[ad_1]

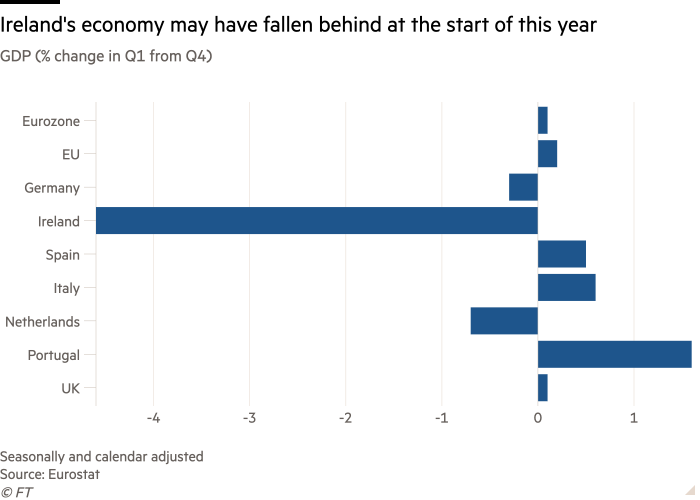

Ireland is a country so rich it is preparing to set up a sovereign wealth fund to deal with its bulging budget surpluses, but official growth numbers suggest it was the worst-performing EU economy in the first quarter.

The Central Statistics Office on Friday said Ireland’s gross domestic product contracted 4.6 per cent over the opening three months of this year. That puts the country behind Lithuania, an economy far more exposed to high inflation fuelled by the war in Ukraine.

The first-quarter dive also came after Ireland reported a 12 per cent GDP expansion last year — a stellar performance that helped the entire eurozone dodge stagnation.

However, economists and the government have played down the downturn, saying the latest figures highlight the flaws of using GDP to measure growth in a relatively small economy used by a huge number of multinationals as their European base.

Officials say using modified domestic demand, or MDD, which strips out the activities of the US tech titans and global pharmaceutical companies headquartered in Dublin, is a more accurate measure.

Like GDP, MDD covers personal consumption and government and private sector spending, but the measure discounts for investments in imported intellectual property. It showed the economy grew 2.7 per cent in the opening three months of the year.

Finance minister Michael McGrath highlighted easing energy prices, improving consumer confidence, strong employment and robust investment spending as key drivers of MDD.

Construction investment powered ahead 8.7 per cent in the quarter as Ireland builds more houses. “Incoming data suggests that momentum has continued into the second quarter,” he added.

Economists agreed with his upbeat assessment.

“MDD tells a very positive story — ongoing expansion in consumer spending and business spending and construction spending,” said Dermot O’Leary, chief economist at brokerage Goodbody. He added: “It’s a data set full of contradictions today.”

O’Leary blamed declining industrial output from pharmaceutical companies for the contraction in GDP, saying it “collapsed in March”, for reasons that were unclear, but could relate to developments on patents or other factors.

Dan O’Brien, chief economist at the Institute of International and European Affairs, noted that computer services exports dipped from the previous quarter, yet still rose 8 per cent compared with the first quarter last year. “I’m slightly perplexed [by the numbers] but certainly not bothered by them,” he said.

Despite the sharp distortions to the GDP figures, the multinationals — lured to Ireland by its low corporate tax rate — are spectacularly boosting government revenues.

Their activities are expected to translate into a €65bn budget surplus over the next three years. That has meant that Ireland, whose economy crashed a decade and a half ago after runaway lending and a property bubble, is now planning to bank surpluses in a sovereign wealth fund at a time when its EU neighbours are facing deficits that are leaving them under pressure to tighten spending.

However, with a third of all corporation tax revenue coming from just three companies, the government warns that Ireland would be foolish to rely on the tax bonanza going on forever.

[ad_2]

Source link