[ad_1]

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One scoop to start: CVC is preparing to announce its intention to float in Amsterdam as soon as this week in a mood-defying move by Europe’s largest private equity group.

Venezuelan bond prices soar after US lifts trading ban

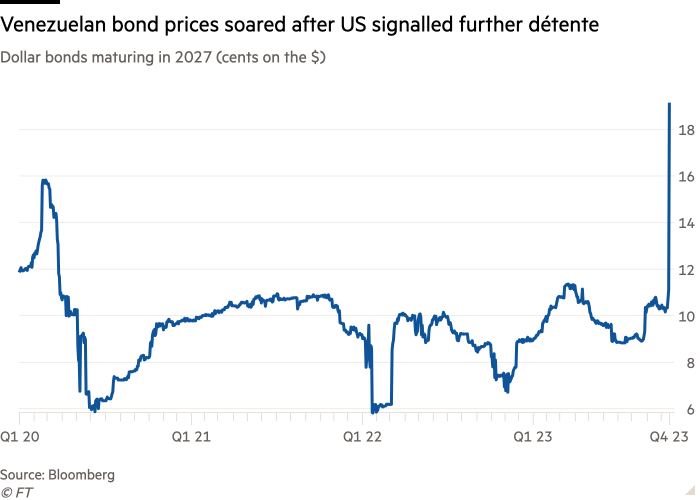

Last week the US government eased sanctions that had barred American investors from trading Venezuelan government bonds, part of the most extensive rollback of Trump-era restrictions on Caracas.

Venezuelan government bond prices soared on the news, handing immediate large gains to some hedge funds, write my colleagues Arjun Neil Alim, Mary McDougall, Costas Mourselas and Joe Daniels.

The price of Venezuela’s sovereign dollar bond maturing in 2027 jumped more than 70 per cent to 19 cents on the dollar, according to Bloomberg data.

The gains, which were mirrored in other Venezuelan debt, came after the US Treasury department late on Wednesday removed a ban on secondary trading of certain sovereign bonds as well as the debt of the state oil company, Petróleos de Venezuela (PDVSA).

The country’s bonds have for years traded at a small fraction of their face value, following Venezuela’s default in 2017 and subsequent removal from widely followed indices, and the Trump-era trading ban.

Some investors said the relaxation of sanctions could pave the way for an eventual restructuring of Caracas’s debt. It could also allow Wall Street heavyweights to dive into the market in the hope of big profits on bonds still trading at highly distressed levels.

“We believe this is a start of a multi-step process . . . of reintroducing Venezuela into the financial mainstream,” said Nick Lawson, chief executive of London-based brokerage Ocean Wall and a Venezuelan bondholder since 2021. “That will probably include ramping up of Venezuelan oil and natural gas production and exports, re-inclusion of Venezuelan bonds in major emerging market indices, debt settlement negotiations and eventual restructuring.”

Among the hedge funds to benefit from Thursday’s rally was Lee Robinson’s Altana Wealth, which launched a fund to buy Venezuelan debt three years ago.

The company has roughly $75mn invested in sovereign and PDVSA bonds with a combined face value of almost $500mn as of the end of September, Robinson told the Financial Times. He said:

“There has been a major push from both sides [to improve relations] for over two years. The Middle East and the Russian attack on Ukraine have perhaps increased the urgency from [the] US and allies.”

Read the full story here

The strange death of corporate Britain

Corporate Britain is dying. But it is not a natural death, writes our chief economics commentator Martin Wolf. By forcing inherently uncertain long-term pension promises to become — at least notionally — certain, huge damage has been inflicted on UK capital markets and done to the country’s corporate sector. It is too late to undo the damage of opportunities foregone. It is not too late to stop inflicting more harm in the future.

Martin argues that a revival of UK capital markets is essential, to reverse a multiyear trend in which pension and insurance companies have dumped UK equities, reducing the ability of companies to raise capital and expand.

This revival will require the recreation of large pools of local equity capital, which would enjoy the advantages of familiarity and contacts that come with residence. Such funds should not be forced to invest in the UK. But they should be able to see — and seize — local opportunities far better than outsiders.

Part of the answer is consolidation of surviving defined benefit funds. A tested solution — the Pension Protection Fund — is already established and proven. It has a successful consolidation record, with more than 1,100 funds absorbed so far. It can kick-start the process. Another part of the answer is a move towards collective defined contribution funds, in place of today’s plethora of smaller funds, of which there are more than 3,000, according to Citi. Again, consolidation is essential.

In a July speech, Chancellor Jeremy Hunt said the state-owned British Business Bank would assess how the government could play a “greater role” in helping pension funds to invest in domestic assets to encourage economic growth.

Now my colleagues Laura Noonan and Josephine Cumbo reveal that the UK government is set to unveil plans next month for a new investment vehicle overseen by the state that is intended to turbocharge pensions funds’ investments in high-growth private companies.

After months of discussions with pension funds, the BBB is now developing plans for an investment vehicle where pension funds can co-invest in high-growth companies under the guidance of the bank.

Chart of the week

Europe’s riskiest corporate borrowers are paying the highest premium in seven years to tap the region’s €412bn junk bond market, highlighting growing fears that a long period of high interest rates and an economic slowdown could trigger further defaults, writes Harriet Clarfelt in New York.

The so-called “spread” — or gap — between the yields on euro-denominated corporate debt rated triple C or lower and government paper has widened to more than 18 percentage points on average, according to an ICE BofA index.

That marks the biggest spread since June 2016 and surpasses levels seen in 2020 when the Covid-19 crisis triggered fears of messy defaults and bankruptcies. At the start of last year, the spread was as low as 6.7 percentage points.

Government bond yields have soared on both sides of the Atlantic in recent weeks, dragged skywards by concerns that both the Federal Reserve and the European Central Bank will keep interest rates ‘higher for longer’ to get inflation under control. But corporate bond yields have climbed at an even faster pace.

Expanding spreads indicate that bondholders are demanding larger premiums to compensate them for the risk of a default.

Analysts and investors said the widening of risky European spreads underscored persistent concerns over the health of the region’s economy. They also pointed to structural issues within Europe’s high-yield bond market — including its lack of depth and liquidity — which have fuelled sharper moves than those in the same asset class in the US.

“I think the economic backdrop in Europe is definitely worse than in the US,” said Christian Hantel, a corporate bond portfolio manager at Swiss firm Vontobel. The widening of spreads “has to be seen in the context of slower economic growth, the aggressive interest rate hikes and the ongoing elevated inflation numbers”.

Five unmissable stories this week

Cathie Wood’s Ark Investment Management has a new pitch to investors who might be concerned by the asset manager’s huge losses — think of the tax write-offs. Because Ark’s actively managed ETFs have lost so much money in the past 18 months or so, the firm is telling investors that they are unlikely to incur taxes on capital gains distributions for at least the next two years.

St James’s Place has announced the largest overhaul of its fees in its 31-year history, as the UK’s biggest wealth manager bows to pressure from regulators to ensure it complies with new rules protecting consumers. The announcement by the FTSE 100 group confirmed an earlier Financial Times report revealing the group faced pressure from regulators to embark on a more radical overhaul of its fees than the modest changes it made in July.

Fund manager M&G is to close its £565mn property fund following sustained outflows by UK retail investors looking to get out of the ailing real estate market. The closure illustrates the renewed strains affecting the UK’s property fund sector, which suffered a spate of suspensions following the Brexit vote in 2016 and again during the early stages of the coronavirus pandemic in 2020.

US private equity investor J Christopher Flowers has warned that a dramatic increase in private credit investments by life insurers is creating systemic risk for investors. Flowers, who attempted a rescue of insurer AIG during the 2008 financial crisis, said investors were underestimating the risks resulting from a flood of money into private credit loans and a push by insurers into these assets in search of higher investment yields.

Investment platforms are facing scrutiny from the UK’s Financial Conduct Authority over the amount of interest they pay on customers’ cash deposits as they reap rewards from soaring rates. DIY trading platforms including Hargreaves Lansdown and AJ Bell have reported bumper profits in recent weeks despite clients making fewer trades and holding smaller asset portfolios, with the windfall largely driven by interest paid by banks where they deposit customers’ money.

And finally

To mark 50 years since the death of Pablo Picasso, the Centre Pompidou in collaboration with the Musée National Picasso — Paris have put together the largest retrospective of drawn and engraved work ever organised. Picasso. Drawing à l’infini presents nearly a thousand works — notebooks, drawings and engravings. The drawings illustrate Picasso’s constant process of reinvention and renewal. As the artist himself once said: “It took me four years to paint like Raphael, but a lifetime to paint like a child.” Until January 2024.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link