One invitation to start: Join DD’s Arash Massoudi and the FT’s Henry Mance for an exclusive conversation with Michael Lewis, bestselling author of The Big Short and Flash Boys, on the rise and fall of FTX’s Sam Bankman-Fried. We’re saving a few spaces just for DD subscribers — email due.diligence.forum@ft.com to claim your spot.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

PE’s latest financial engineering feat

-

Křetínský joins auction for the Telegraph

-

Inside “Project Springsteen”

Private equity uncovers leverage to deal with leverage

Consider it a warning sign when a new piece of financial engineering has some private equity executives calling the manoeuvre a bridge too far.

This was the reaction to a new tactic the industry is turning to in a bid to uncover cash for struggling portfolio companies to repay debt and buy time.

DD’s Antoine Gara and Eric Platt revealed last week that private equity firms are increasingly borrowing against a fund’s investment assets to help pay down the debts of struggling individual companies.

These so-called net asset value loans are being dubbed “defending the portfolio” and growing in prominence as financial markets tighten. PE firms already use NAV loans to fund dividends to investors or finance acquisitions, but are novel as a deleveraging tool.

Last month, Vista Equity Partners used the proceeds of a NAV loan to pump $1bn into financial technology company Finastra, one of the big refinancings in leveraged finance markets.

It means that the private equity group’s “equity” infusion was actually just debt placed elsewhere.

This means private equity firms are essentially shuffling leverage from a single portfolio company to an entire fund. By securing that loan against a larger pool of fund assets, buyout shops like Vista are able to uncover cash and negotiate lower borrowing costs than would otherwise be possible if the portfolio company sought financing on its own.

In the case of Finastra, Vista was struggling to take out a junior loan and lenders were pushing it to make a cash infusion. But Vista held Finastra in an older fund with little dry powder, forcing it to rely on financial engineering.

It ultimately turned to Goldman Sachs for the NAV loan and used those proceeds to pay off the junior loan. Private lenders including Ares Management, Oak Hill and Blue Owl stepped in to provide a $4.8bn senior private loan.

Sources tell DD that bankers and lenders are pitching the tactic to private equity firms, but some are baulking.

“We get pitched left and right,” said one executive at a large US buyout firm that has resisted such loans. “To me, it seems like pretty risky financial engineering.”

The biggest critique is that it can cross-collateralise a fund’s portfolio and create a drag on performance. It also creates the risk of throwing good money after bad, a cardinal sin.

One fascinating nugget DD picked up: this new leverage is somewhat hidden. The lenders to Finastra were not explicitly told where Vista had gotten the $1bn it pumped into the company.

The ‘Czech Sphinx’ slinks closer to a Telegraph deal

Billionaire investor Daniel Křetínský has been dubbed the “Czech Sphinx” for his inscrutability. But his reputation has grown less elusive in recent years as he has risen to become one of Europe’s most prolific dealmakers.

The energy tycoon has joined the auction* for the UK’s Telegraph Media Group, people close to the process told DD’s Arash Massoudi, joining potential buyers including Daily Mail and General Trust.

TMG, once a crown jewel of the billionaire Barclay family, has since become a casualty of their financial misfortunes after being forced into receivership over £1bn of debts.

Křetínský, who last month told the FT that he wouldn’t pay outsized prices for “trophy” media assets, seems to think it can be restored to its former glory. Though unlikely to seek control of the group, Křetínský may support other offers and end up with a minority stake, the people with knowledge of the process said.

It’s his second time eyeing the group after circling TMG in 2020, as the FT reported earlier this year, but later abandoned the idea. He currently owns a slice of France’s Le Monde newspaper as well as a series of titles from French media group Lagardère.

The poker-faced investor first amassed his wealth scooping up energy assets at fire-sale prices in sellers’ rush to decarbonise, a fortune that has more than doubled to $10bn over the past year as the energy crisis juiced up profits in the sector.

Křetínský has now been employing a similar strategy across unloved media, retail and infrastructure assets, including a winning offer to bail out the debt-laden French food retailer Casino and talks to buy publisher Editis from billionaire Vincent Bolloré’s Vivendi.

Despite the recent string of deals, the hunt is very much still on. “We still have some capacity to do some more, but it’s not unlimited. For instance, our retail team has the capability to probably do one more [deal],” he told DD.

*This has been corrected to reflect the original FT report that Křetínský has joined the auction process for The Telegraph.

Born in the USA: a New York law firm’s London coup

DD readers are by now read up on US law firm Paul Weiss’s back-to-back raids on its higher-grossing rival Kirkland & Ellis, signalling its intent to edge in on territory closely guarded by the UK’s “magic circle” firms.

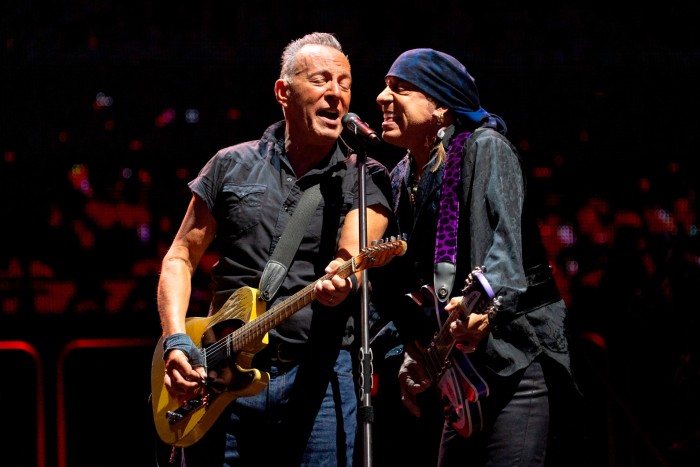

The latest intel from the coup on London’s legal market, as DD’s Will Louch and James Fontanella-Khan reported last week, is that it happened in the most American setting possible: a Bruce Springsteen concert.

The setting helped inspire a name for the secretive plan hatched within Paul Weiss to poach Kirkland’s best and brightest dealmakers: Project Springsteen.

DD spoke to multiple partners from both firms about the raid, which was in part triggered by the exit of Roger Johnson, one of Kirkland’s top lawyers in London. He was angry that he hadn’t been consulted over the hire of Paul Weiss star Alvaro Membrillera, a tiff with Kirkland chair Jon Ballis that escalated to Johnson’s eventual firing.

Johnson’s exit, and the decision by US-based executives to bypass London partners when hiring Membrillera, left Kirkland more exposed to a raid.

Soon after, on a balmy day at Chicago’s Wrigley Field where Springsteen hits including “Born to Run” blasted, the poaching war was on.

The battle isn’t over, though. Challenging Kirkland’s turf in London won’t be easy for Paul Weiss and the recent hire of its star lawyer Membrillera will probably boost its relationship with US investment giant KKR.

Plus, with the golden age of private equity coming to a close, the environment will be tougher for everyone involved.

Job moves

-

Bob van Dijk is stepping down as chief executive of Naspers and as head of Prosus, the Amsterdam-listed investment vehicle it backs. Ervin Tu, chief investment officer of both companies, will take over the two roles in the interim.

-

Cooley has named Rachel Proffitt as its first-ever female CEO, succeeding Joe Conroy, who will continue as chair.

-

BNP Paribas has named AQR Capital Management’s former trading head Scott Carter as global head of investor coverage.

-

Blackstone’s head of European and Asia-Pacific private credit Paulo Eapen will leave the group at the end of this year due to personal reasons.

-

Jeremy Fleming, the recently departed head of British cyber intelligence spy agency GCHQ, has been hired to chair the advisory board of UK venture firm Gallos Technologies.

-

Goldman Sachs’ Nick Pomponi has joined Evercore as a senior managing director in its technology group, based in New York.

-

Condé Nast has appointed Chioma Nnadi to replace Edward Enninful as head of British Vogue, one of the most powerful roles in the fashion industry.

Smart reads

Once upon a wine in Hollywood Exiled Russian billionaire Yuri Shefler, who has been battling the Kremlin over vodka trademark rights for two decades, finds himself in a new tussle over French rosé with Brad Pitt, the FT reports.

Dealmakers become the deal Private equity is in for a massive wave of consolidation, Partners Group boss David Layton told the FT in an interview.

Striking out Nicole Musicco’s abrupt exit from the California Public Employees’ Retirement System followed a big push by the former investment chief into sports deals, Bloomberg reports.

News round-up

UBS sounds out investors over first AT1 sale since Credit Suisse rescue (FT)

Marcelo Claure’s Latin America fund makes first investment (FT)

Cayman Islands to open Singapore office to lure Asia’s wealthy (FT)

German banker with links to Scholz charged in €280mn tax fraud (FT)

Billions of dollars in western profits trapped in Russia (FT)

Big Mamma group sells majority stake to private equity (FT)

Kering bets on Gucci shake-up to revive fortunes (FT)

SoftBank/OpenAI: next bet on AI unlikely to be more successful than the last (Lex)

Due Diligence is written by Arash Massoudi, Ivan Levingston, William Louch and Robert Smith in London, James Fontanella-Khan, Francesca Friday, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Antoine Gara in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to due.diligence@ft.com

Comments are closed, but trackbacks and pingbacks are open.