[ad_1]

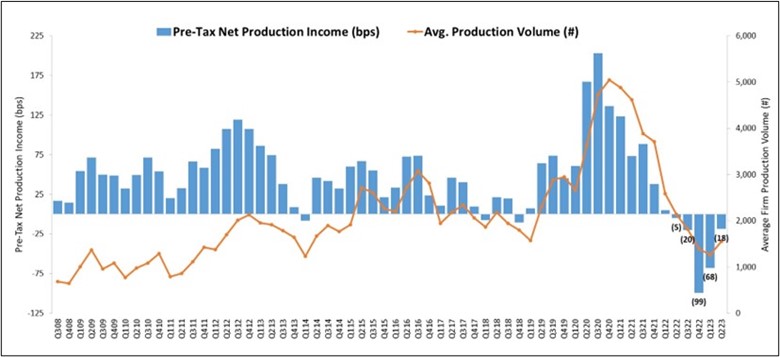

“After 11 consecutive quarters of increases, origination costs declined by over $2,000 per loan during the second quarter of 2023,” Marina Walsh, MBA’s vice president of Industry Analysis, said. “Volume picked up during the spring homebuying season and additional personnel were shed. However, the substantial cost savings per loan was not enough to put the average net production income in the black.”

Walsh added: “There were signs of improvement in the second quarter of 2023. Production losses were less severe than the previous two quarters and net servicing financial income was strong. Additionally, the majority of mortgage companies in our survey managed to squeeze out an overall profit during one of the toughest times for the mortgage industry.”

Including both the production and servicing business lines, 58% of companies were profitable last quarter, an improvement from 32% in the first quarter of 2023 and 25% in the fourth quarter of 2022.

The results are part of a promising trend. The same sampling of lenders reported a net loss of $1,972 on each loan they originated in the first quarter of 2023 – an improvement from the reported loss of $2,812 per loan in the fourth quarter of 2022, MBA researchers found.

[ad_2]

Source link