[ad_1]

Almost 18 years ago, the universe gifted my husband and me with a beautiful, precocious baby girl. As a first-time mom living in a city far from our parents, I worked for a wealth management firm new to young moms. Immediately, I knew the demands as a wife of a mover-and-shaker, mother of precious baby and the first vice president reporting to three principals wouldn’t afford me the time, space or energy to be my best self in these roles.

Fortunately, I met Melissa Hammel, CFP professional, who introduced me to the world of RIAs, fee-only financial planning and NAPFA. I viewed obtaining the CFP credential as an entrepreneurial ticket to having a “portable business” as a “mompreneur” despite the unclear finserv path.

To recount the journey, I gave birth to my daughter in 2005, started my online CFP courses in 2006 and finished in June 2007, passed the CFP exam in November 2007, obtained the right to use the designation in February 2008 and launched my first RIA in 2008. I somehow navigated the housing bubble, relaunched my business after three geographic moves and held various volunteer leadership positions. How I managed to support my husband while potty training, scheduling play dates, visiting doctors, nursing wounds and illnesses, navigating big feelings, snuggling with our daughter and creating websites, templates, workflows, prospect pipelines, client experiences, business services and volunteer thought-leadership activities and content as an RIA business owner and financial professional still remains a mystery. Did I mention that I had a full-time federal job as TSP trainer for almost five years during this period of time, launched a consulting business in the last four years and never had a full-time or consistent babysitter or nanny?

The marvel is that my mompreneur journey is not unique. While it’s not clear how many moms are represented by the 23.7% of women among 96,452 CFP professions (a stat that hasn’t reached 24% since its initial tracking) or among the 1,806 Black CFP professionals (1.9%), these dismal stats suggest a longstanding fight to create and hold space for married women like me who hold roles as a full-time mom and as an underserved and overlooked financial planner and business owner.

I know up close that I’m not alone. My business partner and co-owner of 2050 Wealth Partners, Rianka Dorsainvil, has embraced motherhood while running two businesses and supporting a professionally-thriving husband. We started merging our financial planning practices in late 2019, publicly launched in February 2020 and welcomed her newest addition to the 2050 WPs family in March 2020.

When Hannah Moore, CFP shared her Amplified Financial Planning Baby On Board LinkedIn Series in 2021, my heart connected with community she created for young FinServ moms. I admiringly watched her build two amazing firms, pour her heart into the profession and launch the FPA Extenship Program (now known as “The Externship”) while growing her family. As a beloved leader, she continues to make her mark and pave the way for Millennials and GenZ.

As owners of our own RIAs, women in financial services have the opportunity to create thriving workplaces that brings us flexibility on our own terms and provides essential support working moms and caregivers. We are gradually making strides, noting that “39% of women owned all or part of their practice versus 63% of men” according to the 2014 CFP Making More Room in the CFP Profession white paper reports. We recognize that raising an RIA business is like raising a child—both require a great deal of courage, capital and commitment to something bigger than you.

Now that I have raised my daughter and found stability in my RIA and consulting businesses, these are lessons I learned that I hope inspires future RIA mompreneurs.

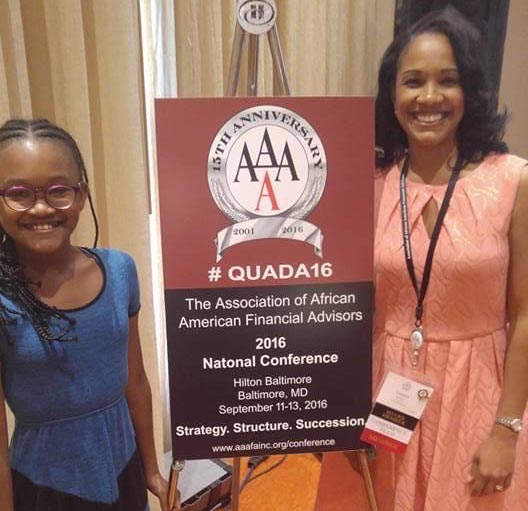

Lazetta (right) and Karis in 2016.

Map Out the Vision, Plan and Finances with your Spouse/Partner.

If you and your spouse/partner are accustomed to you making a W-2 salary before starting your RIA, the loss of income can be a rude awakening. Give yourself at least three years to start paying yourself and a few years later for retirement contributions.

Incorporate Self-Care into Your Routine.

The amount of work you can put into your business is endless. Pay yourself first with the currency of self-care. Build into your workday space to be, feel and restore. Business blues are real!

Watch Out for Mom Guilt.

There is no one on this earth who can give you specific instructions on how to be a mom and there is no mom like you. Don’t compare yourself to anyone! Be nice to yourself and realize there is no perfection to be experienced. Be comfortable with trial and error wrapped in love, care, vulnerability and transparency as your children age.

Surround Yourself With People Who Get it.

It’s hard for people who haven’t walked in your shoes to appreciate the grit and grace necessary to be a mompreneur. There will be times when you experience imposter syndrome, the overwhelming desire to quit and the desire to brag about being a badass without being labeled as overconfident. Know and hold close to your tribe who celebrate all facets of you and your journey. Let go of those who require more of you than you can or should give.

Celebrate as Often as You Can!

Pull yourself out of the grind, take a step back, pat yourself on the back for doing an amazing job and repeat as often as you can! Treat yourself to dinner, drinks, a spa, trip to the beach, a night alone at a hotel—whatever makes your heart sing!

The life of a RIA mompreneur can be a worthy adventure and investment for you and your family. You are presented with the opportunity and freedom to design the life and legacy you desire and deserve. Know that you have at least three fellow CFP mompreneurs who believe in you and are cheering us on!

Lazetta Rainey Braxton the founder/CEO of Lazetta & Associates and co-CEO at 2050 Wealth Partners.

[ad_2]

Source link