[ad_1]

As the defined contribution industry continues its tumultuous ride from supplement savings plans to a full replacement and even an upgrade to defined benefit plans, many obstacles appear. Some of these obstacles are obvious, inherent to the industry as well as the lack of resources. But one challenge is inherent within our own personalities—we see our future selves as strangers. So why sacrifice present pleasures for someone we barely know or save now for retirement?

Examining this dilemma is the life work of UCLA professor Hal Hershfield, who just completed his epic tome, “Your Future Self – How to Make tomorrow Better Today.” Hershfield’s research showed that when people think of their future selves, it activates the same part of the brain as when we think about others, not ourselves.

It explains why people struggle to do things that are good for them or even that they say they want to do. It’s why climate change is such a difficult and polarizing issue—making sacrifices in the present for future generations or, as Hershfield quotes Groucho Marx in a recent TED Talk on NPR, “What have future generations ever done for us?”

UCLA professor Shlomo Benartzi brought behavioral finance to the DC world with his seminal book, “Save More Tomorrow.” He uncovered many of our human character defects that prevent us from doing the right things today like inertia and risk aversion. For example, when people are asked a week before a conference whether they want bananas or chocolate snacks, 70% make a healthy choice but the same percentage opt for chocolate on decision day.

The genius of the measures Benartzi prescribed to help people to overcome our personality defects like auto-enrollment, auto-escalation and professional managed investments, create a dilemma—lack of engagement. Participant in the ideal 401(k) plan need not engage.

There are many obstacles as DC plans attempt to replace DB plans which include:

Data is hard to come by as providers are reluctant to share it and there are legitimate privacy concerns. The technology, so rich and fast moving in our daily lives, is inhibited by the platforms that manage workplace retirement plans. And the goal of creating financial plans by humans for humans is too costly for the vast majority of the 80 million DC participants.

But these obvious industry challenges will never be solved until we acknowledge the real problem—lack of engagement due to our ambivalence about our future selves. This dilemma is even more poignant as we attempt to incorporate retirement income into DC plans. Benartzi has been vocal that we cannot auto-enroll people into a lifetime income solution—we need engagement, and he has created an app to address the issue called Pension Plus.

Hershfield attempts to provide solutions to help people make better decisions today like aging software so we can relate more to our future selves but there is no real panacea like the ideal plan. But before we can even attempt to tackle the problem, we need to better understand the root of the challenge and then work together to create some simple solutions.

Which is why it is so essential that for the retirement industry to make quantum leaps, like Benartzi helped us to do with “Save More tomorrow.” We must engage academics and their courageous and unbiased approach to research.

Which is why it is so essential that for the retirement industry to make quantum leaps, like Benartzi helped us to do with “Save More tomorrow.” We must engage academics and their courageous and unbiased approach to research.

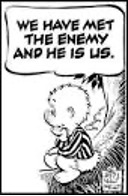

As cartoon character Pogo famously quipped, “We have met the enemy and he is us.” How do we make friends with and help our future selves? There is no better person to help the industry navigate the obstacles and come up with real solutions, not Band-Aids that much of the industry research offers, than UCLA professor Hal Hershfield.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.

[ad_2]

Source link