[ad_1]

Receive free UK mortgage rates updates

We’ll send you a myFT Daily Digest email rounding up the latest UK mortgage rates news every morning.

Three large UK lenders have cut mortgage rates for the second time in three weeks, as competition in the home loan market intensifies on the back of better than expected inflation data.

Nationwide, the second-largest mortgage lender, on Wednesday reduced prices on some fixed products by up to 0.55 percentage points. HSBC, the sixth-biggest provider, trimmed costs by as much 0.2 percentage points, while tenth-placed TSB lowered rates by up to 0.4 percentage points.

Smaller lenders Market Harborough Building Society and MPowered mortgages said on Tuesday that they were cutting costs.

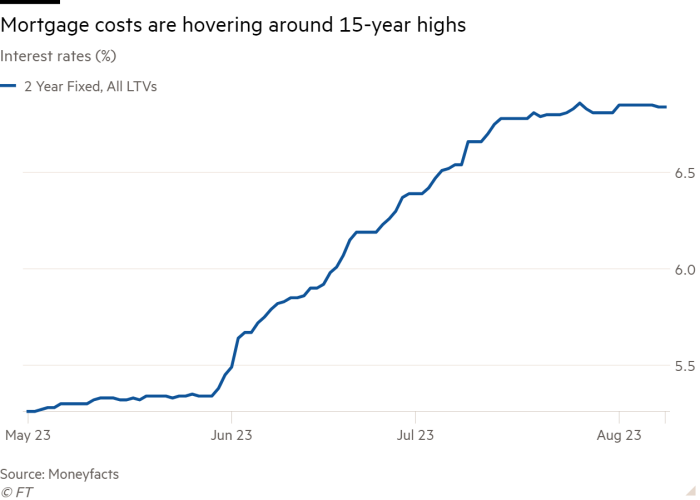

The reductions by the three big providers will further bolster hopes that mortgage rates have peaked, although borrowers still face near-record costs.

It marks the third week of falls after the release last month of better than expected inflation data for June, reversing a sharp increase earlier in the year driven by concerns about the persistence of price pressures.

Mortgage rates have continued to fall despite the Bank of England lifting interest rates to a 15-year high of 5.25 per cent last week, as providers base costs on the swaps market, which factors in future predictions of inflation.

Lenders have also had to cut rates to compete as the market has slowed, with borrowers adjusting their spending in response to the challenging economic environment.

“Higher rates means fewer mortgages for banks and building societies,” said Aaron Strutt, director at broker Trinity Financial. “The people we deal with on a day-to-day basis would rather rates were lower so they could do a bit more business.”

On a results call last month, William Chalmers, Lloyds’ chief financial officer, told reporters that the mortgage market had been quiet in the first half of 2023.

“Overall new business has been pretty slow in the first half of the year [and] mortgage margins are at exceptionally low levels,” he said.

Although the cost of a two-year fixed mortgage has fallen a few basis points from the 15-year high it reached at the start of August, it is still at 6.83 per cent, compared with 3.99 per cent a year ago and above the peak reached last October in the wake of the “mini” Budget.

Brokers have also cautioned that major reductions in mortgage costs are unlikely in the short term, with inflation still high despite the promising data for June and the BoE expecting rates to remain higher for longer.

David Hollingworth, director at London & Country Mortgages, said providers would have to “see what next year brings”, adding: “The bottom line for borrowers is they should expect that rates are not going to return to the ultra low levels they’ve enjoyed over the last 10 to 15 years.”

[ad_2]

Source link