[ad_1]

As our industry continues to age, we find our daily conversations with advisors increasingly centered around succession/continuation plans; the contemplation of when or if to retire is almost a daily occurrence. Our personal experiences, as well as witnessing others’ journeys, mold our preconceived notions on whether retirement is ultimately in our best interest. The sharing of journeys as well as statistical data on the subject of retirement have shown us that working longer brings greater fulfillment, maintains your sense of purposefulness and adds longevity, all while helping to preserve mental acuity. Here are two examples of deferring retirement as long as possible and their motives.

A family member that is a CFP, EA has had a tax practice and financial planning business for many years, but at 68 he decided to slow down, so he sold the tax preparation side of the business to his partner and half his book to his son. He intended to spend more time with family and golf more often, while managing a smaller book. Over the next few years, his book grew back to where it was before the sale. Being connected to his community and being older, people came to him for his wisdom and experience. As he explained, “You can only golf so much, and frankly, I feel that God made me for serving the clients I have. I enjoy what I do, so why not keep doing this as long as I can?” Now 78, some health issues have surfaced and the stress that in the past he thrived on, now wears him down. He’s now in the process of selling his book.

An advisor that I placed in 2016 can’t bring himself to retire when his clients, as he puts it, “Aren’t clients but friends.” He works 20 hours a week with a book made up of mostly mutual funds, so his income is almost all trails. Even though many would salivate over the thought of converting his $250 million of assets to advisory, that never resonated for him nor to his clients. So, at age 66, he maintains his book of mutual funds and keeps in touch with clients. He was diagnosed with Parkinson’s two years ago, but it hasn’t slowed him down nor caused him to contemplate retirement. Ultimately, it will be his Parkinson’s that will define his retirement date. He also appreciates the time at work, as it provides time apart from his wife because too much time together can be problematic, as they can drive each other a bit crazy without some space. Absence often does make the heart grow fonder; couples usually enjoy each other more after they have had some time apart.

When you see people like Warren Buffett, age 92, or his partner Charlie Munger, age 99, still active in the business, fully engaged, you can’t help but wonder, is this the secret to longevity?

It turns out that statistically, continuing to work later in life is better for longevity as well as mental and financial health.

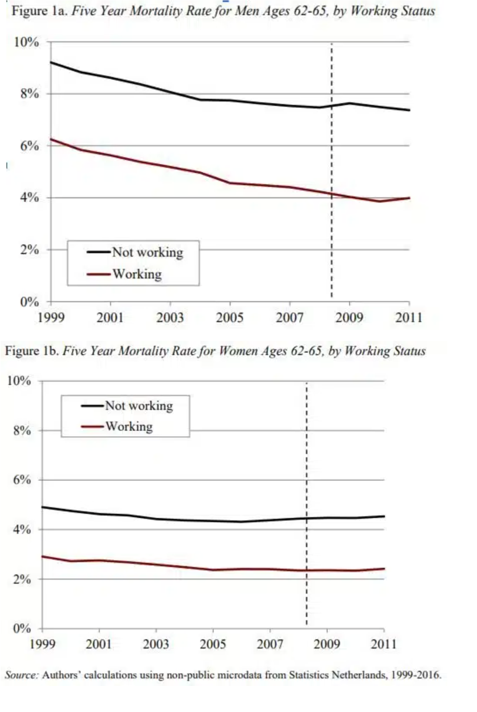

Oregon State University did a study in 2016 that found that healthy persons who worked just one more year beyond 65 had an 11% lower risk of death from all causes compared with those who retired at 65. A Netherlands study came to the same conclusion, as they studied the five-year mortality rate of men and women aged between 62 and 65, with the results showing without question, that our average life expectancy increases by delaying retirement.

A 2015 study by the CDC added to this consensus, finding that people working past age 65 were about three times more likely to report being in good health and half as likely to have serious health problems. One aspect to retirement that can’t be denied is losing a sense of purpose, which can lead to mental decline. When we stop working, oftentimes so does our brain. The CDC saw the working group experience some mental decline, but it progressed at a 50% lower rate than retirees as a whole.

Paring Down Your Practice

If you are in your 60s or 70s, consider paring down your book to where you have the best of both worlds (still work but more free time). One method we frequently see is to sell your “B” and “C” clients if you want to lessen the time commitment you currently have. With your remaining “A” clients, take only those that, as my advisor friend states, you consider to be more like friends. Undue stress is important to keep out of your life as you age, so weeding out those clients that are complainers, question your advice, waste your time or seem to be potential sources for future customer complaints is a must. If you are like my father-in law and find new people knocking on your door to be clients, don’t feel it is rude to have clear boundaries to keep your book at a specific size. Have someone you can refer them to so you don’t end up having more of your time taken than you want.

We are fortunate in our industry that many love what they do. Over half the advisors we ask, “How much longer will you be in the business?” respond, “As long as I can.”

Semi-retirement is a sweet spot where you can still travel, spend time on outside interests or expand into new interests. You will still be active with your best clients, maintaining purpose and mental acuity, while enjoying greater financial freedom.

Jonathan Henschen is the president of Henschen & Associates, a recruiting firm in Marine on St. Croix, Minn.

[ad_2]

Source link