[ad_1]

Some US banks are preparing to sell off property loans at a discount even when borrowers are up to date on repayments, following multiple warnings that the asset class is the “next shoe to drop” after the recent turmoil in the US regional banking industry.

HSBC USA is in the process of selling off hundreds of millions of dollars of commercial real estate loans, potentially at a discount, as part of an effort to wind down direct lending to US property developers, according to three people familiar with the matter.

Meanwhile, PacWest last month sold $2.6bn of construction loans at a loss. And a clutch of other banks are making it easier to execute similar sales in the future by changing the way they account for commercial property debt.

Typically, banks are reluctant to accept losses on big blocks of loans that will retain their full value as long as borrowers make repayments on time. But some are being convinced to take the plunge amid fears of an increase in delinquencies — especially on debt secured against office properties that have experienced falling demand due to the enduring popularity of working from home.

Here’s what else I’m keeping tabs on today:

-

Apple: The tech giant is expected to unveil a “mixed-reality” headset, its most important new product for 13 years. Read a preview of the launch.

-

Economic data: Figures from the Institute for Supply Management’s non-manufacturing index are expected to confirm activity in the US services sector expanded for the fifth consecutive month.

Five more top stories

1. Oil prices are rising today after Saudi Arabia said it would cut production by 1mn barrels a day, following the conclusion of a 2-day meeting of producer countries in Vienna yesterday. Brent crude, the international benchmark, is up $1.05 at $77.18 per barrel in London while West Texas Intermediate, the US marker, is up more than $1 a barrel at $72.76. Read more on the outcome of the fractious Opec+ meeting.

2. The Directors Guild of America, the union representing film directors, yesterday said it had reached a tentative contract deal with Hollywood studios. The agreement includes a “substantial increase” in royalties for dramatic programmes on streaming services and a statement that “generative AI cannot replace the duties” performed by directors. Read more on the contract talks.

3. Rishi Sunak will seek to exert British “leadership” over the artificial intelligence debate when he meets US president Joe Biden later this week, including the idea of hosting a global AI regulatory body in the UK. George Parker has more from the prime minister’s agenda in Washington.

4. President Andrés Manuel López Obrador’s Morena party is set to win a gubernatorial election in Mexico’s most populous state, according to preliminary results released last night. The vote was seen as a crucial test ahead of national polls next June, when voters will choose a president, congress and leaders of nine states.

5. Russia’s army claims to have defeated a large-scale Ukrainian offensive in the eastern Donetsk region. The uptick in military activity in the conflict comes as Kyiv prepares for an anticipated counteroffensive operation which has been months in the planning. Read the latest on the Ukraine conflict.

The Big Read

The volume of international litigation relating to environmental and climate issues has grown rapidly over the past few years, with claimants seeking compensation from companies for environmental damage. But these legal fights are also becoming a business opportunity for those who want to make money from climate-related claims, backed by investors ranging from pension funds to family offices. Not everyone thinks this development is a welcome one.

We’re also reading . . .

Chart of the day

Productivity is expected to barely grow this year across mature economies, according to one US-based research group, with this weakness set to continue. The Conference Board cited the rising cost of capital and ongoing economic and geopolitical uncertainty and said growth from generative artificial intelligence could take a decade or more to kick in.

Take a break from the news

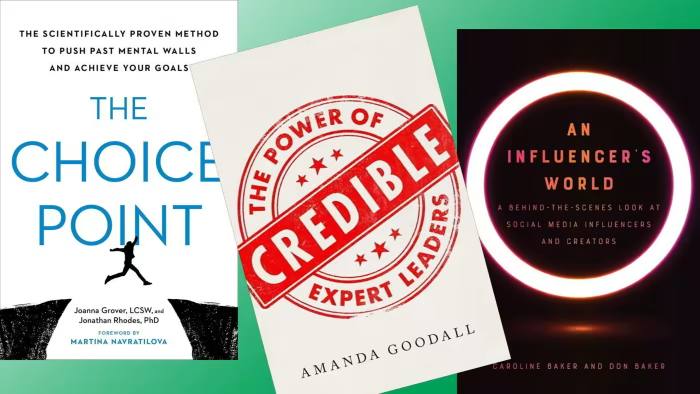

How to set long-term goals, good leadership practice as well as the business, history, culture and psychology of influencing are among the topics covered in the FT’s monthly round up of the latest business titles.

Additional contributions by Tee Zhuo, Annie Jonas and Vita Dadoo Lomeli

[ad_2]

Source link