[ad_1]

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Today’s top story is about a type of gain that has drawn scrutiny from politicians threatening to increase taxes on the private equity industry.

A group of 255 of the UK’s top private equity dealmakers earned £2.7bn in carried interest in a single year, according to an analysis by law firm Macfarlanes. The haul accounted for about 80 per cent of all carried interest — the slice of profits private equity executives make on successful deals — in the 2020 to 2021 tax year.

Carried interest is an important part of remuneration for private equity executives, often dwarfing the size of their salaries if they strike successful deals. Its tax treatment has long been the subject of debate in several countries, including the US.

In the UK — where private equity has spent nearly £80bn taking public companies private over the past five years — carried interest is taxed as a capital gain. That means a rate of 28 per cent is paid rather than the 45 per cent top rate of income tax.

The UK’s Labour party has planned a £440mn tax raid on the industry if it is voted into office at the next general election.

Here’s what else I’m keeping tabs on today:

-

US debt ceiling: A vote on a bipartisan deal to raise the borrowing limit could happen as soon as today after the House rules committee narrowly advanced the bill yesterday evening.

-

Economic data: Canada, Italy and Turkey report first-quarter gross domestic product figures, and Germany and France release May inflation data. The US Federal Reserve publishes its Beige Book on economic conditions.

-

Markets: The UK’s FTSE index holds its quarterly review. Bloomsbury Publishing, B&M European Value Retail, Nordstrom and Salesforce report results.

Five more top stories

1. Western countries are increasing pressure on Turkey to admit Sweden to Nato, with Sweden’s prime minister writing in the Financial Times that a new anti-terror law entering force tomorrow delivers “on the last part” of an agreement to secure Ankara’s support for its entry into the military alliance.

2. About half of the $1.4tn US junk loan market is still shackled to Libor just 30 days before the rate is set to expire. Corporate borrowers and the institutions facilitating their switch to its replacement benchmark face a crunch point to avoid automatically falling back on to potentially less favourable borrowing terms. Read the full story.

3. A top Federal Reserve official said there was no “compelling reason” to wait for another interest rate rise should economic data confirm that more must be done to bring US inflation under control. Read the FT’s interview with Cleveland Fed president Loretta Mester.

4. Exclusive: Labour will ban former ministers from lobbying the UK government for at least five years after leaving office and fine transgressors as the opposition party finalises its general election manifesto. Read more on Labour leader Sir Keir Starmer’s attempt to “clean up Westminster”.

5. Vladimir Putin has vowed to retaliate against what he claims were Ukrainian drone strikes on Moscow. The Russian president accused Kyiv of “terrorist activity” and provoking a “tit-for-tat” response after strikes in residential areas of the Russian capital yesterday morning.

Deep dive

Fearing a potential conflict in Asia, western companies are looking to move production out of Taiwan, but turning away from the self-ruled island will come at a high price for manufacturers. Explore how Taiwan became an indispensable economy for the production of everything from Chinese smartphones to US fighter jets in this visual story.

We’re also reading . . .

Chart of the day

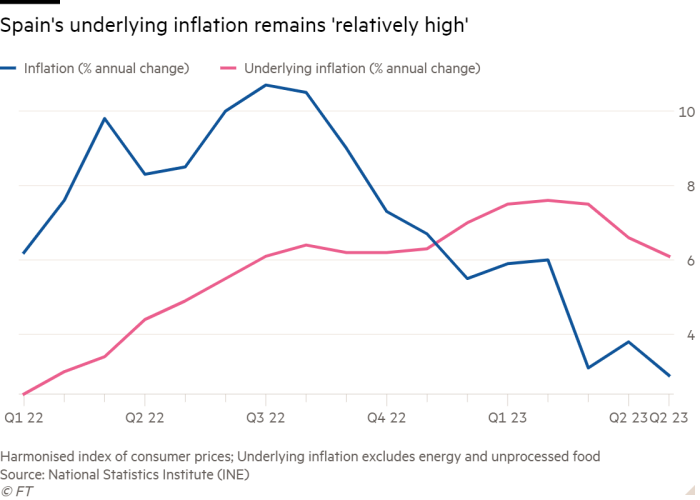

Inflation in Spain dropped more than expected to 2.9 per cent, its lowest level in almost two years, boosting hopes that price pressures would ease quickly across the eurozone.

Take a break from the news

Dyson’s latest invention radically combines a miniature air purifier with noise-cancelling headphones. Rhodri Marsden tries out the bizarre device and other gadgets for people on the move in this week’s HTSI.

Additional contributions by Darren Dodd and Emily Goldberg

[ad_2]

Source link