[ad_1]

Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

Investors are increasing bets Europe will sink into a painful economic downturn, in a growing contrast to the conviction in financial markets that the US is headed for a “soft landing”.

The euro has fallen against the dollar over the past two weeks, while the surprise ascent of European shares this year has stalled, and German government bonds — investors’ preferred retreat in times of stress — are gaining in price.

The shifts show growing confidence among fund managers that economic indicators in the eurozone are weakening in the face of higher borrowing costs, while the US has demonstrated resilience despite the most restrictive interest rate environment in 22 years.

Official figures last week showed the US economy grew at an annualised rate of 2.4 per cent in the second quarter, well above economists’ forecasts, while the Federal Reserve’s preferred gauge of inflation cooled more than expected in June, bolstering expectations it will call time on its rate-raising cycle.

But interest rate rises had been less successful at bringing down inflation in Europe, analysts said. The continent has been teetering on the brink of recession, and eurozone services inflation hit a record high of 5.6 per cent in July.

Here’s what I’m keeping tabs on today:

-

UK interest rates: The Bank of England could slow the pace of interest rate rises when it announces its latest decision today, but investors expect the central bank to continue tightening monetary policy for longer than its European and US counterparts.

-

Donald Trump: The former US president is expected to make his first court appearance in the latest criminal case where he is accused of attempting to overturn the results of the 2020 election. Here’s more analysis on Trump’s legal challenges.

-

Economic data: Turkey publishes its consumer price index for July.

-

Results: Adecco, Adidas, Amazon.com, Anheuser-Busch InBev, Apple, AXA, ConocoPhillips, Expedia, Hasbro, ING, Kellogg, London Stock Exchange, Lufthansa, Rolls-Royce, Veolia and Warner Bros Discovery report.

Five more top stories

1. Exclusive: UK ministers are set to announce a further delay to post-Brexit border controls on animal and plant products coming from the EU. British exports to the EU are already subject to full checks, and the new regime at UK ports was due to start in October. Here’s why the move is being delayed again.

2. Goldman Sachs has been hit by several high-profile staff exits this year, including that of 25-year veteran Mike Koester, co-president of the group’s alternative investments business. The departures add to chief David Solomon’s struggles as he pares back the company’s costly foray into consumer banking. Here are the other executives who have quit.

3. Exclusive: Britain’s semiconductor industry must focus on niche manufacturing and designs rather than seek to challenge international rivals in chipmaking, said the UK’s tech minister, who admitted that “we are not going to recreate Taiwan in South Wales”. Read the full Financial Times interview with Paul Scully.

4. Exclusive: Two people found guilty in a corruption scandal involving KPMG and the US audit regulator are set to have their convictions dropped after prosecutors conceded they had misinterpreted the law. They were among six people fired by KPMG in 2017 in relation to the firm’s attempts to get advance notice of the watchdog’s audit inspections. Read the full story.

5. Artificial intelligence, drone attacks and potential Russian energy disruption are among the main threats to the UK published in the Cabinet Office’s national risk register yesterday. Several vulnerabilities were publicly acknowledged for the first time in a “declassification” of information following a wider shift towards government transparency. Here are some of the other vulnerabilities listed.

The Big Read

Unlike economists and political pollsters whose predictions are regularly upturned by reality, weather forecasters have managed steady improvements in modelling a chaotic system. The UK’s Met Office encapsulates this process. Thanks to more satellites and better computing power, it is today one of the world’s best-performing weather services. In a world facing unprecedented climate change, its job is more important — and challenging — than ever.

We’re also reading . . .

Chart of the day

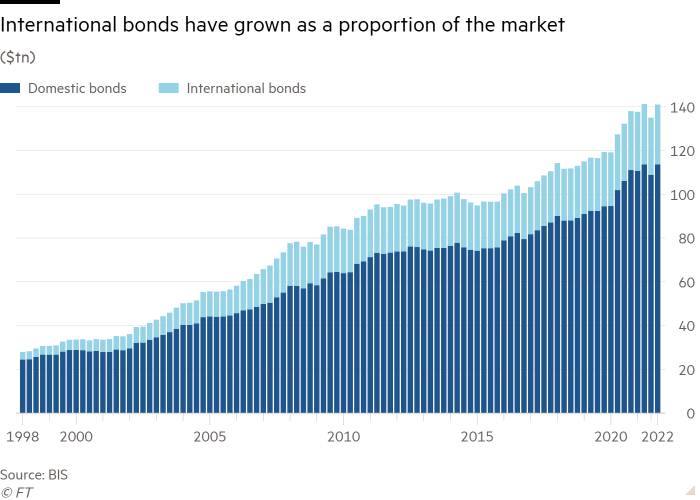

Bonds have long been considered the most boring bit of finance, but they have played an integral role in the development of human society, funding everything from wars and railways to Tesla’s electric cars and Netflix. Alphaville editor Robin Wigglesworth sketches a very short, very wild history of the market that will shape the next financial crisis.

Take a break from the news

George Orwell’s warnings about state control and surveillance are often invoked — especially now, in the age of artificial intelligence and big data. But if the legacy is secure, his reputation is less so. Two biographies offer contrasting perspectives on the author, and the invisible life of his first wife.

Additional contributions by Benjamin Wilhelm and Gordon Smith

[ad_2]

Source link