[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

Our story today revealing how billions of dollars in western profits are trapped in Russia as the Kremlin increases the pressure on “unfriendly” nations is the latest example of how war in Europe and other geopolitical tensions are roiling global business and trade.

Local earnings of companies from BP to Citigroup have been locked in Russia since Moscow announced a dividend payout ban on businesses from the US, the UK and the EU. Many have tried to sell their local subsidiaries but any deal requires the Kremlin’s approval and is subject to steep price discounts.

More significantly for global trade, Russia’s attempts to stop Ukraine exporting its grain continue to threaten global food supplies, rattling markets and increasing prices for developing countries.

Kyiv has stepped up efforts to break Moscow’s Black Sea blockade, but has not been helped by Hungary, Slovakia and Poland banning Ukrainian grain imports over the weekend, a move condemned by Germany and others as potentially illegal and “incompatible” with EU unity. The EU had asked Kyiv to voluntarily prevent surges of produce into neighbouring countries.

The other continuing disrupter to world trade is friction between the west and China.

The World Trade Organization last week warned of the impact of friendshoring as countries switched supply chains to allies, rather than the most efficient exporter, to reduce their dependence on China. Talk of deglobalisation was premature but friendshoring would ultimately lead to higher costs and more global conflict, the WTO argued.

The UK’s outgoing trade chief warned separately that the race to net zero as well as rising animosity towards Beijing were providing the pretext for a damaging trend towards protectionism.

As chief foreign affairs commentator Gideon Rachman points out today, although many in Europe were dismayed by this turn towards protectionism in the US, last week’s announcement of an EU investigation into subsidies for China’s electric car industry suggests that Europe is starting down a similar path.

The Bundesbank added to the debate today, arguing that excessive dependence on trade with China was one of the main reasons why Germany’s “business model is in danger”. The faltering trade with China, Berlin’s biggest trading partner, is one of the reasons its economy has contracted or stagnated over the past nine months.

Attempts to get round China’s influence have also led to talk of a new India-Middle East trade corridor, backed by the US and EU at the recent G20 summit.

Turkey, which would be bypassed by the new route, is negotiating with regional partners over an alternative, the Iraq Development Road, highlighting its traditional role as a bridge between Asia and Europe, a history that dates back centuries to the silk roads.

Need to know: UK and Europe economy

The Bank of England is widely expected to raise interest rates by another quarter point on Thursday, taking the cost of borrowing to 5.5 per cent, its highest level since early 2008. But, as economics editor Chris Giles points out, data showing persistent inflation jars with signals from the BoE in recent weeks.

British politicians need to be more honest on tax, writes chief economics commentator Martin Wolf, rather than fantasise about cuts that pay for themselves or magically engender growth.

UK opposition leader Sir Keir Starmer told the Financial Times he would put a closer trading relationship with the EU at the heart of his growth plans if his Labour party won the general election. Read our interview with Starmer.

The UK’s failure to attract offshore wind developers in its latest renewable energy auction must be a “wake-up call” for the country, warned the head of RWE, one of the world’s biggest renewable energy companies.

A sharp economic slowdown in Italy is testing investors’ patience with the government after recent interventionist moves had raised serious doubts about the direction of policy.

Tobacco smuggling from Gibraltar into Spain is becoming a major irritant in UK-Spain relations. Cigarettes are cheaper in Gibraltar because the British territory does not apply sales tax or other levies, enabling gangs to hop across to Spain and sell them at a mark-up.

Need to know: Global economy

China lifted temporary curbs on gold imports that were imposed on some lenders in a bid to defend the renminbi. Stand-offs with residents of older neighbourhoods resisting redevelopment are hampering Beijing’s plans to revitalise its property sector.

Register here for the FT subscriber event on China’s economic slowdown this Thursday at 11am BST.

California is suing some of the world’s biggest oil companies, claiming they deceived the public about how fossil fuels were destroying the planet. The state says the deception resulted in billions of dollars in damage from drought, wildfires and historic storms.

The World Health Organization urged Beijing to offer more information on the origins of Covid-19 and said it was ready to send a second team to look into the matter, nearly four years after the first cases emerged in the city of Wuhan.

Need to know: business

A new Big Read examines the Biden administration’s efforts to take on the US drugs industry. New rules will make medicines cheaper for older Americans but companies warn innovation will suffer.

The UK’s public broadcasters are launching a digital service that will finally end the need for an aerial for freely available TV channels. The new service — called Freely — will be built into the next generation of smart TVs, in effect taking the Freeview TV platform on to the internet.

Apple is facing new competitive pressures in China, its largest manufacturing hub and biggest international market due to a ban on its products and a resurgent rival in Huawei.

A UK pub group thrust the idea of surge pricing into the spotlight last week after its decision to charge more for pints at peak times. The strategy is becoming more attractive in leisure and retail but the penalties for getting it wrong are significant, as our Big Read explains.

Share buybacks in the US are falling as high interest rates undermine the incentive for companies to purchase their own stocks. Analysts say the slowdown is likely to mark the beginning of a longer-term trend that could put downward pressure on stock markets.

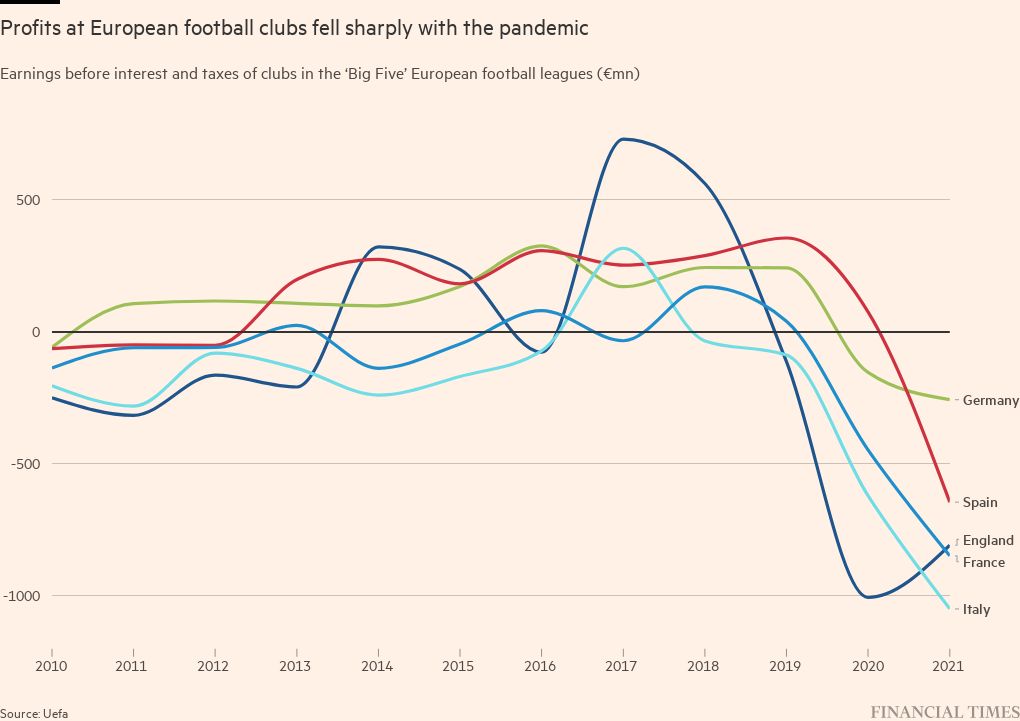

Pressure is growing for tougher financial regulation of European football clubs as transfer fees and wages for star players accelerate. A Big Read explains.

The World of Work

Professional women have become more likely to work full-time since the pandemic in sectors where hybrid and remote working are now standard practice, according to research based on official UK data which offers some of the strongest evidence yet of benefits from homeworking for individuals and the wider economy.

An FT survey highlights problems facing workers in the global consulting industry as the rush of demand fostered by the pandemic comes to an end. Industry professionals are getting used to job cuts, new routines and fresh insecurities.

US banks are gradually doing more on diversity, equity and inclusion in the workforce, including unconscious bias training for staff and sponsorship programmes for employees from under-represented groups. Read more in our special report: The Future of Banking.

Some good news

European Commission president Ursula von der Leyen launched what some have called the world’s first green container ship, a Maersk vessel powered by green methanol.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link