[ad_1]

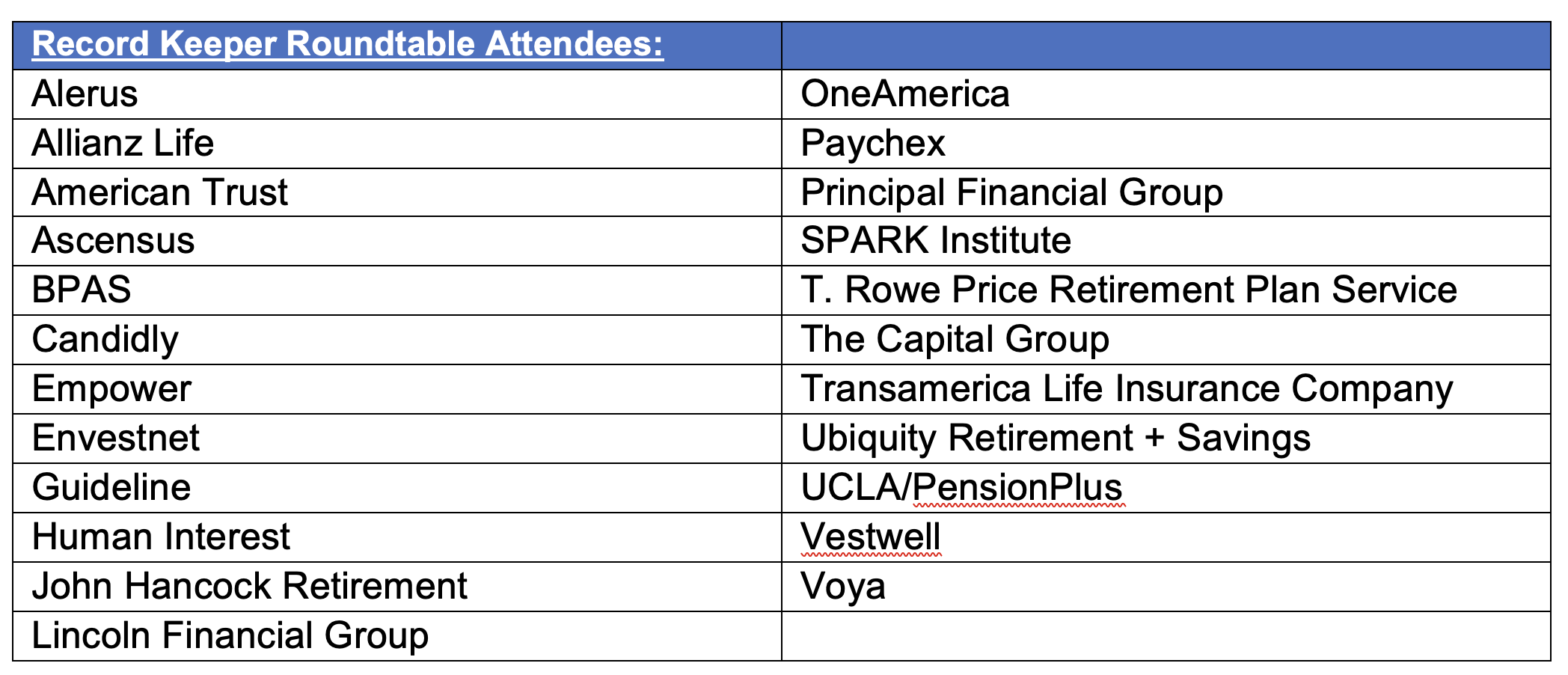

In the complicated and interdependent ecosystem that makes defined contribution plans so difficult to navigate, everything begins with data, making record keepers the lynchpin. At the fifth annual RPA Record Keeper Roundtable & Thinktank held in New York City and hosted by WealthManagement.com on Sept. 6-7 before the 2023 WealthManagement.com Industry Awards (The Wealthies), senior leaders from most of the major firms gathered to discuss their biggest opportunities, challenges and threats, as well as ways to better collaborate not just with partners but with each other.

The major themes throughout the symposium included:

- Serving the underserved 97% of participants

- Safe and appropriate use of participant data

- Leveraging technology

- Serving small businesses through wealth advisors

The consensus was that, though very difficult, if the industry does not better serve the 97%, the government could step in.

DC record keepers, especially those focused on RPAs, face daunting challenges and amazing opportunities as well, which include:

- Conversion of wealth, retirement and benefits at the workplace

- Fee compression fueling consolidation

- New laws and growing lawsuits

They depend on many partners to help and collaborate with who also face their own challenges and potentially divergent priorities. Of the estimated 288,000 active financial advisors, Cerulli estimates just 13,000 have 50% or more of their revenue from DC plans while 63,000 may have significant DC assets but do not focus on them, leaving another 100,000+ with at least one plan, many of whom have relations with business owners.

In the opening discussion, UCLA Professor Shomo Benartzi, founder and CEO of PensionPlus who won a Wealthies award for in-plan retirement income, bluntly stated that without data, the industry cannot move the needle to serve the underserved and offer retirement income. Laurel Taylor, CEO and founder of Candidly, who also won a Wealthies Award, warned that consumers expect value in exchange for data.

Tim Rouse, SPARK’S Executive Director, said based on focus groups and surveys, each member of the DC ecosystem had a different perspective about data, including:

- Plan sponsors believe they own the data (or at least are the stewards) and are willing to lend, not give it to providers under the right circumstances

- Participants want to be helped not exploited

- Advisors understand the need for positive election

- Record keepers are concerned about lawsuits and the ability to use minimal data to serve the plan without permission

One record keeper who attempted to supply data to advisors and help them leverage opportunities with participants was disappointed that most did not follow up. Kevin Collins, head of retirement plan services at T Rowe Price, observed that advisors are in the early stages of leveraging wealth opportunities within DC plans and developing the needed wealth stack. On the other hand, wealth firms like Creative Planning do a good job, according the Wayne Park, CEO at John Hancock Retirement, by creating a holistic financial planning looking at all assets, not just DC account balances or IRA rollover opportunities.

John Farmakis, SVP of business development at Ubiquity Retirement, raised the obvious question of how to get to the 275,000 wealth advisors not focused on DC plans. Todd Hedges, senior manager at Paychex, said he is working with broker/dealers who are eager to engage with their wealth advisors by providing data on who may have clients that touch businesses. While early stages, Aaron Schumm, CEO and founder at Vestwell, observed a growing interest by wealth advisors in DC plans though many independent broker/dealers are concerned about risk mitigation with the untrained reps.

Are advisors not leveraging participant data because most are not of them are not attractive opportunities, wondered Mark Alley, national market president at Alerus. Because the entire financial service industry is focused on a very small percentage of people, Kevin Collins suggested that advisors may be as well.

ChatGPT is largely unused and not well understood by the DC industry even as we all realize its vast potential. Candidly’s Taylor, who previously worked at Google, warned that before the industry engages, the government needs to regulate large language models. The DC industry could lag behind because of compliance concerns.

The group noted the industry was not doing a good job engaging participants where they are (as opposed to on their websites) and anticipating when they might need help. They also asked whether we have an income rather than a retirement savings gap. And though talent is becoming easier to find, the group questioned whether remote work is working especially for less experience employees, which could cause retention issues.

Ralph Ferraro, head of retirement plan services at Lincoln Financial, suggested the industry should collaborate on financial literacy while Jeff Rosenberger, COO at Guideline, questioned whether “collaboration” was too strong a word and suggested “standardization” might be more realistic and whether we should lean in on an easier goal like more usage of auto features.

Retirement income will continue to struggle without collaboration of providers, advisors and plan sponsors, causing Mike DeFeo, Allianz Life’s head of DC distribution, to ask where it is on record keepers’ priority list. John Hancock’s Park noted the difficulty in making money on a declining asset while another attendee was surprised by the lack of understanding about the subject as the industry still attempts to compare retirement income solutions to mutual funds, for example. Maybe participant call centers need to be better trained on the subject as well, noted Jack Barry head of product development at John Hancock.

Amazing insights from a fully engaged group of leaders from top providers, outlining the immense opportunities of almost $10 trillion in DC assets (another $12+ trillion in IRAs), 700,000+ DC plans and growing due to state mandates and SECURE 2.0 tax credits, and the chance to serve the 80 million DC participants while the challenges seem just as daunting as the threat of lawsuits and government intervention looms.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.

[ad_2]

Source link