This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. On his way to Japan for the G7 summit, UK prime minister Rishi Sunak said that he is considering following Washington’s lead by imposing new restrictions on domestic companies making investments into critical industries in China.

US president Joe Biden has been drawing up a plan to limit investments in key parts of the Chinese economy by American companies that is yet to be announced.

Sunak said that any joint action over tougher controls on western investments in China was still a work in progress and would not be agreed at the Hiroshima summit given the US had not yet a “fully formed view”. But the prime minister added: “In broad terms, absolutely, that will be something we will be talking about.”

Placing further export controls on China will also be discussed by western allies at the G7 gathering with “economic security” high on the agenda, Sunak said.

-

UK-China relations: Rishi Sunak has backtracked on his promise to ban Confucius Institutes from operating in Britain, in the latest sign of the UK prime minister trying to improve relations with Beijing.

Here’s what else I’m watching today:

-

Biden meets Kishida: With US president Joe Biden set to arrive in Hiroshima for the G7 summit, he is expected to meet prime minister Fumio Kishida.

-

China-Central Asia Summit: President Xi Jinping hosts a two-day summit with the leaders of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan.

-

Earnings: Alibaba, BT Group, Burberry, easyJet, Investec, Premier Foods and Walmart are among the companies reporting results today.

Five more top stories

1. Ageing populations are hitting public finances across the world, as recent interest rate rises increase the impact of higher pensions and healthcare costs, rating agencies have warned. Moody’s, S&P and Fitch have all warned that worsening demographics are already hitting governments’ credit ratings with downgrades likely without sweeping reforms.

2. Taiwan’s largest opposition party has picked Hou Yu-ih as its presidential candidate for elections in January. Hou, the popular mayor of the country’s largest municipality, said that while he opposes Taiwan independence, he also rejects rule by China under “one country, two systems”. Read more about the mayor of New Taipei City.

3. Joe Biden was “confident” the US could avoid an unprecedented debt default, as he prepared to head for Japan for the G7 summit on Wednesday. Biden also left the door open to meeting a Republican demand and adding new work requirements to anti-poverty programmes. Here are the latest details on the fiscal stand-off, over which Biden plans to cut short his trip to Asia.

4. South Korea is trying to cut down on tech leaks to China with three leaks of major technologies in the first quarter of 2023. The country’s government now has a database of chip engineers in order to monitor their travel and has also tried to make it easier to prosecute would-be leakers.

5. Japan has emerged from a technical recession on the back of a post-Covid recovery in household spending and tourism, sending stocks to a new 33-year high in Asia’s most advanced economy. Economists warned, however, that the strength of Japan’s recovery was modest.

Big Read

Investors are pouring billions into companies that claim they can analyse DNA to detect cancer early. The technology has been hailed as “revolutionary” and “cutting edge” by British and US health chiefs, but some scientists question if it really works.

We’re also reading . . .

-

Flying high: Thomas Flohr aimed to upset the private jet industry. But after 19 years, the billions in debt held by his company VistaJet are causing concerns.

-

‘Defining decade’: Soaring commodity prices have helped Australia’s Labor party balance the books, but the nation will soon face a host of mounting bills.

-

Share buybacks: Company repurchases of their own stock hit a global record of $1.3tn last year, but such schemes are no substitute for thoughtful investment in growth and decent pay for staff, writes Brooke Masters.

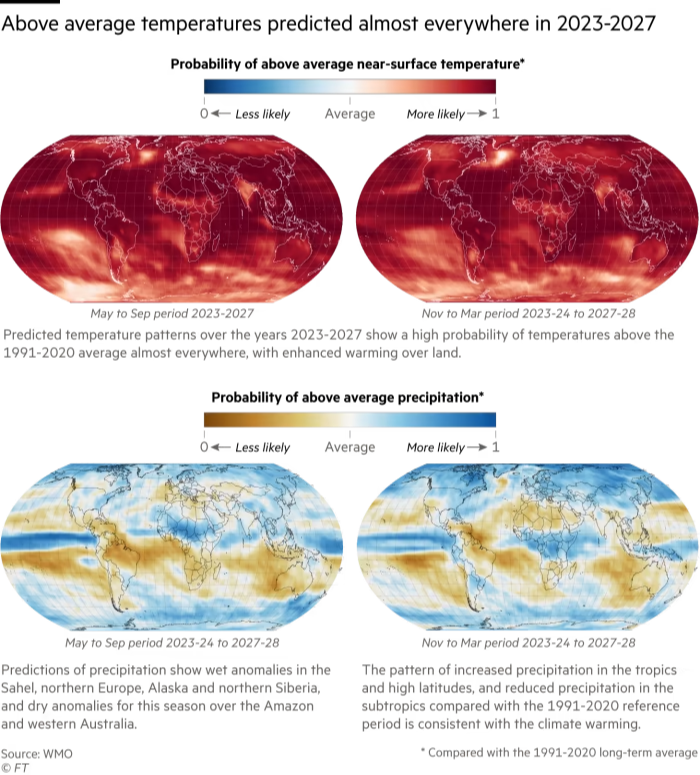

Graphic of the day

Global temperatures are likely to exceed 1.5C above pre-industrial levels for the first time in human history within the next five years, the World Meteorological Organization has said in its latest annual assessment.

Take a break from the news

People have been anticipating the cultural renaissance of the snoozy island nation of Singapore for nearly 15 years. Is it finally here?

Additional contributions by David Hindley and Gary Jones

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

Comments are closed, but trackbacks and pingbacks are open.