[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

Asia faces one of the worst economic outlooks for half a century thanks to a sluggish post-pandemic recovery, China’s property crisis, rising levels of debt and US protectionism.

That’s today’s verdict from the World Bank which downgraded its growth forecast for China from 4.8 per cent to 4.4 per cent next year and for the broader set of developing economies in east Asia and around the Pacific from 4.8 per cent to 4.5 per cent.

The region, one of the world’s main growth engines, is now likely to experience the slowest pace of improvement since the late 1960s, barring extraordinary periods around the pandemic, the 1970s oil shock and the Asian financial crisis.

China is the main barrier to progress due to a number of factors including the precarious state of its property sector, which normally accounts for more than a quarter of activity in the world’s second-largest economy, prompting Beijing last month to unleash a huge stimulus programme to rekindle demand.

Retail sales meanwhile have fallen to pre-pandemic levels, although economists believe there could be a boost in spending on restaurants and outings during China’s Golden Week, the longest holiday break of the year, which starts today.

Foreign investors are concerned but there have been signs of life in the past few weeks. Factory activity expanded in September for the first time in six months according to government PMI data on Saturday, while S&P Global data yesterday also showed improvement. Consumer prices have edged back from deflation and the rate of decline in exports has eased.

There has also been positive news on trade tensions after a new “mechanism” was agreed with the EU to discuss export controls, mirroring a similar effort between Beijing and Washington. As the FT’s chief economics commentator Martin Wolf recently concluded, it’s far too soon to write off China just yet.

Elsewhere there are signs that weakening global demand is taking its toll.

Goods exports are significantly down in Indonesia, Malaysia and Vietnam and the World Bank’s worsening forecasts reflect the potential damage from US industrial and trade policies encapsulated in the Inflation Reduction Act and the Chips and Science Act. Countries such as Vietnam are fighting back, unveiling billions of dollars in deals with the US on semiconductors and AI.

The way forward for the region was through deeper service sector reforms, said World Bank economist Aaditya Mattoo. “In a region which has really thrived through trade and investment in manufacturing . . . the next big key to growth will come from reforming the services sectors to harness the digital revolution,” he said.

Need to know: UK and Europe economy

Prime minister Rishi Sunak’s weakening of UK climate policies has left exporters facing hefty EU carbon tax bills. The collapse of the country’s carbon market, which sets the price to be paid for every tonne of CO₂ released, means the UK will be hit by EU rules that penalise countries with substantially lower carbon costs.

House prices fell across all UK regions for the first time since 2009 in the three months to September as high mortgage rates took effect, according to mortgage lender Nationwide. The construction industry is bearing the brunt of a cooling UK labour market.

Anti-Ukraine former prime minister Robert Fico is set to try to form a coalition government after winning Slovakia’s elections, potentially joining Hungary in undermining western unity in helping Kyiv in its war against Russia.

EU plans to enforce 30-day payment terms have dismayed retail groups, which say the proposals will inadvertently push up prices and encourage them to buy more from China. UK businesses meanwhile are bracing for the impact of new post-Brexit rules for Northern Ireland.

Ireland is booming yet its creaking infrastructure, and housing in particular, is hampering businesses’ ability to recruit and retain staff. Our Big Read explains.

€14.40 for a Maß of pilsener anyone? Despite the gloomy outlook for the German economy, record numbers of drinkers are flocking to Munich’s Oktoberfest.

Need to know: Global economy

The United Arab Emirates, which will host the UN’s COP28 climate summit this year, has offered to also host the follow-up meeting, giving it large influence over global climate policy during a key two-year period. COP29 was due to be held in eastern Europe but Russia has blocked any EU member country becoming host in the wake of the Ukraine war.

Zimbabwe’s president Emmerson Mnangagwa is preparing to restart talks on $14bn of unpaid debt as deep divisions persist over disputed elections. His government is grappling with the collapse of the revived Zimbabwe dollar and triple-digit inflation.

UBS settled with the government of Mozambique over Credit Suisse’s involvement in a £2bn alleged “tuna bond” fraud that wrecked the country’s finances. The 2013 loans were ostensibly to fund projects including a state tuna fishery but later collapsed into default over the alleged looting of hundreds of millions of dollars.

Japan’s prime minister Fumio Kishida asked investors to “reassess our economy” as heads of global funds gathered in Tokyo for a series of events to attract investment. Read more in our special report: Investing in Japan.

The Revival of the Japanese Stock Market: Is this time different? Register today for our exclusive subscriber webinar this Wednesday October 11 at 14:00 BST.

Need to know: business

Trading in options tied to the Vix volatility index — known as Wall Street’s “fear gauge” — is set to hit a record high as cautious investors look to protect themselves from the risk of a sudden stock market reversal.

“There’s a dark cloud hanging over green stocks.” Shares in renewable energy companies have sold off sharply in recent months, significantly underperforming fossil fuel companies, as higher interest rates take their toll.

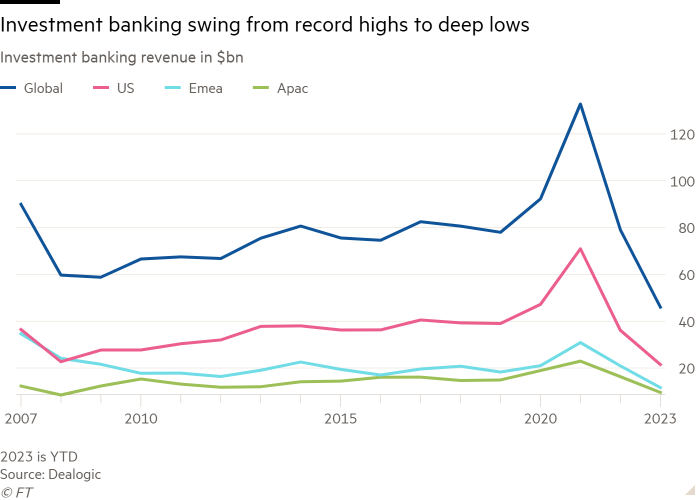

Wall Street bankers are hoping a rebound in dealmaking will lift bonuses and morale, but a return to the industry’s 2021 peak looks a long way off. Fees on corporate mergers, equity raises and debt underwriting surged in 2020 during the pandemic and hit record highs in 2021, but activity plummeted when central banks began aggressively lifting interest rates.

The trial of FTX founder Sam Bankman-Fried, former poster child of crypto, gets under way tomorrow. He is accused of having defrauded dozens of the world’s top investors as well as millions of customers at his FTX cryptocurrency exchange and stealing billions of dollars entrusted to his custody.

America’s shale pioneers vowed to keep a lid on drilling even if oil hits $100 a barrel, hitting out at what they claim is a “war” on fossil fuels waged by the Biden administration. Production cuts by Saudi Arabia and Russia have put up petrol prices, causing Biden a political headache as he seeks re-election.

UK water bills are set to soar by an average £156 a year as providers seek £96bn to fund investment in the water and sewage network. The plans, submitted today to regulator Ofwat, come amid public anger over sewage outflows and the effect of price increases during a cost of living crisis.

Lovers of coffee and chocolate face higher prices and “shrinkflation” in product sizes as underlying commodity costs surge. Sugar prices hit their highest level in 12 years this month while cocoa futures reached a four-decade high. It’s not looking great for cheese lovers either: recent floods have devastated Greek production of Feta.

The World of Work

Recent visits to picket lines by president Joe Biden and potential rival Donald Trump highlight how workers’ rights are moving to the centre stage of US political debate. The Hollywood writers’ strike is a case in point.

What is the difference between a hook-up, a fling and a relationship? Management editor Anjli Raval says this may now be required knowledge for directors at big companies as personal conduct becomes a growing risk for business.

Hybrid working has exposed the inadequacies of modern office design, says columnist Pilita Clark.

Some good news

What is believed to be the first baby beaver born in London for hundreds of years has been spotted in Enfield after the council and Capel Manor college began reintroducing the animals back to the capital.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link