[ad_1]

Receive free Annuities updates

We’ll send you a myFT Daily Digest email rounding up the latest Annuities news every morning.

Asset manager Standard Life has launched a pension annuity product, in another sign that the fixed income market has been rejuvenated by higher interest rates.

Pension annuities, which allow retirees to buy a stable income for life with some or all of their pension savings, have become more popular over the past 18 months as interest rates allow them to offer higher levels of income.

“Annuities are increasingly better value, with current rates improving by 20 per cent in the past 12 months, as of June 2023,” said Standard Life’s managing director for individual retirement, Claire Altman.

The insurer’s research suggested three-quarters of people said they wanted “income certainty” in retirement at a time when the economic outlook remained unclear, she added.

The annuities market was hit in 2015 by the Pensions Freedom Act, which ended any obligation for retirees to buy the fixed products with their pension pot. After the financial crisis, low interest rates kept annuity rates down and many savers moved to “drawdown” products in which their savings were invested in the stock market and subject to its fluctuations.

Since the end of 2021, interest rates have increased from close to zero to more than 5 per cent in less than two years. Some annuities, known as enhanced or impaired annuities, now offer rates of over 8 per cent for retirees whose health is classed as “poor”, according to mypensionexpert, a pension advice site.

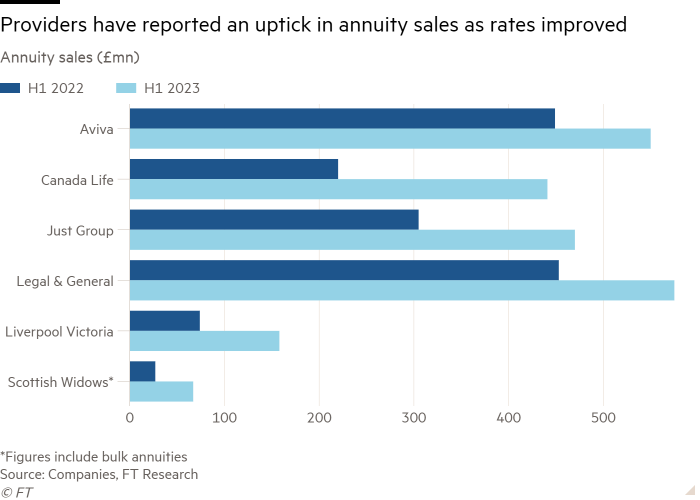

Sales of annuities have increased sharply over the past year as UK savers look for guaranteed income amid an uncertain macroeconomic picture. Some £2.3bn of lifetime annuities were sold in the first half of 2023, up from £1.7bn for the same period in 2022, according to the Association of British Insurers.

Standard Life offered annuity services on the open market until 2017, when it replaced it with a multi-asset strategy for retired investors. Other insurers, such as Prudential, also stopped offering the products.

In 2019 Standard Life was fined £30mn for mis-selling annuities to customers over the phone between 2008 and 2016. The Financial Conduct Authority claimed the company failed to tell customers with health problems that they could have bought a better “enhanced” product elsewhere.

Some industry figures welcomed the Edinburgh-based company’s entry into the industry on the basis that increased competition would benefit investors. The market is dominated by insurers such as Aviva, Canada Life and Legal & General.

“Standard Life’s re-entry provides a welcome boost to the annuity market and gives further choice to those in need of a guaranteed income in retirement,” said Helen Morrissey, head of retirement analysis at Hargreaves Lansdown.

“The surge in annuity rates we’ve seen over the past 18 months has reinvigorated the market . . . Increased competition from such a well-known name should help drive higher incomes for retirees and benefit the annuity market as a whole,” Morrissey said.

The investment platform said the number of quotes issued for annuities, which are calculated based on factors such as age and health, surged by more than 120 per cent in the 12 months ending July 2023 against the year before.

“An annuity does mean that you are forgoing the chance to get high returns by keeping your assets invested in equities or in higher return forms,” said David Sturrock, a senior research economist at the Institute for Fiscal Studies, a think-tank.

He nevertheless cautioned that some investors might misjudge the returns from an annuity by underestimating their lifespan. In an era of higher inflation, retirees needed to look beyond the headline income figure and consider inflation protection, he added.

“Annuities not linked to inflation could be even more of a concern if inflation is going to be high for an extended period,” he said. “The initial income you’d get from a non-inflation indexed annuity will be higher but that will come at the cost of lower income in the future.”

[ad_2]

Source link