[ad_1]

Receive free UK interest rates updates

We’ll send you a myFT Daily Digest email rounding up the latest UK interest rates news every morning.

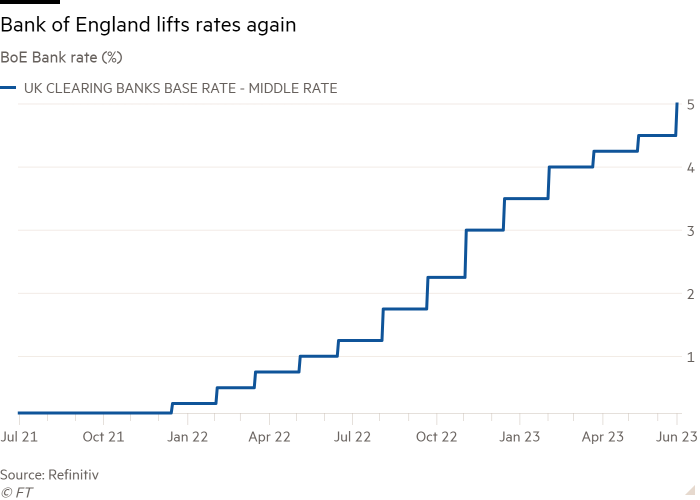

The Bank of England has stepped up its fight against persistent inflation with a surprise half-point rise in interest rates to 5 per cent, the highest level since 2008.

Voting seven to two in favour of the larger-than-expected increase, the central bank’s Monetary Policy Committee said it was responding to “material news” in recent economic data that showed worse inflationary pressures in the UK economy.

The BoE hopes its decisive move demonstrates determination to get a grip on rapidly rising prices. In a letter to the chancellor explaining the decision, governor Andrew Bailey said: “Bringing inflation down is our absolute priority.”

With its 13th consecutive rate rise, the MPC defied market and most economists’ expectations of a quarter-point increase.

But it will reinforce financial market movements over the past month that have prompted lenders to withdraw fixed-rate mortgage rate deals and increase the costs of home loans substantially in what has become known as a mortgage “time bomb”.

Justifying the move, the MPC said: “There has been significant upside news in recent data that indicates more persistence in the inflation process.”

Sterling edged higher and UK government bond yields fell slightly on the news of the half-point rate rise, a bigger increase than a majority of investors had expected.

The pound was 0.3 per cent higher against the US dollar at $1.2810, building on small early gains. Two-year UK government bond yields, which are highly sensitive to short-term interest rates, fell to 5.01 per cent from 5.06 per cent, reflecting a rise in prices.

Heading into the decision, swap markets had indicated that a slim majority of investors expected a quarter-point rate rise, although the odds of a half-point increase had mounted this week following the latest evidence of stubbornly high inflation.

[ad_2]

Source link