Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

There was mixed news for the Federal Reserve today when new data showed US jobs growth slowed more than expected in June but wage growth and unemployment remained stubbornly high.

The economy added 209,000 new non-farm posts, compared with a forecast of 225,000, the first time the report has fallen short of expectations in 15 months.

Hourly wage growth however was up 4.4 per cent, well above the roughly 3.5 per cent rate that most economists think is consistent with the Fed’s 2 per cent inflation target, while the unemployment rate only edged down from 3.7 per cent to 3.6 per cent.

Markets still expect the Fed to keep on increasing interest rates to get inflation down but overall reaction was much calmer than yesterday, when buoyant private sector jobs data sparked a global sell-off on stocks and bonds, driving US borrowing costs to their highest level since 2007.

The minutes from the Fed’s last policy meeting, published on Wednesday, showed officials lining up behind additional rate rises in light of the still tight labour market and “upside risks” to inflation.

The mood was reinforced by Fed policymaker Lorie Logan, who said yesterday that the “clearly pretty hot” recent data meant the central bank had to follow through. “If we lose ground in our effort to restore price stability, we will need to do more later to catch up,” she warned.

“The labour market data is likely to become much more important than inflation data going forward . . . the main question for the central banks and markets would be when the economy is starting to show reasonable signs of a slowdown,” said one economist.

How all this affects the mood of the American consumer is the subject of the new column from US editor at large Gillian Tett, who says optimism is disappearing even as news on employment and inflation appear to be largely positive and retail sales remain surprisingly resilient.

One explanation is that the official data is wrong or incomplete, she writes. Another is that the lived experience of consumers is worse than official data imply. Another is that the mood surveys are misleading. Either way, she concludes, “those shoppers are a baffling tribe. So much for America being the land of optimism.”

Need to know: UK and Europe economy

UK house prices fell 2.6 per cent in June according to mortgage provider Halifax, the fastest annual drop since 2011. Markets now expect UK interest rates to hit 6.5 per cent next March, the highest level since 1998.

The FCA watchdog told Britain’s largest banks that it wanted to see faster progress on improving savings rates for customers, as lenders come under fire for profiteering. The FT editorial board said the focus should be on finding co-operative ways to support deposit competition rather than dictating market terms.

India’s top trade official said that talks with the UK on a trade agreement were “moving very well” and downplayed hurdles on easing temporary work visas for Indians and opening up industries including automotive and spirits.

Luis de Guindos, vice-president of the European Central Bank, said underlying price pressures were starting to soften in another sign that rising interest rates were having an impact. He added however that the job of the ECB “is not yet done”.

The Russian rouble hit a 15-month low as the repercussions of mercenary group Wagner’s aborted insurrection piled pressure on a currency already suffering under sanctions. The rouble has lost a third of its value since December.

Need to know: Global economy

Chinese president Xi Jinping’s feared corruption investigators have turned the focus on themselves. An academic said the internal scrutiny likely reflected the “chronic, never-ending” nature of China’s corruption problem, despite graft-busting being one of Xi’s hallmark policies.

After 12 years of preparations and more than $200bn spent on infrastructure for the World Cup, what’s next for Qatar? A Big Read examines whether the state of 3mn people, just 400,000 of whom are Qataris, could become an investment destination of choice.

Small-scale miners in the Democratic Republic of Congo risk their lives digging up cobalt, the silver metal essential for the world’s transition to clean energy. A Big Read looks at the clean-up needed to bring the “artisanal” industry up to international standards. Former White House official Jennifer Harris said the clean energy transition would demand far more lithium and other commodities than the world is on track to produce.

Need to know: business

Samsung’s operating profits plunged 96 per cent in the second quarter as chip prices continued to fall due to oversupply, even as it cut production. The company said it was working to capitalise on demand for artificial intelligence wafers.

The Dutch government won the right to cut flights at Amsterdam’s Schiphol airport, the most drastic move yet in the EU to tackle noise and pollution caused by the industry. London’s Gatwick airport appears to be going in the opposite direction: it has submitted plans to increase capacity by 60 per cent.

Tourists have been swallowing higher prices as the travel industry gets back into full swing since pandemic restrictions were lifted, but slowing economic growth and high interest rates pose risks for hotels and airlines. Summer hotel prices have soared more than 50 per cent in three-quarters of 35 popular European cities this year.

Diplomats are nearing agreement on a date for net zero emissions for the highly polluting shipping industry “close to 2050”. The FT editorial board said an international levy on emissions could provide significant funds to modernise shipping, including in emerging markets, as well as ensuring an equitable transition. Danish climate minister Dan Jørgensen agrees: read the latest instalment in our Climate Exchange series.

The length of UK office leases has hit the lowest level on record at two years and 10 months, while vacancies rates have soared as the shift to working from home shakes up the market.

Science round up

UK officials hope to strike a deal on rejoining the EU’s flagship €95.5bn Horizon research programme this month. British researchers have been excluded since 2020 because of a post-Brexit row over Northern Ireland’s trading arrangements.

Is Toyota’s “solid state” battery — said to be half the size and cost of current power units — the “holy grail” for the electric car industry? Read our new explainer.

A new space-based lightning detector on Europe’s Meteosat Third Generation satellite can predict severe storms from its geostationary orbit 36,000km above the equator over central Africa. Severe storms have caused an estimated €500bn of damage over the past 40 years in Europe alone, Eumetsat said, and they are becoming more frequent as a result of climate change.

Blue Origin, the rocket company owned by Amazon founder Jeff Bezos, is hunting for a site to build an international launch facility as well as new partnerships to accelerate the scaling up of its space services.

Whether or not aspartame is carcinogenic, we know it is not the healthy option that many consumers believe it to be, says FT science commentator Anjana Ahuja. Next week’s World Health Organization rulings are likely to just stoke confusion on whether artificial sweeteners are good or bad for us.

Something for the weekend

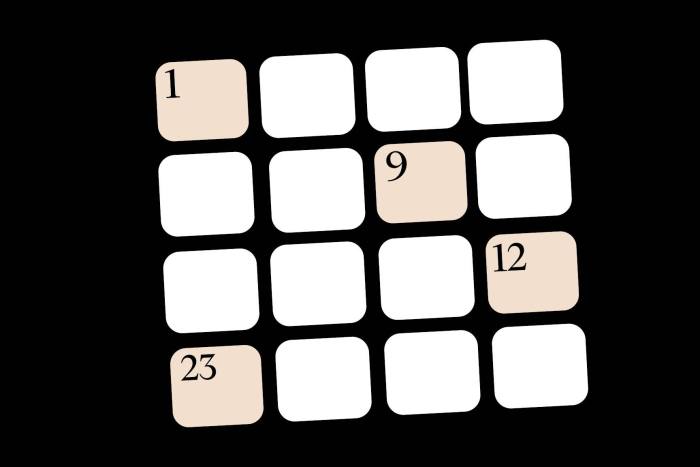

Try your hand at the range of FT Weekend and daily cryptic crosswords.

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Some good news

US regulators approved lecanemab, now known by the brand name Leqemb, as the first Alzheimer’s drug to slow the progression of the disease. An FT Big Read tells the story of how Swedish start-up BioArctic reignited the search for new therapies after Big Pharma had almost given up.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

Comments are closed, but trackbacks and pingbacks are open.