[ad_1]

A recent PitchBook study that surveyed founders from top accelerators found that they are generally interested in just three things:

- Learning how to operate a startup

- Networking with potential customers

- Getting warm intros to VCs

But now that so many venture capital firms provide these services — along with marketing boot camps, personal coaching, founder/investor retreats, and other value-adding activities — is getting accepted into an accelerator still as important as it once was?

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

“Starting a tech company today costs 99% less than it did 18 years ago when Y Combinator was started,” says Brett Calhoun, managing director and general partner at Redbud VC.

As a result, he says the accelerator model must evolve, as “nearly every early-stage VC will have a ‘platform’ component to support early-stage founders.”

Thanks for reading TC+ this week!

Walter Thompson

Editorial Manager, TechCrunch+

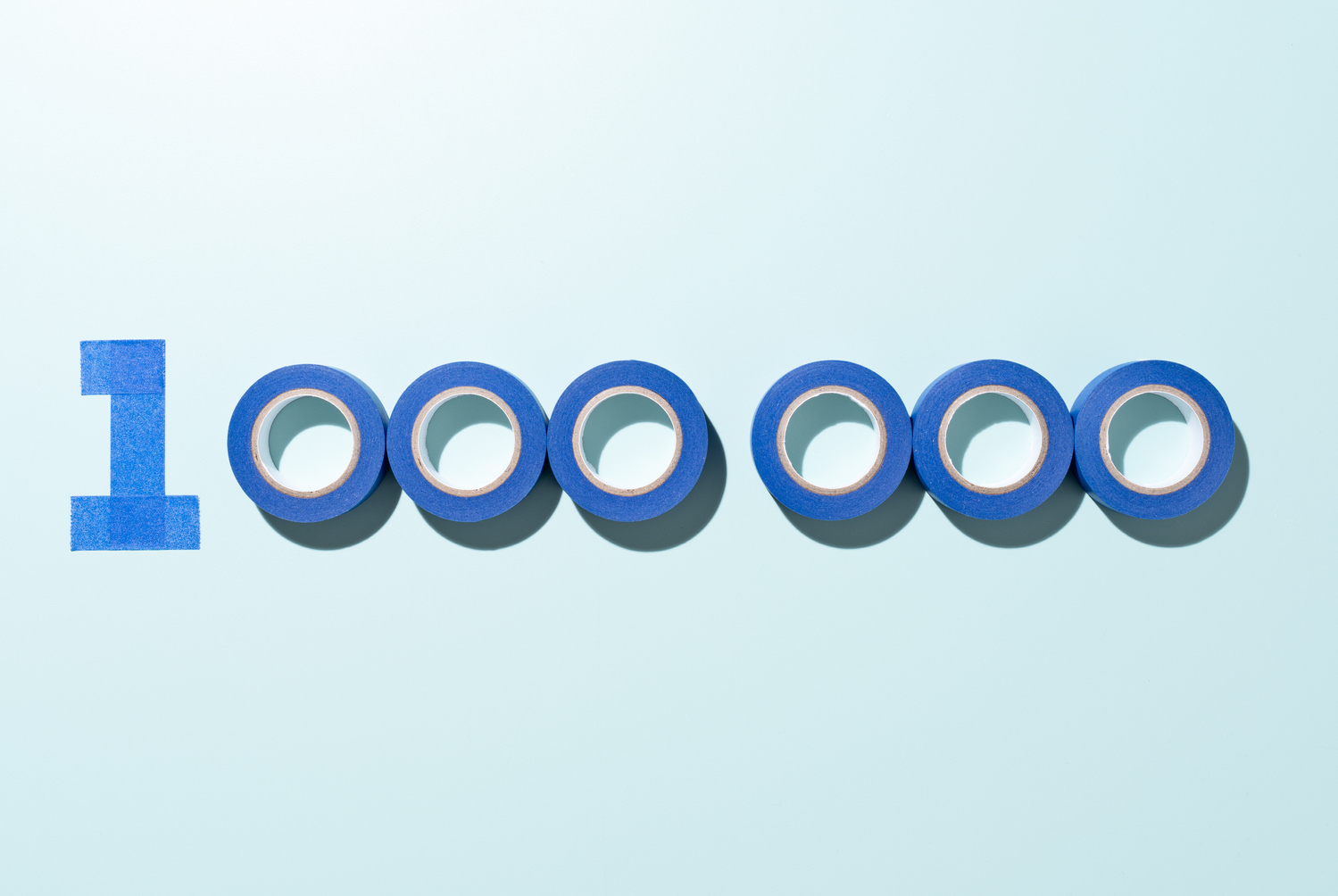

A growth framework for reaching $1M ARR

Image Credits: MirageC (opens in a new window) / Getty Images

We don’t run many columns that promote basic best practices: Advice like “find product-market fit” and “nail down your messaging” is just not worth paying for.

Unless, of course, someone can explain exactly how to do it.

In his latest TC+ column, growth marketer Jonathan Martinez describes the process he used to lead his last startup from zero to $1 million ARR in Year One.

“I do not pretend to have a silver bullet,” he says, “but I do have a tried-and-true framework you can use to help you achieve your first million.”

Pitch Deck Teardown: DeckMatch’s $1M pre-seed deck

Image Credits: DeckMatch (opens in a new window)

Using this slightly redacted 14-slide deck, the founders of DeckMatch raised a $1.1M pre-seed round to scale up their AI-powered platform that analyzes startup pitch decks for VCs:

- Cover

- Problem

- “Generative AI is part of the problem”

- “Who experiences this problem”

- Problem impact

- Solution

- Demo

- Market opportunity

- Go-to-market

- Moat

- Goals/milestones

- Team

- The Ask

- Closing

How to submit a guest column to TechCrunch

Image Credits: MicroStockHub (opens in a new window) / Getty Images

TechCrunch operates a guest contributor program, and each submission is evaluated on its own merits.

Guest columns fall into two categories:

- TechCrunch+: Strategies and tactics for building and scaling startups.

- TechCrunch Opinion: Editorials about tech-related topics in the public interest.

If you’d like to contribute, we’ve just updated our editorial guidelines.

As unicorns grow rarer, maybe it’s time to look toward revenue, not valuations

Image Credits: Nigel Sussman (opens in a new window)

Just two years ago, unicorns roamed the earth in herds so large, they shook the earth from Palo Alto to San Francisco.

Since then, an ice age has decimated the ranks of these majestic, delicate creatures.

In 2021, “some months saw more than 60 unicorns being minted — more than two per day,” writes Alex Wilhelm.

Today? “Only two new unicorns were minted in July, according to Crunchbase.”

Women-led firms are a bright spot in 2023’s fundraising slump

While we don’t have the data, it certainly feels like women-led firms are having a great year for fundraising.

Are women making real progress when it comes to raising VC funds, or is the overall slowdown in deal flow creating an optical illusion?

In light of recent successes by firms like Supply Change Capital, Cake Ventures and Adverb Ventures, Rebecca Szkutak looked into whether these wins have kicked off a sustainable trend in venture fundraising.

“It is probably standing out because there are only so many funds being raised and there aren’t 10 funds being closed every day,” said Kyle Stanford, a senior venture capital analyst at PitchBook.

“But it doesn’t negate the fact that women are coming to the table from an investor standpoint.”

The tech jobs market is as strong as it ever was

Job resume document out from laptop. Hands holding cv resume papers. Human resources management concept, searching professional staff, work. Found right resume. Vector illustration in flat style

When an automobile factory lays off thousands, it can send economic ripples through a community for years as people retrain and relocate to seek new employment.

When digital workers are laid off, however, the impacts are felt differently: “IT still remains the fastest-growing job category by a fair amount,” reports Ron Miller.

6 fintech investors sound off on AI, down rounds and what’s ahead

Image Credits: Bryce Durbin / TechCrunch

Fintech fundraising and valuations are down and the industry is crowded, which means many companies are looking for AI-powered solutions that will save money and help them differentiate their products in the marketplace.

Mary Ann Azevedo asked six investors about how their portfolio companies are adding AI to the mix, what they’re looking for at the moment, and whether more down rounds are on the horizon:

- Mark Goldberg, partner, Index Ventures

- Aditi Maliwal, partner, Upfront Ventures

- Hans Tung, managing partner, GGV Capital

- Lizzie Guynn, partner, TTV Capital

- Ed Yip, partner, Norwest Venture Partners

- Lauren Kolodny, co-founder and partner, Acrew Capital

[ad_2]

Source link