[ad_1]

Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

There will be a recession, it’s just going to come later.

That’s the gloomy message for many countries from a new aggregation of global forecasts published today by Consensus Economics. The consultancy said persistently high interest rates in major economies would lead to growth slowing in 2024 to 2.1 per cent after a (better than expected) 2.4 per cent in 2023, thanks to strong consumer demand and labour markets.

Economists’ caution is based on the belief that persistently high demand will keep inflation higher for longer, forcing major central banks to keep borrowing costs high well into next year.

Recent national data and policy moves however have highlighted key differences between the US, China and Europe.

In the US, Friday’s jobs report suggested the world’s largest economy was cooling, giving the Federal Reserve room to hold rates steady at its September meeting. Investors are now dreaming of a “Goldilocks” scenario in which inflation comes under control without causing a recession, after the data showed an uptick in the unemployment rate, subdued jobs growth and wage rises back at pre-Covid rates.

This is in strong contrast to the growing pessimism around China, the world’s second-largest economy, which is beset by structural problems and a downturn in manufacturing and exports. Its problems are also reverberating across Asia. In South Korea for example, Asia’s fourth-biggest economy and seen as a bellwether for the region’s tech supply chain which has helped support global growth for decades, exports and factory activity are falling. Japan and Taiwan are suffering similarly.

On the positive side, investors today appear to have taken heart from Friday’s moves from Beijing to prop up its ailing property sector.

In the eurozone, a better than expected performance this year means the European Central Bank is also likely to keep rates higher for longer. ECB president Christine Lagarde in a speech today offered no clues on the next move but said the bank must do more to explain why its forecasts are sometimes wrong and accept the limitations in its predictions or risk a further erosion of public trust.

Germany, the bloc’s largest economy, remains a concern: new export data today added to signs of a poor start to the third quarter. Europe is also facing a stickier inflation problem than the US.

In the UK, where the Bank of England is also expected to keep interest rates higher for longer, there are at least grounds for optimism after radical data revisions last week shattered the prevailing economic narrative.

The changes, notes economic editor Chris Giles, completely alter analysts’ and policymakers’ thinking, not just about the UK’s comparative growth performance, but also about productivity, inequality and how society has changed since the pandemic.

Need to know: UK and Europe economy

Brexit and pandemic-related labour shortages have pushed up wages across the UK. FT reporters examine why some sectors are affected more than others.

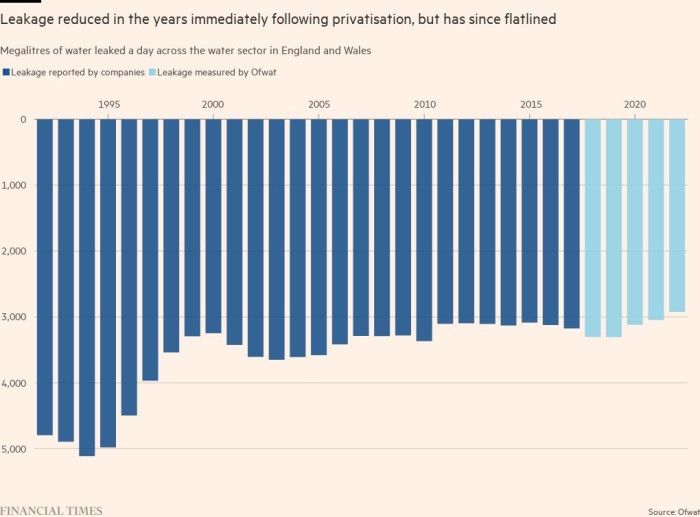

Why is famously rainy Britain at risk of running low on water? A new Big Read explains.

Commentator Martin Sandbu says the EU is poised for a giant leap towards further integration with pivotal decisions on expansion, financing and how decisions are made.

Need to know: Global economy

India is grappling with geopolitical tensions ahead of this weekend’s G20 summit, especially over the use of language on the Russia-Ukraine war that has been opposed by Beijing as well as Moscow. The absence of Chinese president Xi Jinping is a blow to the G20’s status as a global leadership forum.

Demonstrations continued for a third week in Syria as protesters called for the removal of president Bashar al-Assad. Their anger was originally sparked by the slashing of fuel subsidies but the calls have morphed into larger anti-regime protests.

Eccentric former TV commentator and “anarcho-capitalist” Javier Milei, the frontrunner in Argentina’s presidential race, is still in the ascendancy, and appears to be winning over significant chunks of the population.

With vast natural resources and proximity to the US, Canada ought to be one of the world’s economic superpowers. Why is it underperforming?

Need to know: business

US biotech Roivant Sciences distanced itself from its founder and presidential contender, Vivek Ramaswamy, after he alleged that the Food and Drug Administration was “corrupt” and said it should be gutted.

US financial editor Brooke Masters examines how American drug prices affect the rest of the world. The country is responsible for almost half the world’s medicine spending and US R&D accounts for two-thirds of the OECD total.

BMW chief Oliver Zipse warned that the forthcoming EU ban on combustion engines was pushing European carmakers into a deadly price war with Chinese rivals. China’s frenzy of battery-plant building is expected to reinforce its position as the world’s leading EV maker. Read more in our battery revolution series.

The World of Work

The UK is now the only developed country where more people have continued to drop out of the workforce since the pandemic — and an increasing number of them are young, writes FT columnist Camilla Cavendish. Here’s how some bosses are helping staff through long-term illness.

Virtual reality may be common when it comes to training pilots but in other sectors companies are still trying to figure out how VR can help in learning and development. Read more in our special report: Upskilling.

UK banks are hardening their stance on working from home, arguing it is sapping productivity. The London office of Goldman Sachs is facing a £1mn lawsuit over claims it is a “dysfunctional” workplace.

Networking is seen as an essential tool to getting on but a nakedly self-serving approach is likely to put people off, writes Miranda Green.

Corporate diversity programmes are increasingly under attack in the US from conservative campaigners: law firms are the latest battlegrounds.

Some good news

While kidney transplants are the definitive treatment for end-stage renal disease, they are limited by organ availability and post-transplant complications. US researchers have come up with a potential alternative: an artificial kidney that could also free patients from the need for dialysis.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link