Is it time to move out of the US stock market? In the past decade it has served investors very well, including many UK retail savers who have steadily switched funds out of the dejected London market for America.

But stock valuations are high, with a lot hanging on the performance of a handful of mega tech companies that have generated all the recent gains in the S&P 500 index.

Moreover, the US is already gearing up for next year’s presidential election — a huge political battle that seems certain to inflame public debate, and spread uncertainty, division and even fear. Hardly the best conditions for calm business decision-making.

Trading volume in options linked to the Vix volatility index — widely seen as Wall Street’s “fear gauge” — is set to reach a record this year, as equity investors seek to protect themselves from the risk of a sudden reversal, as the FT reported this week.

This year investors have traded an average of 742,000 options tied to the Vix each day, according to exchange operator Cboe, up more than 40 per cent on the same period in 2022 and above 2017’s full-year record of 723,000.

While the US is well known for its economic and financial resilience, could this be the time for investors to look elsewhere? Or should they keep betting on America and its world-beating tech sector? FT Money looks at the arguments.

Too big to ignore

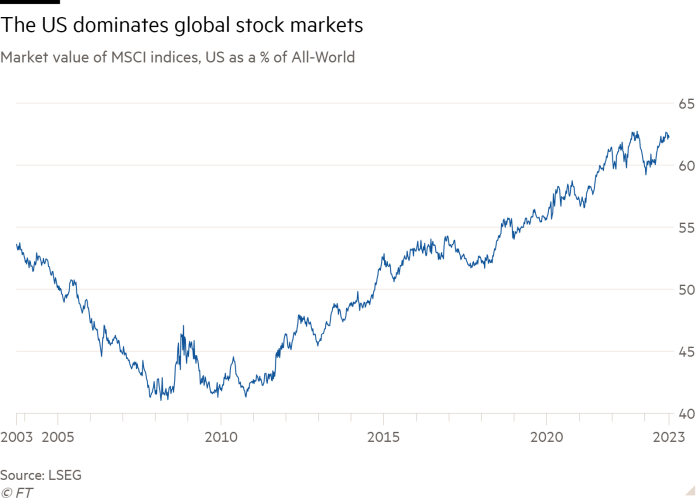

No equity investor can ignore the US stock market: it’s the 800-pound gorilla of shares. It is not just that fluctuations on Wall Street set the tone for the trading day in other markets. The US dominates global equity valuations.

Take an investor who wants a diversified exposure to global equities. They may decide to buy a fund that tracks the MSCI World index. But if they do, they are really making a bet on America since the US market makes up about 70 per cent of the MSCI World.

This is the highest weighting that Wall Street has ever had; in the late 1980s, the US market comprised only 30 per cent of the MSCI World and was briefly even overtaken by Japan.

What is even more striking is that the current performance of the US stock market is dependent on a very small number of companies. According to Torsten Slok of Apollo Global Management, a private equity firm, the 10 largest firms in the S&P 500 make up 34 per cent of the index. That concentration is the highest the market has seen since the dotcom bubble at the turn of the millennium. These stocks also trade on an average price/earnings ratio of 50, according to Slok. Buying US shares is thus an implicit bet that those stocks can maintain their high ratings, and rapid profits growth.

Many of those titans are familiar tech names: Apple, Alphabet (Google’s parent company), Amazon and Meta (Facebook’s parent). Other stock market giants include Tesla (Elon Musk’s electric car company), Berkshire Hathaway (Warren Buffett’s conglomerate) and Nvidia, which makes the chips that will power artificial intelligence.

Regulatory threat to tech boom

In some cases, the high valuations of these stocks are caused by the companies’ strong market positions (Google in internet search or Amazon in online retail). In other cases, it is related to the companies’ ability to persuade consumers to pay premium prices (Apple’s iPhones and Tesla’s cars).

But many of these companies face a common threat in that they tend to catch the attention of regulators.

Apple’s share price has recently taken a tumble, for example, after the Chinese government imposed restrictions on the use of iPhones by public officials. In September, the EU named 22 “digital gatekeepers” to be subject to a new regulatory regime. They include services run by five tech giants: Alphabet, Amazon, Apple, Meta and Microsoft.

In the US, the Federal Trade Commission just filed an antitrust suit against Amazon, accusing the group of inflating costs for consumers and sellers. Worryingly, the tech companies are the target of ire from both Republican and Democrat politicians (see box below).

Keep watching the Fed

Short-term fluctuations in the US stock market tend to revolve around the actions of the Federal Reserve. The US central bank has been steadily pushing up interest rates since March 2022 in an effort to combat the inflationary impulses set off by Russia’s invasion of Ukraine, and the resulting disruption in energy markets. But it left rates unchanged at its latest meeting last month and indicated that there might be only one more rate rise in its tightening cycle.

That was in response to a slowdown in the US inflation rate to 3.7 per cent (on the headline rate) and 4.2 per cent on the core rate, which excludes food and energy, the Fed’s preferred measure. Nevertheless, those inflation measures are well above the Fed’s target and the US central bank indicated it would have to keep rates at around these levels for some time to come.

That raises the question of whether the lagged effect of the rate increases will eventually push the US economy into recession. At the start of 2023, many commentators thought the risk of a recession was high. But so far, the economy has held up well: the Fed is forecasting that the US economy will grow by 2.1 per cent this year and 1.5 per cent in 2024.

However, there are worrying signs. Normally, the yield on longer-dated bonds is higher than that of shorter-term securities, since investors need to be offered more to lend their money for long periods. For more than a year, however, two-year Treasury yields have been higher than those on their 10-year equivalents. This “inverted yield curve” has occurred before every US recession in the past 50 years.

Nathan Sheets of Citibank says, historically, unwinding high inflation alongside tight labour markets has required a marked rise in the unemployment rate, and all five episodes have been associated with recessions. “Our view is that the laws of ‘economic gravity’ seen in previous cycles will ultimately reassert themselves, and the US economy will face recession during 2024,” he says.

That creates a potentially difficult background for US stocks. A further problem is that US corporate profits have recently been weak. The latest figures from the Bureau for Economic Analysis show that, at the national level, profits fell by $83.3bn in the first quarter, before edging up $6.9bn in the second.

US presidential election could sow seeds of chaos for stocks

The event that will dominate the news headlines of 2024 will be the US presidential election. At the moment, it looks likely as if this will be a rematch of 2020, with the current president, Joe Biden, pitted against the former president, Donald Trump. At the time of the polls, the former will be almost 82 years old and the latter 78.

Markets are generally assumed to prefer Republican presidents, although the crashes of 1929 and 1987, the collapse of the dotcom bubble in the early 2000s and the great financial crisis of 2007-2008 all occurred when Republicans were in office. Since 1947, the average annual return under Democrat presidents has been almost twice as large as that under Republicans.

Despite all the turmoil of the first Trump presidential term, the US market set repeated highs while he was in office until the pandemic caused a setback in 2020. Investors particularly liked the sweeping tax cuts passed in 2017, including a substantial reduction in the levy on corporate profits.

Nevertheless, it seems probable that there will be some nervousness as the poll date approaches. The US political system has become increasingly dysfunctional and confrontational in recent decades, as illustrated by the latest stop-gap deal to avoid a government shutdown and the ousting of Kevin McCarthy as House Speaker.

There was chaos after the last election, when Trump refused to accept the result and his supporters stormed the Capitol. There could be a repeat of the violence next year; it seems highly unlikely that Trump (or his most committed supporters) will accept another defeat. Indeed trouble could emerge whatever the outcome; protests would flare if Trump achieves power by using one of the devices he proposed in 2020, such as local Republicans reversing the result in a state that voted for Biden.

Furthermore, Trump is not a conventional Republican candidate. He is not in favour of free trade and he is hostile to parts of the corporate sector (notably some of the leading technology companies). In this he is backed by rightwing Republicans: JD Vance, the senator for Ohio, has called big tech companies “enemies of western civilisation.”

The sector doesn’t have a lot of fans, despite the amount it spends on lobbying. The right dislikes the tech companies for infringing freedom of speech; Democrats dislike the sector for its market power and for its effect on privacy.

Some of Trump’s views may have a greater impact on international markets than on the US itself. He is not a huge supporter of Nato or of Ukraine’s resistance against Russian invasion. His isolationism may not simply mean that EU nations have to spend more on defence. It may also mean greater geopolitical instability if authoritarian powers feel they do not have to worry about US reaction if they pursue aggressive policies. It adds up to increased risk, and when things get risky, investors tend to prefer the safety of government bonds to equities. Philip Coggan

Valuations worryingly still high

But investors have not been discouraged from buying shares. Over the year to the end of August, the vast bulk of the 14 per cent capital gain made by the S&P 500 index came not from higher profits but from higher valuations, says Patrick Palfrey of Credit Suisse.

Rising share prices combined with weak profits mean that valuations are now close to the top of the historical range. Robert Shiller, a Nobel Prize-winning economist from Yale University, calculates a cyclically adjusted price/earnings ratio (Cape) for the US market. This averages profits over 10 years to even out the peaks and troughs of the economy. On the latest measure, the ratio is 30.8; in other words, investors are paying more than 30 times the average of the past decade’s profits to buy stocks.

This ratio is lower than the peak of 44.2, recorded at the end of 1999, when the dotcom bubble came to a head. But it is not far from the 32.6 set in September 1929, just before the crash that is commonly cited as the trigger for the Great Depression.

It is worth noting that the Cape has been elevated, relative to its 20th century average, since the turn of the millennium. The rationale for this high ratio has been that the returns on cash and bond yields have been very low for much of this period. In relative terms, keeping money in bonds and cash has looked unattractive. Furthermore, a key component of equity valuations is the future stream of company profits.

These profits are discounted in order to convert them into today’s value; the lower that bond yields fall, the lower the discount rate and thus equity valuations can be higher. But bond yields and cash returns have risen. In late September, the 10-year Treasury yield hit its highest level since 2007. That makes it much harder to justify high equity valuations.

MSCI commented that the US equity market is “trading expensive today relative to its long term average”. The index provider added that the market also looks expensive relative to the rest of the world and that “there have only been a few occasions over the past 50 years when the valuation spread has been so wide. In 2001-02 and 2008-09, following the peak in that valuation spread, US equities saw significant declines.”

With no havens in equities, consider bonds

So the US stock market looks expensive relative to its own history, and to that of other countries, while US equities also face regulatory, political and economic risks. That might seem like a recipe for avoiding the market. But herein lies the dilemma. The US market is so dominant in global terms that neglecting it would give the investor a very lopsided portfolio, one with a limited exposure to technology stocks and a high exposure to Japan and European markets, which have their own problems.

Furthermore, what happens in the US affects everywhere else. If the US economy falters, so do other economies; if the Fed pushes up interest rates, other central banks tend to follow suit; if the US suffers political or financial turmoil, investors around the world become more risk averse. The 2007-08 financial crisis had its origins in the subprime mortgages imprudently created in the US finance sector. But when the loans started to fail, the damage was spread worldwide, not just the US; indeed, the US dollar rose against other currencies because its liquidity (and that of the Treasury bond market) made it attractive to nervous investors.

In short, as an equity investor, there is no way of avoiding the US stock market altogether, even if you are nervous about valuations, Donald Trump or the impact of higher interest rates. Given the risks, that suggests investors might prosper by devoting more of their portfolios to taking advantage of the higher rates now available on bonds and cash rather than looking for equities outside the US.

Comments are closed, but trackbacks and pingbacks are open.