[ad_1]

Vartana, a business-to-business (B2B) sales closing and financing platform, today announced that it raised $20 million in a Series B funding round led by Activant Capital with participation from Mayfield and Audacious Ventures. The financing, which brings Vartana’s total raised to $39 million, will be put toward hiring and expanding the company’s product offerings, according to co-founder and CEO Kush Kella.

“Today, Vartana is specifically focused on expanding its product offering to solve the needs of B2B sellers in the software-embedded hardware space and the reseller space,” Kella told TechCrunch in an email interview. “These two types of companies require the most diverse sets of payment options which enable Vartana to continue supporting all companies in the software-as-a-service (SaaS) space.”

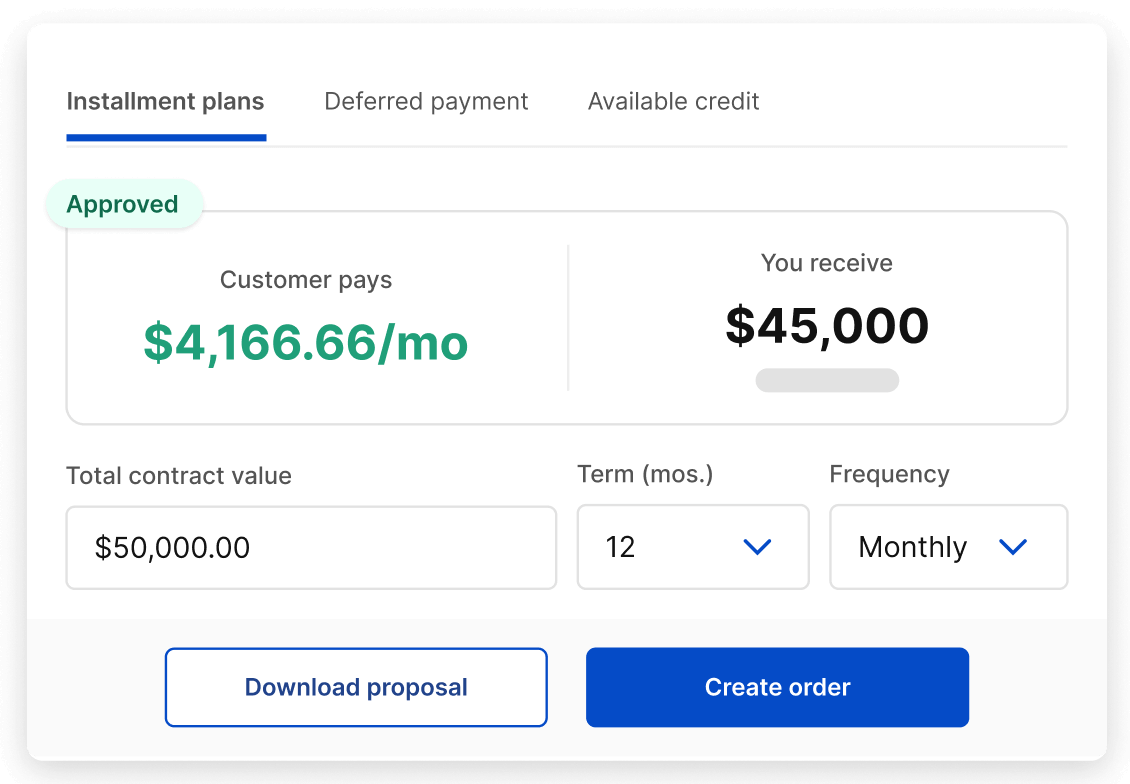

Vartana’s platform is designed to be used by sellers of B2B software, hardware and hardware paired with SaaS software. Vartana helps to manage tasks like contract tracking, payment terms and signature capture, accepting a range of different payment options (e.g. pay in full, deferred payment) and installment plans.

That might not sound incredibly sophisticated from a technical standpoint. But Andrew Steele, a partner at Activant, argues that Vartana’s making a dent in an industry — B2B sales in SaaS — that’s long been stuck in the dark ages.

“B2B commerce will never fully come online until you enable salespeople, who deliver the human touch for large, mission-critical transactions,” he said in an emailed statement. “That’s where Vartana comes in, bringing fintech to the sales suite to unlock a digital transaction.”

Vartana’s platform is designed to facilitate B2B sales. Image Credits: Vartana

Consider, too, that B2B sellers in all industries have less time these days — and more pressure — to build relationships and close deals, making tech-forward approaches highly appealing. B2B buyers responding to a recent Gartner survey report spending exceedingly little time with sales reps, with the majority saying that they had only 17% of the total purchase journey in such interactions. Any given sales rep has roughly 5% of a customer’s total purchase time, the report found — and that’s on the high end.

Sellers on Vartana can send multiple quotes at one time and give buyers the flexibility to select which payment style works for them. Once a method has been selected, the buyer can e-sign the agreement from the web or mobile to finalize the deal.

On the capital marketplace side, Vartana-developed algorithms to normalize data, rate each buyer and extend debt financing offers. The platform matches buyer loan requests to a network of banks and lenders, allowing buyers to request funds and receive quotes in real time.

“In the typical B2B sales process, enterprise companies partner with national banks and large lenders to provide their customers the payment flexibility they need to perform business,” Kella said. “Unfortunately, this process involves lots of manual back and forth, paperwork, and negotiation for a vendor’s salespeople, which makes for a sub-par customer experience for the end software buyer. This is the process Vartana is digitizing.”

Vartana, which has around 51 employees, plans to double in size over the next 12 months.

[ad_2]

Source link