[ad_1]

NatWest and Nationwide, two of the UK’s largest mortgage lenders, announced on Thursday they were increasing rates, piling further pressure on household budgets and the government as it tries to contain the cost of living crisis.

The decision by NatWest is the second time this week it has increased rates, mirroring a similar announcement by HSBC, another one of the big home loan providers, on Wednesday.

Lucian Cook, head of UK residential research at estate agents Savills, said the recent further increases in borrowing costs would stretch the finances of prospective home buyers. “Clearly it is going to put some strain on affordability”, he said. “It is going to be more difficult for borrowers to hit the stress test.”

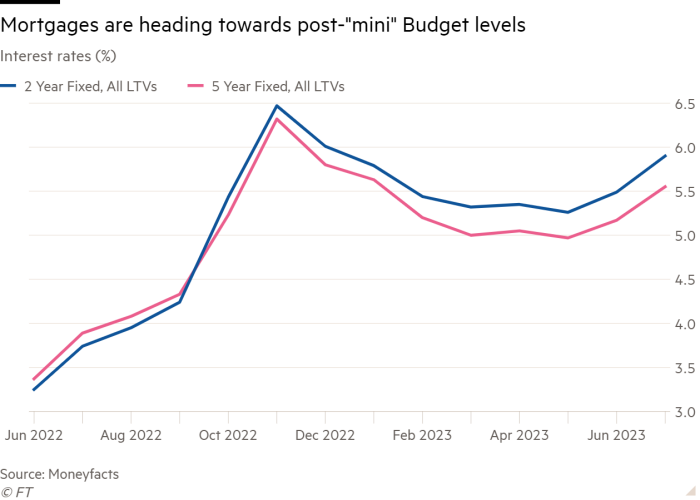

Moves to withdraw or reprice mortgage deals have increased in recent weeks as the financial markets react to stubbornly high inflation data, which has changed expectations of how far the Bank of England will have to raise interest rates.

The issue of rising mortgage costs is becoming increasingly political and poses a growing threat to the government of Rishi Sunak by exacerbating the cost of living crisis ahead of an election next year. The prime minister insisted this week that his “number one priority” was cutting inflation and bearing down on interest rates.

Fears among Tory MPs about a “mortgage time bomb” contributed to the ousting of Liz Truss as prime minister last year, after her “mini” Budget spooked markets and pushed up interest rates.

Marcus Brookes, chief investment officer at Quilter Investors said that a predicted 1.4mn fixed-rate deals are expected to come to an end this year, with the rates on offer far higher than when they were taken out.

“This will ultimately suck a huge amount of money out of the economy with people having far less each month to spend on goods and services making the threat of recession loom ever larger,” he warned.

NatWest said it was withdrawing a number of mortgage products, while increasing the rate on others by as much as 0.45 percentage points from Friday. It had previously repriced some of its mortgages on Tuesday.

The bank said that it had seen “double the normal volumes of applications” making the move necessary “to ensure that applications can be assessed, completed and drawn down in a timely fashion.”

Nationwide, the UK’s largest building society, said it would also be increasing rates from Friday across a range of products by as much as 0.7 percentage points, citing “the continued upward trajectory” of swap rates, which lenders use to price their fixed-rate products.

Financial markets have reacted to stubbornly high inflation data in recent weeks as expectations changed of how far the Bank of England will have to raise interest rates. This has led to volatility in swap rate markets making it difficult to price home loans competitively.

Other mortgage providers to announce changes to their pricing or withdraw products this week include Santander, the Family Building Society, Clydesdale Bank and Atom Bank.

“They tend to be like buses — when you have one lender who moves, that reorders who is the most competitive,” said Simon Gammon, founder and managing partner at broker Knight Frank Finance. “If one big lender moves, it’s quite normal to see three or four move in short succession, which makes the market much more difficult to navigate.”

[ad_2]

Source link