Receive free Student finance updates

We’ll send you a myFT Daily Digest email rounding up the latest Student finance news every morning.

The US Supreme Court has thrown out Joe Biden’s student loan relief scheme in a fatal blow to one of the administration’s flagship programmes.

In a 6-3 decision penned by Chief Justice John Roberts, the court’s conservative majority held that the government had no authorisation for the programme under the Heroes Act, which was passed following the September 11 attacks and allowed the administration to grant student loan relief in a national emergency.

The Supreme Court’s decision will block one of the cornerstones of Biden’s economic policy, which would have erased hundreds of billions of dollars of student debt by wiping out a portion of loans for millions of Americans.

The programme proposed scrapping up to $10,000 in debt for most individuals earning up to $125,000. The non-partisan Congressional Budget Office estimated it would have costed more than $400bn.

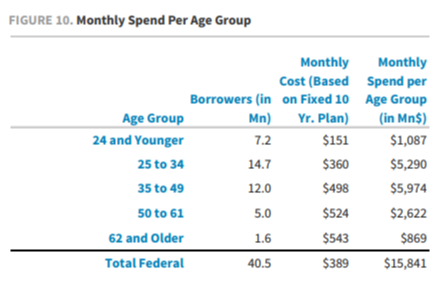

The restart of student loan repayments will be an aggregate headwind to US consumer spending of $15.8bn a month, according to Barclays. Its retail team estimated in a recent note that the average borrower will be on the hook for an incremental monthly payment of $390 or thereabouts.

There’s an estimated $1,430bn federal student debt outstanding, or $35,314 each across 40.5mn borrowers, two-thirds of whom are millennials and Gen-Xers:

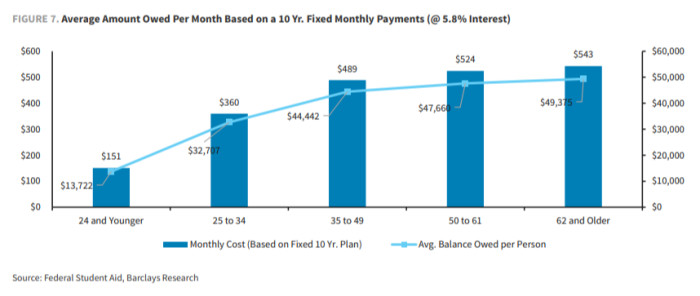

Repayment plans vary based on income and loan maturity so it’s tricky to give an overview of the cost. Barclays simplifies things by assuming a 10-year fixed monthly payment plan at a flat interest rate of 5.8 per cent, which seems to describe circumstances for about a third of borrowers.

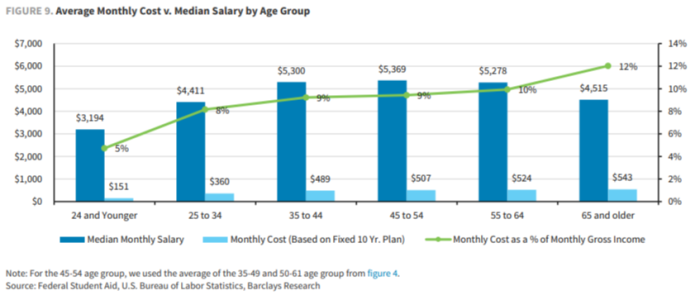

For the majority, that means repayments consuming 8-9 per cent of their salary:

Barclays’ calls its forecasts “inherently conservative” because they only include federal loans, which are 87 per cent of total student borrowing.

One possible surprise in its analysis is that the wallet pinch might be felt by Cracker Barrel as well as Urban Outfitters. While most direct debt is being carried by the working population, a surprisingly high number of pensioners are about to suffer a big hit to their discretionary spending power:

Further reading:

— US Supreme Court strikes down Joe Biden’s student loan forgiveness scheme (FT)

Comments are closed, but trackbacks and pingbacks are open.