position index, which tracks the 50 constituents of the S&P 500 with the highest total dollar value of short interest outstanding, is on track for its best month since October last year. A similar basket of stocks at Barclay is on track for its biggest monthly gain in at least 10 years.

Chart of the week

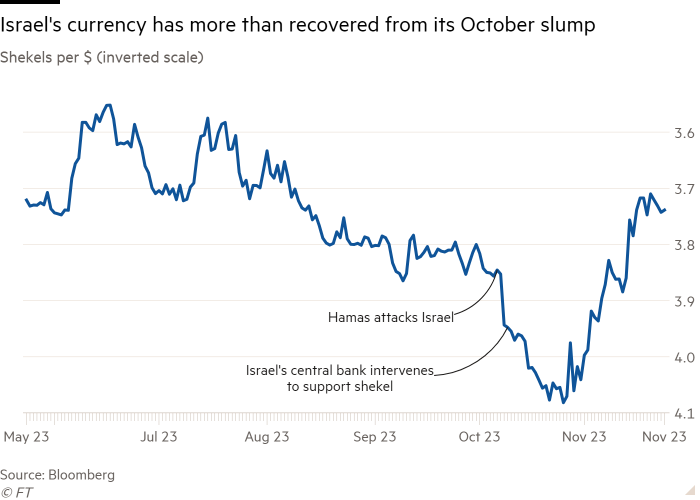

The Israeli shekel is the world’s top performing currency this month, driven by billions of dollars of purchases by the central bank since the outbreak of the war with Hamas, write Mary McDougall and Stephanie Stacey.

The currency has risen by around 8 per cent in November to 3.74 shekels per dollar on Friday, more than reversing a fall of nearly 6 per cent in the first 20 days of the conflict when investors took fright at the potential for a war to escalate across the Middle East.

The rebound is a sign that investors believe the war will remain contained while also reflecting confidence in the Israeli government’s strong balance sheet and the bank’s willingness to defend the currency. The currency has also been supported by billions of dollars of financial inflows from abroad.

“The rally reflects the easing of geopolitical tensions, especially perceptions that the risks of spillovers from the conflict in Israel into the wider region have eased,” said Oliver Harvey, a senior FX strategist at Deutsche Bank. He added that the shekel “typically performs well with higher US equities and we have seen a big rally over the last month”.

The recent rally has also been fuelled by an unwinding of “extreme” short positioning — bets on lower prices — and the Bank of Israel’s willingness to use reserves to offset excessive currency weakness.

Earlier this month it disclosed its reserves had dropped by $7.3bn in October as it sought to defend the shekel against further declines.

“The BoI did a pretty good job defending levels beyond 4.00 per US dollar and the disclosure of central bank FX [currency] intervention firepower managed to suppress speculative short shekel flows,” said Luis Costa, head of emerging market sovereign credit at Citibank.

Five unmissable stories this week

Investors are selling dollars at the fastest rate in a year as they raise their bets that the US Federal Reserve has finished its aggressive campaign of interest rate increases and will deliver multiple cuts next year. That has helped put the greenback on course for its worst monthly performance in a year.

Sir Christopher Hohn’s $60bn activist hedge fund TCI has opened an office in Abu Dhabi, joining a wave of groups betting that the United Arab Emirates will help power the industry’s growth. Bronwyn Owen, the group’s head of investors relations, is relocating from New York to run the office, which will be used to forge ties with local investors.

Scott Shleifer, the head of Tiger Global’s $30bn-plus private equity business, will step down from his role at the hedge fund at the end of the year. The move will be a significant change for $58bn group Tiger, which was founded by Chase Coleman in 2001. Shleifer spotted enormous opportunities from ascendant technology companies, particularly in China.

Blackstone is to close a fund that offers investors exposure to a range of hedge funds and other trading strategies, after assets fell nearly 90 per cent in four years amid lacklustre returns. The US alternative asset manager has told investors it will wind down the Blackstone Diversified Multi-Strategy fund by the end of the year.

Boots has agreed to transfer £4.8bn of pension obligations to insurer Legal & General in one of the largest-ever such transactions in the UK. The deal paves the way for a potential sale of the UK’s largest pharmacy chain by owner Walgreens Boots Alliance.

And finally

The Fondation Louis Vuitton in Paris has established itself as France’s embassy for American art, writes our chief art critic Jackie Wullschläger. Its latest exhibition is a Mark Rothko retrospective, with more than 100 paintings, half of them borrowed from museums across America. His paintings answer TS Eliot’s call to modernism in “The Love Song of J Alfred Prufrock”, writes Jackie: “It is impossible to say just what I mean!/But as if a magic lantern threw the nerves in patterns on a screen.” To April 2, fondationlouisvuitton.fr

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Comments are closed, but trackbacks and pingbacks are open.