ATTOM’s national home flipping report also noted that the median resale price of flipped homes grew faster than they did back when home-flip investors were buying homes. It pointed out that in the first quarter of 2023, the typical resale price on flipped homes was $305,000 – 1.7% bigger than the $300,000 recorded in the fourth quarter of 2022, and bigger than home flippers were used to seeing, as at the time they had purchased their properties flipped-home prices were increasing by only 1% per quarter.

This recent, modest profit turnaround ran counter to the broader national housing market, where the return on investments was still consistently on decline. Rising mortgage rates, sustained record-high levels of inflation, and general economic uncertainty translated to home values dropping since the second quarter of 2022. ATTOM noted that the national median home price was now down by 7%. Home-flipping profits, on the other hand, started to change course earlier this year.

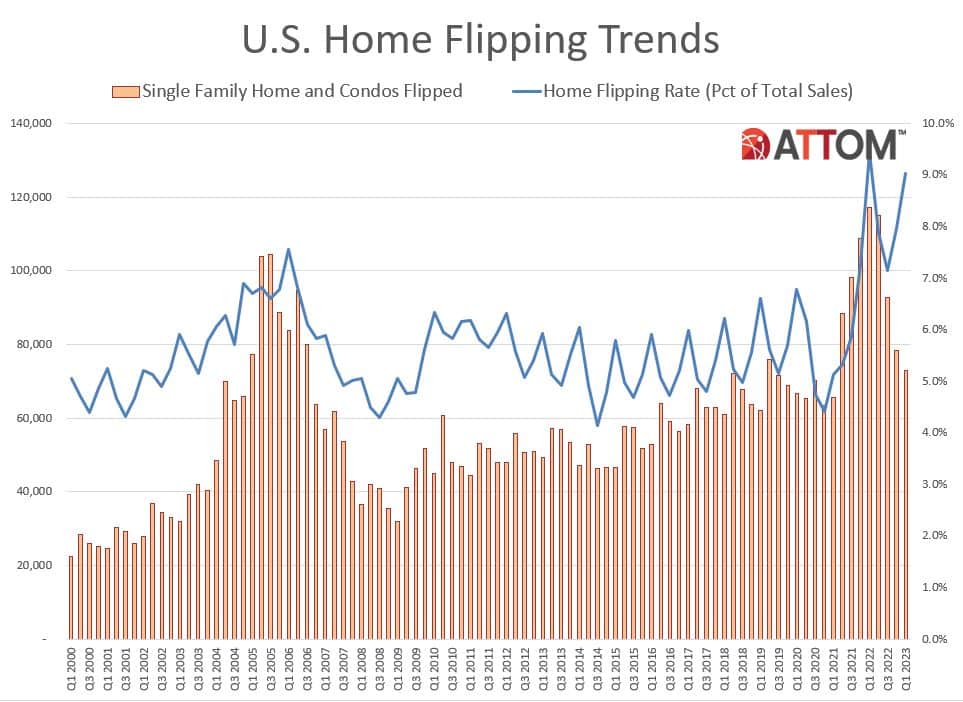

Even the volume of flipped-home sales in relation to home sales in general recorded a quarterly increase of roughly two percentage points or less in 128 of the 172 metropolitan statistical areas across the country that ATTOM had enough data on to study. Among those metros, the largest flipping rates during the first quarter of 2023 were in Macon and Atlanta, Georgia, where flips respectively comprised 17% and 15.3% of all home sales in the state. Macon and Atlanta were followed by Jacksonville, Florida, at 15.2%, Memphis, Tennessee, at 14.4%, and Clarksville, Tennessee, at 14.3%.

The areas where home flipping comprised the smallest share of all home sales were Indianapolis, Indiana, at 4%, Wichita, Kansas, and Bridgeport, Connecticut, at 5% each, Madison, Wisconsin, at 5.2% and South Bend, Indiana, at 5.3%.

Comments are closed, but trackbacks and pingbacks are open.