[ad_1]

Want more fintech news in your inbox? Sign up here.

While there are a multitude of fintech companies offering digital banking services to a variety of demographics, there has been one segment of the population that historically has been underserved even more than others: the undocumented immigrant.

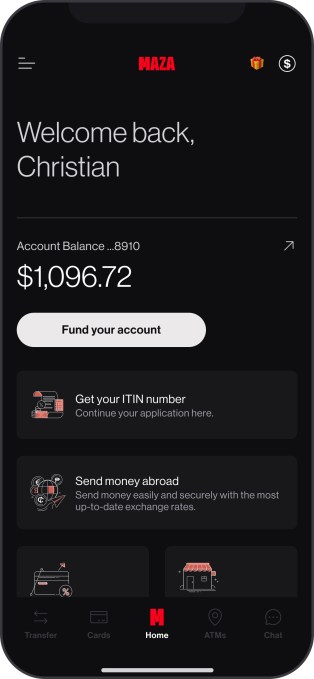

Because undocumented immigrants don’t have Social Security numbers, it can be difficult to impossible to access traditional banking services. A startup called Maza has set out to help solve that problem.

While several fintech startups set out to serve immigrants generally (Welcome Technologies, Majority, TomoCredit are examples), Maza says its main differentiator is that it provides immigrants with an individual tax identification number (ITIN), plugging in directly with IRS-certified acceptance agents “to make the Tax ID number process automated for customers.” The end goal, notes co-founder and COO Robbie Figueroa, is to unlock access to the rest of the U.S. financial system and avoid non-traditional (and sometimes predatory) approaches to finance, such as loan sharks and pawn brokers.

Maza customers are “immediately” equipped with a U.S. bank account and debit card. The company claims that because its members also have a tax ID number, they can start building a credit history and applying for loans. Having a bank account also allows them to receive payments from employers and file taxes. With Maza, customers without SSNs can access credit and thus, develop a credit history so they can do things like get auto or home loans. The startup also says it offers a robust peer to peer payments functionality.

On the back end, Maza says it “handles” their taxes to ensure they remain compliant, even going as far as automatically renewing their financial identity documentation for them.

Since its 2022 inception, the Los Angeles-based, 15-person startup has grown to having 50,000 users (each paying $150 a year for access) on its platform, enabling $41 million in digital payments to date.

Maza’s unique model caught the attention of Andreessen Horowitz (a16z), which recently led the company’s $8 million seed funding round. Other backers include SV Angel, Box Group, Restive Ventures, Global Founders Capital, Abstract Ventures and a group of angel investors including Anré Williams, CEO of American Express National Bank, and Plaid co-founder William Hockey.

While its total addressable market is the more than 15 million immigrants living in the U.S., Maza says its focus is on the Latino, or Spanish-speaking, population.

“Customers go from undocumented to partially documented,” Maza co-founder and CEO Luciano Arango told TechCrunch in an interview.

Arango and Figueroa teamed up with Siggy Bilstein (CTO) to start Maza after seeing their own parents struggle as immigrants in the U.S. (The trio is a combination of Colombian, Peruvian, Brazilian and Ecuadorian descent.)

Image Credits: Maza

Like many fintechs offering digital banking services, Maza is not itself a bank. It is able to offer its services without requiring an SSN by partnering with Visa and Blue Ridge Bank. The company’s banking product features “broad payment functionality,” it touts, as well as integrations with all major payment platforms, including PayPal, Zelle, Venmo and CashApp. Further, money deposited in Maza, the company claims, earns “one of the highest checking account interest rates,” an effort to help its members “grow their wealth over time.”

Interestingly, while Maza might be a digital bank, its marketing efforts are mostly focused offline. The company has found success targeting high-density, smaller Latino neighborhoods in markets such as South Florida, Washington Heights, New York and east Los Angeles with campaigns including posting bulletins in churches. It also does Google advertising but Arango says most of its growth thus far has been organic.

In the long run, Maza’s goal is to expand into credit building and to outside of the U.S. because as Arango said, “the whole world doesn’t have a Social Security number.”

Image Credits: Maza

“We want to be able to get folks cleared into the U.S. financial system no matter where they are,” added Arango, who also previously co-founded — and then sold — ScopeAI, which got acquired by ObserveAI in 2021.

“We’re doing much more than just providing a bank account — we’re really giving immigrants a stable and legal financial foundation from which to build credit and wealth indefinitely,” Figueroa said.

Andreessen Horowitz Partner Seema Amble said Maza’s thesis is something that a16z has “been excited about for a long time.”

Writing via email, she said: “There is a massive gap between mainstream financial access and the Latino population in the US (which is 19% of the U.S.). And the product needs don’t mean just translating existing products into Spanish – it’s offering them a set of products that fits their life and work.”

Banking products are not accessible to most Latinos, Amble added, but not primarily because of a language barrier.

She wrote: “They’re blocked from even accessing these products in the first place. Maza has identified the true pain point, lack of SSN, and they have built a product that unblocks everything from payments, to credit and mortgages without leaving the app….Compared to some of the other startups, Maza has focused on this core pain point and wants to continue to offer community-tailored products, rather than just offer another card product marketed towards Latinos.”

[ad_2]

Source link