[ad_1]

Receive free Sovereign bonds updates

We’ll send you a myFT Daily Digest email rounding up the latest Sovereign bonds news every morning.

Investors have been buying up local currency bonds issued by emerging economies in a bet that policymakers there have done a better job of battling inflation than their developed market counterparts.

The gap in government borrowing costs between emerging and developed markets has fallen to the lowest level since 2007 this week, as investors price in imminent interest rate cuts in some big emerging economies at a time when markets are bracing for further tightening from central banks in the West.

“There has been a massive divergence between local currency emerging market debt and developed markets this year,” said Richard House, chief investment officer for emerging market debt at Allianz Global Investors.

“Investors are recognising the narrowing of the credibility gap between policymakers . . . Emerging markets have done a good job at navigating this inflation shock and I’m not sure you could say the same about some of the Western central banks”.

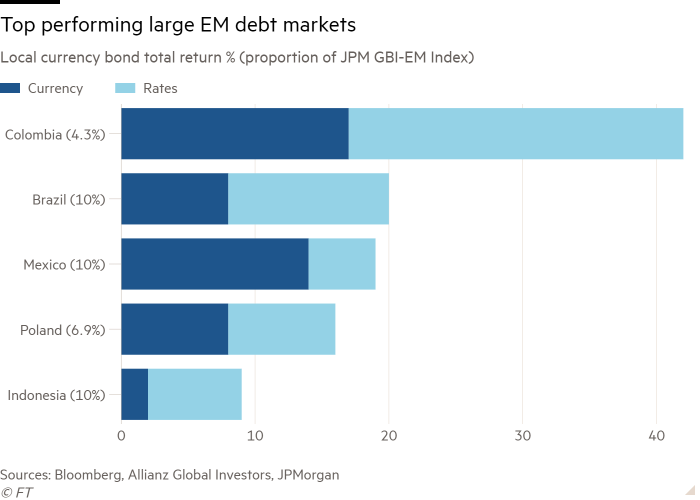

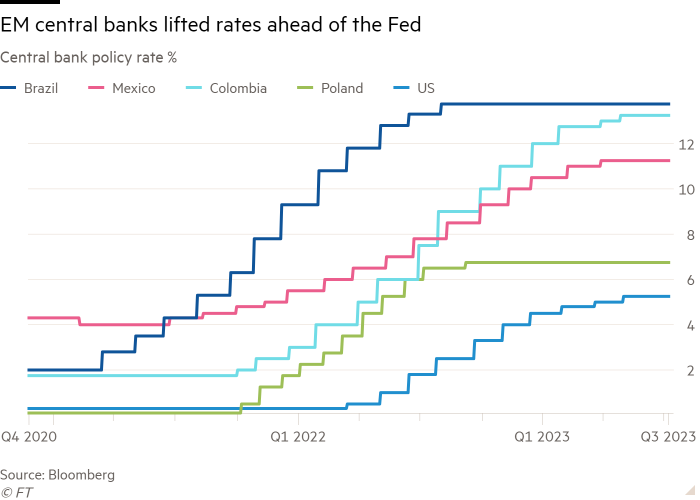

Central banks in Latin America and eastern Europe — regions that are home to the best performing bond markets in the world this year — acted more quickly to raise rates in response to inflationary pressures when economies reopened after coronavirus pandemic restrictions were eased.

JPMorgan’s widely-followed benchmark of emerging market local currency government bonds has delivered a 7.5 per cent total return year to date, boosted by the Latin American sub-index, which has risen 21 per cent, and by central and eastern Europe, which has gained 11 per cent.

In contrast, US government bonds have delivered total returns of just 1.6 per cent this year, as measured by an ICE Bank of America Index of government bonds, while German bonds — the de facto benchmark for the eurozone — have delivered total returns of 1.2 per cent.

The gap between emerging and developed market borrowing costs stands at its narrowest in 16 years at less than 2.9 percentage points, down from 4.8 a year ago, according to figures from Allianz Global Investors.

Given the still high real yields on offer in emerging market debt, declining inflation and the prospect of rate cuts that should boost bond prices, many investors are positioning for further gains.

“Local currency rates and bonds present a very attractive opportunity over the next six months and beyond,” said Liam Spillane, head of emerging markets debt at Aviva Investors, singling out Mexico, Peru, South Africa, Czech Republic and Poland where he thinks markets have underestimated the potential for rate cuts.

Iain Stealey, international chief investment officer for fixed income at JPMorgan Asset Management, said he expected emerging market local currency bonds “to continue to do well given high real rates, central banks which are largely done with hiking and declining inflation”.

“Our preference is for countries with high real rates like Brazil, Mexico and Indonesia as well as countries where we expect inflation to fall sharply, like the Czech Republic,” he added.

Economic prospects across the developing world look relatively strong too. In a recent note to clients, Bank of America forecast that emerging economies will grow by an average of 4.1 per cent in 2024, ahead of a 0.5 per cent growth in the US, which would be the highest growth differential in a decade.

The performance of local currency debt reflects the relative resilience of some of the larger emerging economies, which typically have deep local bond markets. Smaller and less developed emerging markets, which rely more heavily on foreign currency borrowing, have struggled this year as rising bond yields in the West dim the appeal of their dollar-denominated debt.

Higher US interest rates have driven some countries that rely on dollar-denominated debt, including Pakistan, Tunisia and Egypt, into debt stress and closer to default, according to David Hauner, head of emerging market cross-asset strategy and economics at Bank of America.

“You have one very positive story which benefits the mainstream, more liquid markets and at the same time you have a silent debt crisis in the frontier markets,” Hauner said.

[ad_2]

Source link