One scoop to start: Richard Buxton is leaving Jupiter Fund Management after a nearly four-decade career at City institutions that made him one of the UK’s best-known asset managers.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

Beijing deploys hundreds of billions of dollars into western companies via PE

An IVC Evidensia veterinary practice in Sweden may not appear to have much in common with a Vena Energy solar project in Taiwan, or GardaWorld security personnel at a Canadian ice-hockey game.

But some of the capital that helps sustain all three companies comes from the same place: the People’s Republic of China, write my colleagues Will Louch, Yuan Yang and Kaye Wiggins in this Big Read.

Private equity firms EQT, Global Infrastructure Partners and BC Partners — the immediate owners, respectively, of the three businesses — are just three among dozens of western buyout groups that Chinese state-backed investors such as the State Administration of Foreign Assets and China Investment Corporation have poured money into, according to people familiar with their affairs and an analysis of regulatory filings.

These relationships, often established via offshore vehicles, have enabled Chinese state funds to deploy hundreds of billions of dollars into western economies, taking indirect stakes in companies across sectors such as healthcare, technology and industrial even as regulators and politicians move to reduce the west’s economic dependency on China.

These indirect investments in private equity funds have been increasing as a result of western governments and regulators taking steps to stop the same Chinese state funds from investing directly in companies and infrastructure.

They have also been helped by the growth of the private equity industry, which over the past three decades has grown from a niche corner of the financial services sector to a near $13tn asset class. Its rapid growth has turned it into an important conduit for global capital flows, with firms such as Blackstone, KKR and Carlyle Group managing and investing money on behalf of sovereign wealth funds, endowments, super-rich individuals and state pension plans, among others.

Private equity executives insist there is no risk to national security in having money from Chinese state entities in their funds because the way they are structured typically does not give such investors board seats or voting rights. Indeed, some see it as a risk-free way to attract Chinese capital without giving up any actual corporate influence.

However, the close relationship between private equity and the Chinese state has become increasingly at odds with the shifting political mood in western capitals, where governments have become much more vigilant about the potential for Chinese influence over strategic industries.

Meanwhile Caisse de dépôt et placement du Québec (CDPQ), one of Canada’s top pension funds, has become the latest western investor to put the brakes on its investment in China, amid rising geopolitical tensions. And JPMorgan chief executive Jamie Dimon has warned that tensions between the US and China have upended the international order, making it more complex for business to deal with than during the cold war.

Holland’s ‘once-in-a-generation’ pensions move

To the Netherlands, where the country made global headlines last week when Dutch parliamentarians approved a major overhaul of the country’s decades’-old pension system, writes Josephine Cumbo in London.

Under the reforms, given the green light after years of political wrangling, the Dutch system will move from a defined benefit (DB) model — where pension funds make retirement income promises to members based on salary and length of service — to a defined contribution (DC) model, where members pay into individual accounts.

This is no easy feat as it involves converting millions of existing pension pots to the new arrangement. The move is also expected to lead to big changes in asset allocation for the €1.45tn sector.

“This is a once-in-a-generation event,” says Onno Steenbeek, managing director for strategic portfolio advice at APG Asset Management, the country’s largest pension fund manager with €541bn of assets under management.

The change was prompted after the DB system came under pressure from low interest rates and an ageing population, which strained funding. The majority of Dutch pension money is currently invested in bonds, but this is set to change.

“I would expect some changes in the way and extent pension funds will use interest rate swaps and currency hedging products,” says Steenbeck. “I imagine the focus might become more on total return strategies but it is very difficult to say at this stage.”

While many other countries, including the UK, Australia and the US, have established individual DC markets, these types of accounts, where the savers take on full investment and longevity risk, will be new territory for the Dutch who are used to a collective approach.

Under the collective DC model, investment risk is shared between members, giving schemes wider opportunity to invest in more illiquid asset strategies.

Kees Swinkels, wealth leader at consultant Mercer, expects the Dutch will initially opt for collective investment models as they adjust to the new system.

“It would be a big jump for the Dutch to move from DB to individual DC accounts,” said Swinkels. Funds must complete the transition to the new system by 2028.

Meanwhile in the UK, MPs from both main parties are falling over themselves to talk about pensions. Here’s the FT View on how to make Britain’s pension assets work harder. And here deputy editor Patrick Jenkins weighs up the pros and cons of retooling the Pension Protection Fund, the UK pensions lifeboat, to come to the rescue of UK equities.

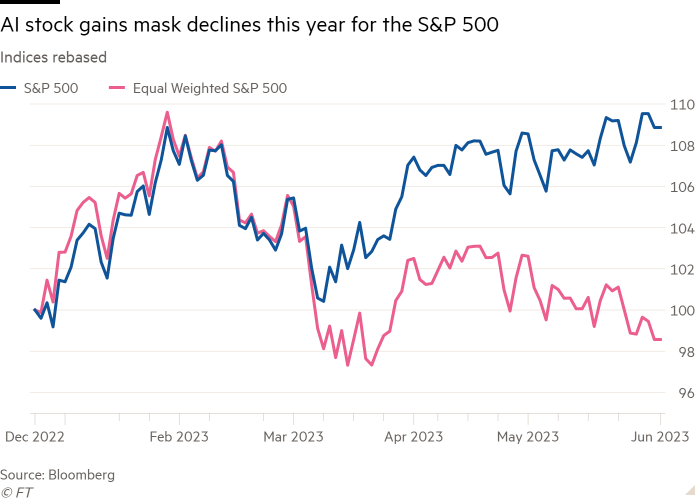

Chart of the week

By one measure at least, the US stock market has slipped into negative territory since the start of the year.

The S&P 500 Equal Weighted index, which gives equal value to each stock, has fallen 0.35 per cent since January, data from Refinitiv shows, writes George Steer in London. That stands in stark contrast to the 9.5 per cent gain for the benchmark S&P 500, where companies with larger market capitalisations account for a larger share of the index.

Although bigger gaps have previously opened up between the two measures of the same stock market’s performance, “there has never been such a strong negative divergence”, said Manfred Hübner, managing director at research house Sentix.

Rapidly rising demand for the very biggest stocks explains the difference. Riding the AI wave, Nvidia, Microsoft, Alphabet, Apple, Amazon and Meta have added a total of $3.1tn in market cap terms in 2023, data from AJ Bell show.

Ignoring their contribution, the S&P 500 has shed $286bn so far this year. High quality, low-risk tech stocks may also have begun to trade like traditional haven assets such as US Treasuries and the dollar, “both of which are beset by doubt”, argued Erik Knutzen, chief investment officer multi-asset class at Neuberger Berman. “Perhaps market participants are more concerned than they look,” he said.

Five unmissable stories this week

A group of 255 of the UK’s top private equity dealmakers earned £2.7bn in carried interest in a single year, according to an analysis by law firm Macfarlanes, the kind of gain that has drawn scrutiny from politicians threatening to increase taxes on the industry.

Franklin Templeton has agreed to buy rival Putnam Investments for more than $1bn as the California-based asset manager continues its expansion into alternative products and retirement plans.

Jacek Olczak, the chief executive of Philip Morris International, says the maker of Marlboro cigarettes is charting a path to becoming an ESG stock as part of a push to win back investors that have shunned the stock because of tobacco exclusion policies.

Nvidia is one of a handful of companies that will sustain this year’s rebound in US stocks even as the rapid advances in artificial intelligence “creates more losers than winners”, according to Rajiv Jain, founder and chief investment officer of GQG Partners, one of the biggest recent buyers of shares in the US chipmaker.

Lansdowne Partners has agreed to buy UK investment boutique Crux Asset Management, a move that cements its evolution in recent years from one of Europe’s top hedge funds into a mainstream asset manager.

And finally

The works of Swedish painter Hilma af Klint and Dutch painter Piet Mondrian are juxtaposed in a new exhibition at Tate Modern.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Comments are closed, but trackbacks and pingbacks are open.