New York Department of Financial Services

New York requires at least 20 hours of pre-license education. You must meet at least one of these conditions:

- Pass on both the National and New York State components of the SAFE exam;

- Pass on both the National and stand-alone UST components of the SAFE exam; or

- Pass on the National Test Component with Uniform State Content.

4. Apply for NMLS license

Next, you can apply for your NMLS license. In New York, you can apply for your NMLS license by taking these steps:

- Log in to NMLS account

- Select the filing tab (top of the screen)

- If applying as an individual, select “individual”

- Click request new/update. If you are paying the filing fees, click “continue”. (If you are already employed by a mortgage company, your employer might handle this step for you.)

- Click “add” to apply for your New York license

- Select appropriate NY license and click “next”

- Verify info

- Before proceeding, read the final page carefully. Click “finish” if the info is correct

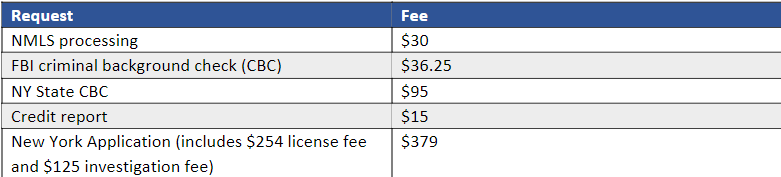

5. Complete background checks/pay fees

The SAFE Act established registration and licensing standards for mortgage professionals. To receive your New York mortgage license, you must provide the following information and pay the fees that come with them:

6. Associate NMLS account with employer

If you worked for a federal bank or are moving from another state, you can now apply for your NMLS license before being hired by a New York-regulated entity. After the DFS is satisfied that you have met all the requirements to become a mortgage broker, other than affiliation with a NY-regulated entity, you will receive a sponsorship notification. This will require that you become affiliated with a NY-regulated entity within 30 days of the date of the notification.

Comments are closed, but trackbacks and pingbacks are open.