[ad_1]

Siqi Chen, the former president of Sandbox VR, the brick-and-mortar VR experience franchise, didn’t always have a strong grasp of finance. And it’s something he felt self-conscious about.

“I’ve always thought it was something for ‘real business people’ and I could just go and do what I enjoyed, which is product and engineering,” he told TechCrunch in an email interview. “This is the state of the world for most founders today.”

After countless frustrating experiences with Excel spreadsheets, Chen was spurred to create an alternative. So he started Runway, which aims to replace spreadsheets with “intuitive” financial modeling, planning and reporting workflows.

“Runway is the first strategic management platform for modern, high-growth technology companies,” Chen said. “[It gives] teams a clear and joyful god’s-eye view of their entire business, from finance to HR, sales, marketing, product and growth — enabling them to make better business decisions faster.”

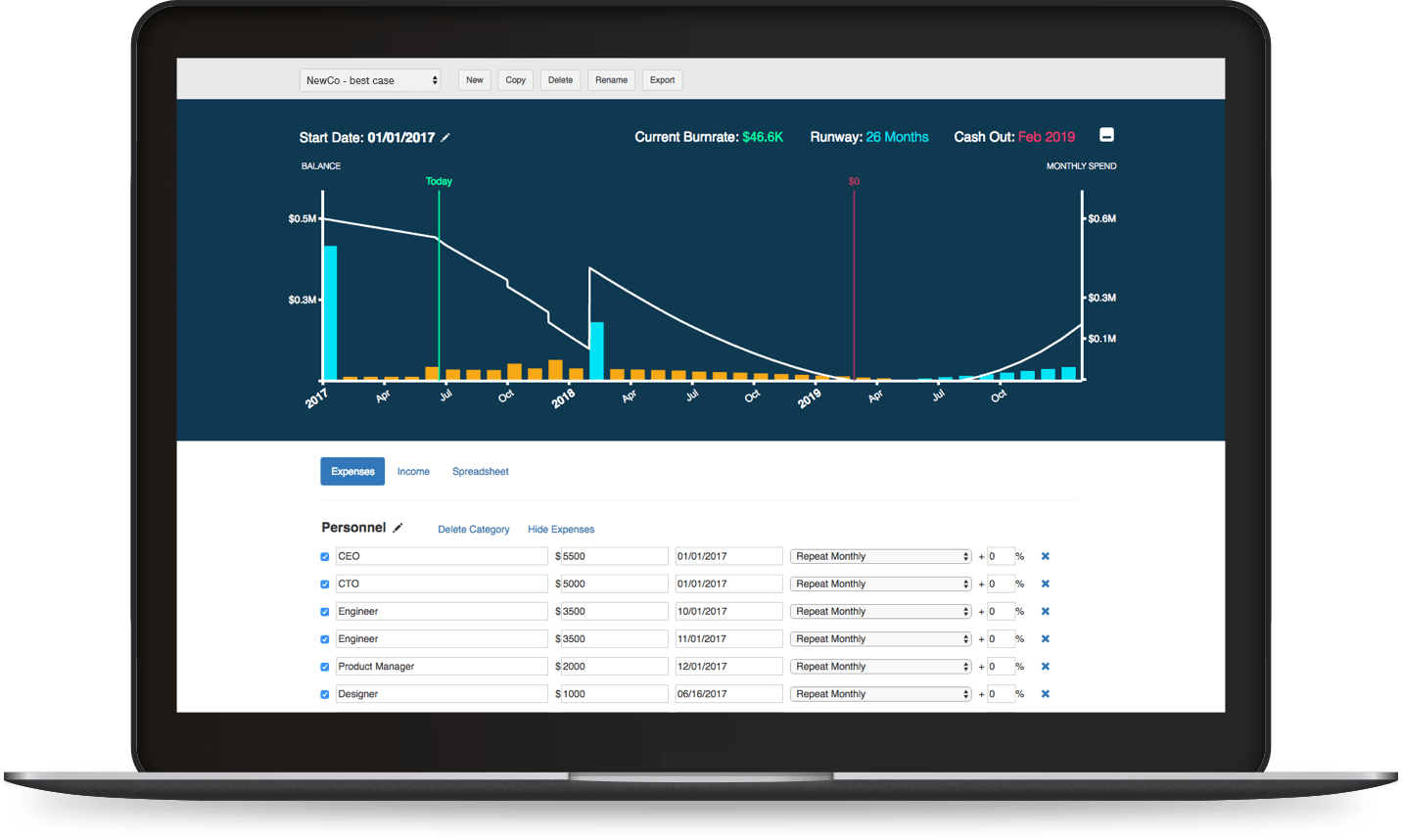

Runway, which connects to existing accounting tools, data warehouses and human resources information systems, allows customers to write formulas and create models that can be incorporated into business plans and scenarios (e.g. a pay bump, hiring new people or increasing marketing spend). With the reporting component, users can build dashboards with live charts, tables, text and even video and content from the web. Meanwhile, Runway’s AI “copilot” allows customers to create scenarios by typing a prompt and letting the system generate business plans based on a model and live data from connected business apps.

“With Runway, customers are able to feel more confident about their business, because the platform helps them save time, understand the business and the impact of decisions more clearly, and gives everyone better context so that they can execute faster,” Chen said. “Making the business more accessible to folks outside of finance helps companies create context over control, giving them a huge competitive advantage.”

Image Credits: Runway

Now, is it true that Runway accomplishes all that? Perhaps. But it’s also true that there’s other platforms that accomplish — or at least claim to accomplish — much the same thing.

Consider Dougs, which handles a company’s financial statements and generates certified tax filings, connecting bank accounts so that the platform can automatically generate reports and invoices. Elsewhere, there’s Firmbase, which offers a financial planning and analysis platform for startups. Other rivals include Pigment and Mosaic.

Runway seemingly hasn’t had trouble attracting business, though, from customers including Superhuman, Stability AI and Chen’s old stomping ground, Sandbox VR. Chen touts its close partnership with Rippling — “qualified” Rippling customers have priority access so that employee data, payroll, headcount expenses and hiring plans can all be synced automatically.

“We can share that we are growing at more than 10x year-over-year and currently have a pipeline booked out through the end of the year,” Chen said. “Our burn rate is well under $500,000 today.”

That’s impressed investors.

Runway today announced that it raised $27.5 million in a Series A round led by Initialized Capital with participation from angels including Elad Gil and Jason Tan. It brings the company’s total raised to $33.5 million, following a previously-undisclosed $5 million seed round led by Andreessen Horowitz.

“As a product that helps businesses understand their financials and plan better, we are in the fortunate position of being a counter cyclical product,” Chen said. “Companies are only getting more disciplined financially and that increases the demand for a product like Runway.”

[ad_2]

Source link