[ad_1]

More than half (53%) of Certified Financial Planners said they would do more pro bono planning work if their firm encouraged it, according to a new survey conducted by the Foundation for Financial Planning, given exclusively to WealthManagement.com. Among CFP professionals under the age of 35, that figure increases to 71%, an indication that firms encouraging pro bono work can gain a competitive edge in recruiting.

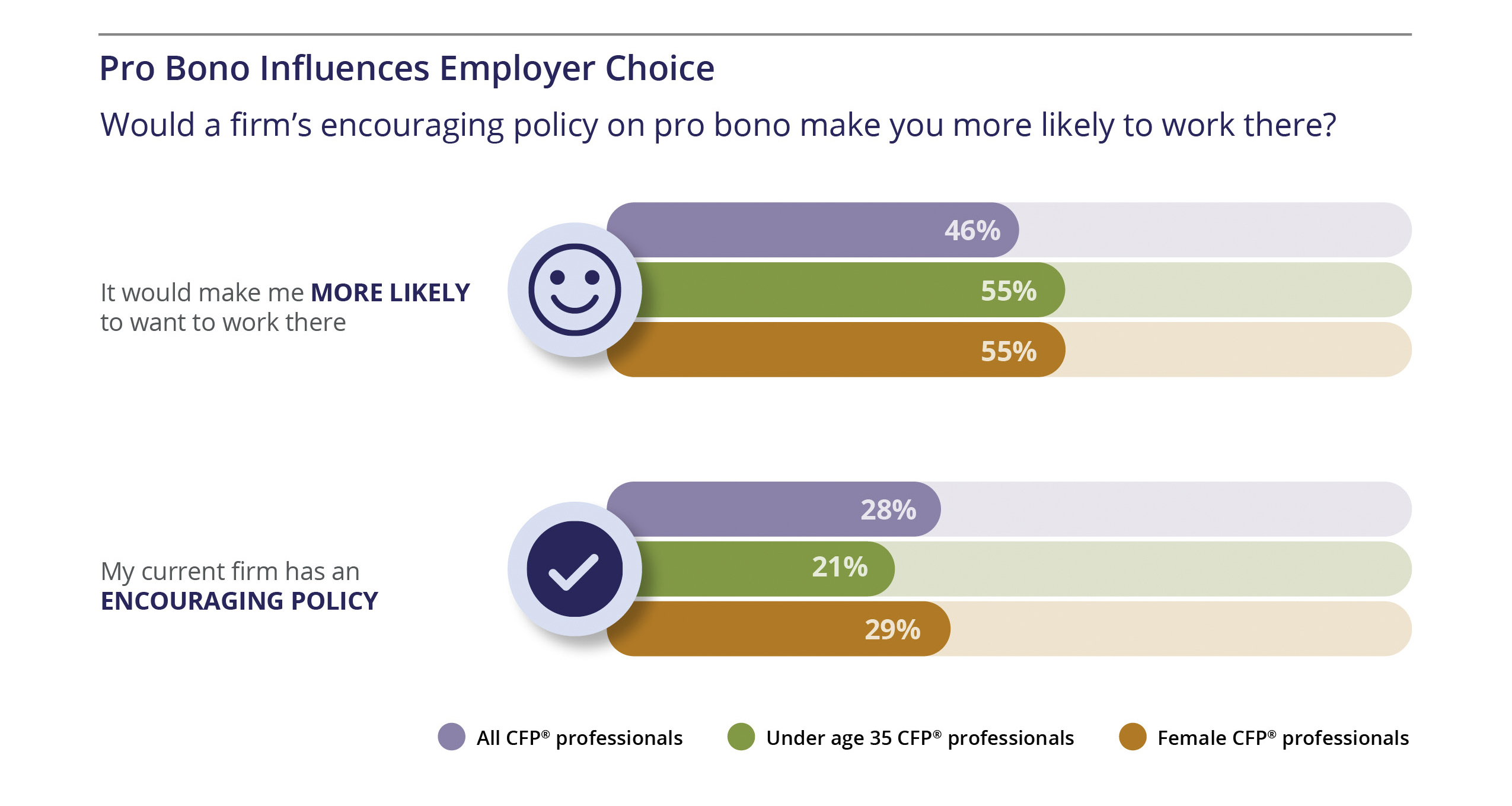

Yet, only 28% of CFP professionals report that their firms encourage pro bono planning.

“There’s a real gap there, and we think that creates a human capital opportunity. We know there’s a war for talent now for advisors,” said Jon Dauphiné, CEO of FFP. “There are a lot of advisors that are going to be retiring in the next 10 years, and it’s just really, really critical to engage those younger and newer entrants to the field.”

Further, some seven in 10 CFPs agreed that financial advisory firms should be more like leading law firms in encouraging and supporting advisors who provide pro bono service.

To conduct the study, FFP surveyed 1,166 CFP professionals in June 2023, and found that 73% of respondents said they had previously performed pro bono services.

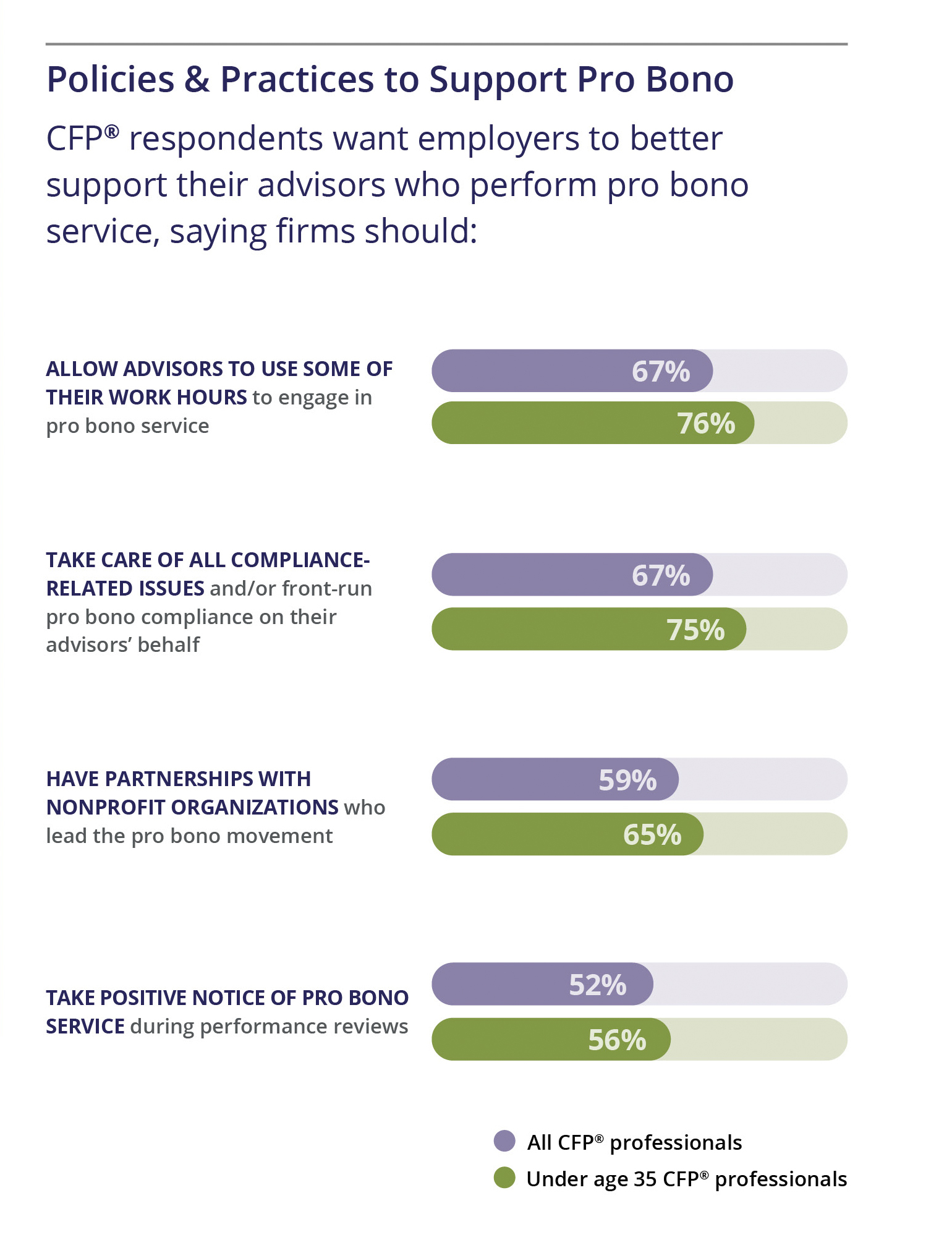

Sixty-seven percent of all CFP respondents said firms should allows advisors to use some of their work hours to engage in pro bono; that increased to 76% for CFPs under age 35. Another 67% said firms should take care of all compliance-related issues and/or front-run pro bono compliance on their advisors’ behalf.

“If a firm doesn’t treat each time an advisor wants to do this work as a one-off but actually have an encouraging policy and has the compliance unit involved and aware, we think that can help smooth the way,” Dauphiné said.

Nearly six in 10 CFPs said firms should have partnerships with nonprofit organizations who lead the pro bono movement, while more than half said firms should take positive notice of pro bono service during performance reviews.

Jason Van de Loo, chief client officer at Edelman Financial Engines, which has 370 financial planners, said his firm has taken many of these steps to encourage pro bono work. The firm’s financial planners recently embedded pro bono into its “culture code.”

“Our planners had actually taken initiative to say, ‘As part of creating this culture of professionals, we believe pro bono financial advice needs to be an explicit expectation of each other, and an explicit commitment we make as planners both to our own community and to the communities in which we serve,’” he said.

Edelman Financial Engines has also assigned one of its divisional vice presidents to be responsible for coordinating and driving pro bono work across the firm. That person is looking for opportunities in the local community, promoting those to its planners, actively recruiting other CFPs to be part of the effort, and sharing success stories, both among its planners and with the broader firm, to show the impact that pro bono work is making. That person is also getting involved externally through the CFP Board and its events.

Van de Loo says the firm has tried to go beyond just awareness to make it an explicit expectation within the culture.

“That might look like making that part of performance appraisals, making that part of career development plans or professional development plans, making that part of awards or recognition, as we’ve done in our organization making it part of the code of conduct that our planners hold themselves accountable to,” he said.

Edelman Financial Engines has also integrated pro bono work into its employer resource groups, which focus on underserved communities, including women in leadership, Black and African Americans, and LGBTQ+.

“The work we’ve done around culture is a significant competitive advantage for us, and we’re finding it’s helping us attract the type of planners that stick with us and are successful with us,” Van de Loo said.

When asked what would increase the likelihood that respondents would provide pro bono service, 79% said if liability insurance was provided at no cost, 78% said if they received CE credits for providing pro bono, and 70% said if they had easier access to pro bono opportunities. Other things CFPs said would increase the likelihood included having additional pro bono training, eliminating compliance issues and having it formally recommended as part of professional and ethical obligations.

Dauphiné said the FFP has solved for some of those barriers. For example, the FFP offers free liability insurance to CFPs who volunteer through its platform. The organization created ProBonoPlannerMatch.org, a free online volunteer matching platform, which now has 120 nonprofits posting different types of opportunities, many of them virtual. FFP also offers pro bono training, and maintains a compliance FAQ, in partnership with MarketCounsel, to address concerns that may be raised by compliance departments.

And in July, the CFP Board announced it now recommends each CFP professional do a minimum of 20 hours of pro bono service each year.

The FFP is focused on expanding access to fiduciary advice to the more than half of American families who wouldn’t be able to pull together $1,000 for emergency event. Many of these folks are low-income workers and don’t have much in the way of assets. Within that, there are certain vulnerable groups that FFP has identified, such as families facing serious cancer, communities of color, underserved women, military and veterans, domestic violence survivors, wrongly imprisoned and at-risk seniors.

[ad_2]

Source link