Receive free UK tax updates

We’ll send you a myFT Daily Digest email rounding up the latest UK tax news every morning.

Scrapping the tax perks enjoyed by the UK’s so-called non-doms would net £3.6bn a year for the government, according to academic research that claims the risk of wealthy people leaving the country is “modest”.

The £3.6bn estimate by academics at Warwick University and the London School of Economics comes after the Labour party proposed abolishing the non-domicile regime that benefits many affluent foreign nationals who were born overseas but live in the UK, including many City of London workers.

One government insider said the Treasury had looked at the case for reforming the non-dom system and decided the risk to the UK’s competitiveness was too great.

The Treasury has not costed Labour’s plan, but officials cast doubt on the estimate that scrapping the tax perks could raise £3.6bn a year. They said non-doms might choose to move to other countries, meaning there could be a net loss of tax revenue.

Wealth advisers to non-doms said Labour’s proposals were causing uncertainty among their clients, with some considering leaving the UK.

The non-dom regime allows foreign nationals — resident in Britain but claiming their domicile in another nation — to avoid paying UK tax on their overseas income or capital gains for up to 15 years, provided they do not remit the money back into the country. Non-doms also have their foreign assets exempt from UK inheritance tax.

There were 68,300 non-doms in the UK in the tax year ending in 2021, according to HM Revenue & Customs. They contributed £7.9bn that year in personal taxes to the Treasury.

The academics at Warwick and the LSE, who analysed 21 years’ worth of non-doms’ tax returns running up to 2018, said: “We estimate additional tax of £3.6bn a year if you were to scrap the [non-dom] regime.”

The research modelled how non-doms reacted to government rule changes in 2017 that ended their ability to claim the fiscal perks on a permanent basis — they are now limited to a 15-year period — and concluded the mobility of the super-rich in response to tax rises “is lower than is traditionally believed”.

“We find that [the 2017] reform led to modest emigration,” said the academics.

Arun Advani, an associate professor at Warwick and co-author of the research into non-doms, said it found very few left the UK in response to the 2017 reform.

The research concluded that those who did depart Britain were people who had very little in the way of economic ties to the country, and were unlikely to be working and paying much income tax.

By contrast non-doms who had a much greater presence in the UK — for example people working in the City — were much more likely to absorb the effect of the tax changes.

Advani claimed a lack of data on non-doms meant anecdotes by wealth advisers who have a vested interest in lobbying for the status quo rules have held great sway in the debate about scrapping the tax perks.

The Treasury said non-doms have invested more than £6bn in the UK since 2012 via a government scheme that provides tax breaks on money they remit to Britain to make qualifying investments.

The government insider who warned against scrapping the non-dom regime said: “We want to be open for very high earners to come to the UK.”

Critics of the non-dom regime have claimed it is unfair, complex and old-fashioned.

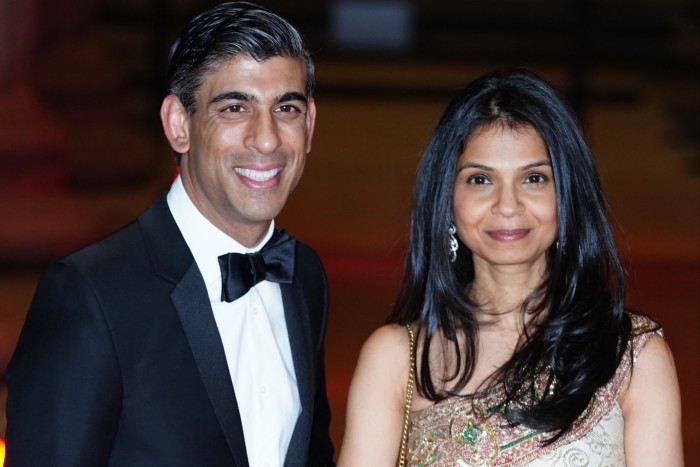

And the debate about the system’s fairness intensified last year after it transpired Rishi Sunak’s wife enjoyed the tax perk.

Akshata Murty subsequently announced she would pay UK taxes on all her income out of a “British sense of fairness”.

The Labour opposition has proposed abolishing the non-dom regime, and using the tax raised to increase recruitment and training of NHS staff, as well as boost spending on school breakfast clubs.

The party has said a future Labour government would replace the non-dom regime with a “clear, simple, and modern system” for people who are living in the UK for short periods.

One Labour insider said these new arrangements would “continue to attract top international talent . . . genuine temporary residents would not pay tax on their overseas income and gains”.

Shadow chancellor Rachel Reeves has said Labour would look at countries including Canada, France and Japan to develop the new system and would consult on the details.

“The idea that [scrapping the non-dom system] will be bad for investment and business is as outdated as the loophole itself,” she added.

But with Labour holding a big lead over the Conservatives in opinion polls ahead of a general election expected next year, wealth advisers said they were having more conversations with non-doms about quitting the UK or starting to plan for potential changes.

Nimesh Shah, chief executive of Blick Rothenberg, a tax advisory firm, said: “The UK’s brand has been damaged by Brexit and political turmoil. Labour’s comments [about scrapping non-dom status] haven’t really helped. People are uneasy about [what] could happen.”

Lucy Woodward, partner at accountancy firm Saffery Champness, said scrapping the inheritance tax exemption enjoyed by non-doms would cause people “to leave pretty quick”. “It would be a disaster scenario,” she added.

Emma Chamberlain, a barrister who specialises in non-dom work, said scrapping the regime would not necessarily lead to an exodus of people, but much would depend on what, if anything, replaced it.

She added that her clients did not like the uncertainty in the UK and “the sense everything is becoming very political . . . They are definitely worried about it.”

Michelle Denny-West, partner at accounting firm Moore Kingston Smith, said it was ironic that while Labour was campaigning to abolish the non-dom regime other countries had been quietly copying it.

In Italy, foreign nationals resident in the country can pay a fee of €100,000 to get a tax exemption on their foreign earnings for up to 15 years. Greece has similar arrangements.

“Should the [UK] regime be abolished, it is almost certain that wealthy overseas investors looking for a new home will overlook the UK in favour of other jurisdictions,” said Denny-West.

Comments are closed, but trackbacks and pingbacks are open.