Receive free Eurozone inflation updates

We’ll send you a myFT Daily Digest email rounding up the latest Eurozone inflation news every morning.

Eurozone inflation fell more than expected to 5.5 per cent in June, its lowest rate since the start of last year, but any relief for policymakers was tempered by a slight rebound in core consumer price growth.

Annual inflation in the single currency zone was down from 6.1 per cent in May, the EU’s statistical office said on Friday. It was also below the 5.6 per cent forecast in a poll of economists by Reuters.

But core inflation, which excludes energy and food, was 5.4 per cent, up from 5.3 per cent in May. This was a setback for the European Central Bank, which has said it will keep raising interest rates until underlying price pressures are clearly falling towards its 2 per cent target.

“There is nothing in this release that would deter the ECB from raising interest rates by another 25 basis points at the meeting in July,” said Jack Allen-Reynolds, an economist at research group Capital Economics, adding that there was “a good chance of another hike” in September.

European stocks rallied as investors hoped that interest rates in the bloc would soon hit their peak. The pan-European Stoxx 600 added 0.8 per cent, while France’s Cac 40 rose 0.9 per cent and Germany’s Dax advanced 1.1 per cent. The euro fell against the dollar after the release of the inflation data but partly recovered to trade down 0.1 per cent at $1.085.

Eurozone energy prices fell 5.6 per cent in the year to June, a steeper fall than their 1.8 per cent decline in May. There was also a slowdown in food, alcohol and tobacco inflation to 12.5 per cent and industrial goods inflation dipped to 5.5 per cent.

But these were partly offset by an acceleration in services prices to 5.4 per cent, a record high for the eurozone. The jump reflected a surge in German transport prices after Berlin increased ticket costs for buses and trains from the heavily subsidised levels of last summer.

“The core rate rose . . .[and] will remain sticky over the summer, but all other components are on a clear softening trend,” said Melanie Debono, an economist at research group Pantheon Macroeconomics.

Inflation fell in 18 of the 20 eurozone countries, rising only in Germany and staying flat in Croatia. Price growth fell below the ECB’s 2 per cent target in Spain, Belgium and Luxembourg for the first time in over a year.

ECB president Christine Lagarde told its annual conference this week in Sintra, Portugal, that it “cannot declare victory yet” in the fight to tame inflation. The bank raised its forecasts for price growth early this month to reflect an expected 14 per cent increase in eurozone wages by 2025, which it thinks may push up prices in the labour-intensive services sector.

“We will face several years of rising nominal wages, with unit labour cost pressures exacerbated by subdued productivity growth,” Lagarde said.

The eurozone labour market continued to tighten in May, when jobless numbers in the bloc fell by 57,000 from the previous month, while the unemployment rate remained at an all-time low of 6.5 per cent, Eurostat said on Friday.

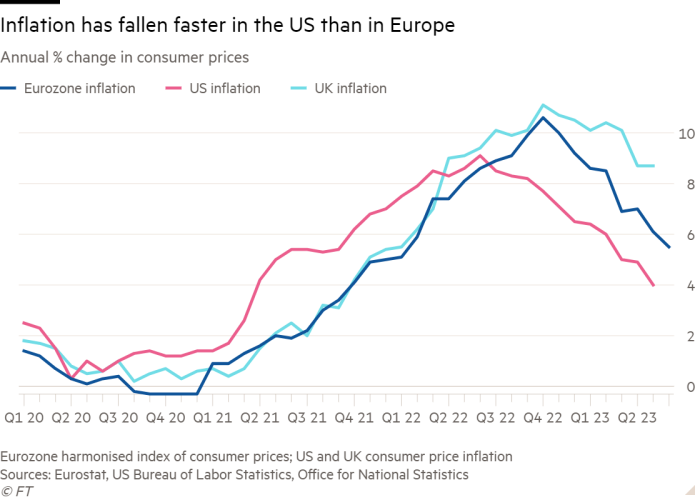

Inflation in the eurozone has fallen more slowly than in the US, where it was 4 per cent in May, but faster than in the UK, where it was stuck at 8.7 per cent last month.

Several members of the ECB’s rate-setting governing council told the Financial Times that recent criticism of the Bank of England over its struggle to bring down inflation had served as a cautionary tale.

Comments are closed, but trackbacks and pingbacks are open.