[ad_1]

One scoop to start: EU funds managed by Odey Asset Management are weighing up restrictions on investors’ withdrawals as part of emergency measures to contain the fallout of sexual misconduct allegations against the hedge fund manager’s founder. It comes as the firm announced a series of management changes to funds run by Crispin Odey ahead of the market opening on Monday.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Crispin Odey to leave hedge fund after assault claims

Partners at Odey Asset Management said that founder Crispin Odey would leave the firm after 13 women accused him of sexual misconduct.

The high-profile financier and his firm have been at the centre of a growing crisis after a Financial Times investigation by my colleagues Madison Marriage, Antonia Cundy and Paul Caruana Galizia reported on Thursday that 13 women alleged Odey had sexually assaulted or harassed them in various incidents over a 25-year period.

“Mr Crispin Odey is leaving the partnership. As from today, he will no longer have any economic or personal involvement in the partnership,” Peter Martin, chief executive, and Michael Ede, chief financial and operating officer, wrote in a statement seen by the FT on Saturday.

They added that Odey Asset Management Group Limited, a holding company that is part of the group and majority owned by Odey, would also be removed as a member and that the partnership would now be owned and controlled by remaining partners.

OAM, which had $3.8bn of assets under management in 2022, said that it “has been investigating allegations concerning Mr Odey” but said it could not comment in detail for confidentiality reasons. It said that “further communications” with clients would follow.

Reached by phone at lunchtime on Saturday, Odey confirmed he had been notified of the firm’s decision but suggested he would fight it. “You have to have [a] willing buyer, willing seller,” he said, declining to comment further.

A law firm representing Odey had previously said allegations made against him were “strenuously disputed”. Odey said this week that “none of the allegations have been stood up in a courtroom or an investigation”.

For more than three decades, Odey has reigned over London’s hedge fund scene as an eccentric with a reputation for delivering enormous returns as well as devastating losses, Madison, Antonia and Paul chronicle in this FT Magazine cover story. His firm was once one of Europe’s largest hedge fund companies and Odey, the man, a character from a bygone era of finance. An imposing figure at over 6ft tall, he cultivated an image as an unapologetically posh gentleman rebel.

This newspaper once described him as “a large puppy in a pinstripe suit”. He used his wealth and influence to boost the country’s Conservative party, back Brexit and cultivate friendships with former prime minister Boris Johnson, among others. Although his firm’s fortunes have declined in recent years, he has maintained his reputation as one of London’s last hedge fund mavericks.

Thirteen women who have worked for OAM or had social or professional dealings with its founder told the FT that Odey abused or harassed them; eight alleged he sexually assaulted them. The incidents — which included masturbating on a female entrepreneur after a business meeting and forcing a friend’s hand on to his penis — occurred between 1998 and 2021. The FT has corroborated accounts of an abusive workplace culture through interviews with more than 40 former employees of OAM at every level.

Several large financial institutions quickly moved to cut ties with the firm in response to the FT’s reporting. Prime brokers Morgan Stanley and Goldman Sachs began unwinding their relationship with OAM. Exane, which is owned by French bank BNP Paribas, is terminating the relationship; and JPMorgan is reviewing its relationship, which includes custody and prime broking. Asset manager Schroders has sold its remaining investments in an Odey fund that was held by two of its multi-manager products.

Meanwhile OAM faces a widening investigation by the UK’s Financial Conduct Authority. It opened an investigation into potential “non-financial misconduct” at the hedge fund two years ago. The inquiry later shifted to examine corporate governance issues after Odey fired his executive committee in 2021, and it may now be widened to consider fresh allegations of sexual assault reported in the FT investigation.

Attention is also turning to whether Brook Asset Management, which was established as a subsidiary of OAM in November 2020, will continue in its current set-up. It runs almost half of the firm’s funds, including those by partners James Hanbury and Oliver Kelton.

Anne Boden stepped down as Starling CEO after investor clash

The founder of Starling Bank stepped down as chief executive following a row with investors over a more than £1bn fall in the valuation of the digital lender, write Emma Dunkley and Siddharth Venkataramakrishnan in London.

Anne Boden, who founded Starling in 2014, said last month she would step down at the end of June to remove any potential conflict of interest stemming from her 4.9 per cent shareholding in the business.

However, Boden’s decision followed a clash with investors over fund manager Jupiter’s decision in February to sell its holding in the bank at a price that cut Starling’s valuation from £2.5bn to between £1bn and £1.5bn, according to people familiar with the situation.

The sale was to a group of existing investors, included Chrysalis investment trust, which is run by Jupiter fund managers Richard Watts and Nick Williamson.

As the sale was being negotiated Boden became concerned about the implied fall in the value of her stake in the business as well as the 15 per cent owned by employees, according to the people familiar with the situation.

She ultimately decided to step down after conceding that her position as chief executive was being unduly influenced by her concerns as a shareholder, said the same people. Read the full story here

Chart of the week

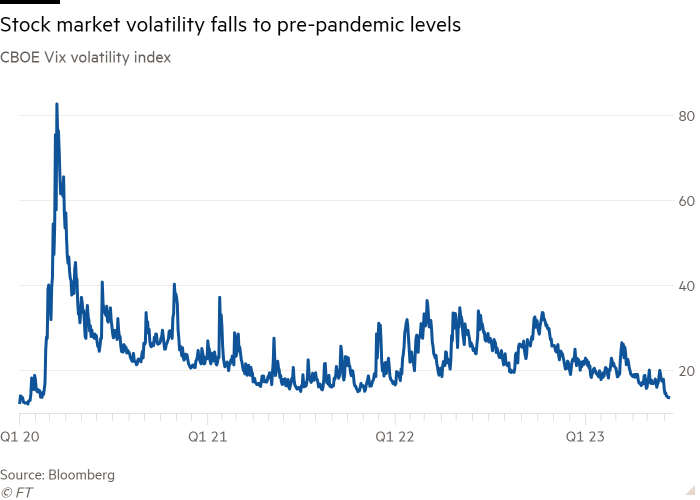

A closely watched measure of US stock market volatility has fallen to its lowest level since the start of the coronavirus pandemic, even as investors fret over the direction of interest rates and inflation.

The Vix index — measuring the options-implied volatility of the S&P 500 over the next 30 days — this week fell to 13.5, writes George Steer in London. That was the lowest since late January 2020, shortly before the pandemic shut economies around the world and panicked financial markets.

The Vix has fallen from a peak in October despite rising interest rates, the collapse of several US regional banks in March and widespread uncertainty over the future path of inflation, which remains far above the 2 per cent target set by many central banks on either side of the Atlantic.

Led by a handful of technology stocks, the S&P 500 last week returned to bull market territory, defined as a rise of 20 per cent or more from the most recent low, which was hit last October. It last fell by more than 1 per cent in a day on February 3, Refinitiv data shows.

The market’s tranquility may not last long, however. “Typically, when investors are this complacent, volatility surges in the coming weeks,” said James Demmert, chief investment officer at Main Street Research.

Five unmissable stories this week

Venture capital giant Sequoia Capital is splitting its China business into a separate entity. Don’t miss this deep dive on how US-China tensions shattered the empire of a group renowned for its bets on fast-growing tech companies such as TikTok parent ByteDance and Alibaba.

A pair of prominent hedge fund managers have emerged as recent donors to the UK’s two main political parties. Alan Howard, founder of Brevan Howard Asset Management, has given £1mn to the Conservative party, while Stuart Roden, former chair of Lansdowne Partners, has donated £180,000 to the opposition Labour party.

Big money managers including State Street, Fidelity and Amundi missed out on the rally in Nvidia and spent the past two weeks catching up, racing to amass shares of the US company that has become a go-to bet on artificial intelligence.

BlackRock is buying Kreos Capital, one of Europe’s biggest providers of loans to start-ups and technology companies, as the world’s largest money manager continues to expand its $45bn private credit business.

Hedge fund Marshall Wace has tapped Todd Builione, a partner and global head of private wealth at its private equity backer KKR, to be its new head of North America. Builione is replacing Michael Sargent, who will retire in January after almost two decades at the firm.

And finally

To the Musée d’Orsay in Paris where this exhibition brings together Édouard Manet and Edgar Degas, a friendship and rivalry which drove art onwards in the 1860s-80s. Look out for the portrait by Degas of Manet and his wife at the piano. Dissatisfied by the work, Manet chopped out the “excessively ugly” image of his wife. Degas, terribly hurt, took the mutilated painting away with him. Decades later, he added a strip of canvas in order to “restore Madame Manet” and return the portrait to her, a plan he was never to carry out. The show moves to New York’s Metropolitan Museum of Art in September.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link