Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

A jump in self-directed investing has been partly propelled by a surge in the sway of financial influencers, research shows, but how are investors to tell if they are getting bad advice from social media?

This question is already beginning to vex regulators. In August last year the US Securities and Exchange Commission issued an investor alert about social media and investment fraud, while the UK’s Financial Conduct Authority issued a warning last month to “finfluencers” themselves on the risks of promoting illegal get-rich-quick schemes.

“I don’t think there is a way [to tell good finfluencers from bad ones]. People say bad things about good people and good things about bad people,” said Kevin Paffrath, a finfluencer who is known as Meet Kevin, to his 1.87mn subscribers on YouTube, and who has launched his very own exchange traded fund.

Paffrath himself is a case in point. Shortly after the MeetKevin Pricing Power ETF (PP) launched in December last year, Paffrath became unexpectedly embroiled in the scandal surrounding the collapse of crypto trading platform FTX.

Paffrath said he earned $289,000 from FTX endorsements. “We wish we had never worked with them in hindsight — so much bad press and we had no idea, nor could we have,” he said.

He has been named as a defendant in a class-action lawsuit brought by investors against a group of YouTube influencers that promoted FTX.

However, Paffrath is unusual among finfluencers in that he has gained a number of financial qualifications, including one to act as a licensed financial adviser.

Unlike him, the quality that most financial influencers share is that they have no formal financial education at all.

This might seem odd, but it could be an unfortunate byproduct of strict rules on marketing and endorsements that apply across the world to asset managers and other finance professionals.

Regulators themselves have been trying to fill the education gap — the SEC’s National Financial Capability Month in April was the latest example — but such campaigns face a tough battle for investors’ attention.

A report from Performance Marketing World published in August last year estimated that financial influencers experienced an average 8 per cent annual growth rate in the number of followers in 2021 — double the 4 per cent growth for all other influencers.

Newer investment apps lean heavily on finfluencers to spread the word about their services. Adam Lees, head of marketing at InvestEngine, a UK investment app that offers only ETFs, said the company worked with about 80 partners, including YouTubers, bloggers and personal finance websites.

Lees said around 40 per cent of marketing was spent on influencers, such as Jubair Ahmed, a postdoctoral researcher in biomedical engineering at University College London. He earns a fee when viewers of his InvestEngine content click a link that leads to the investment app.

BlackRock has caught the attention of many in the asset management industry by involving a finfluencer in an innovative sponsorship marketing campaign. The set of videos features five rookie US basketball hopefuls at the NBA Draft — a selection process that draws a wide audience across US society.

The basketball players are “coached” by social media influencer Lauren Simmons, previously one of the youngest traders on Wall St, who introduces them to investment principles that might guide how they invest the sponsorship money they receive as part of the campaign.

“iShares Future Baller$ was deliberately conceived at the intersection point of investing and basketball to introduce young and new investors to the iShares brand,” said Monique Le, head of iShares direct investing and marketing for the Americas.

“Our research showed the sport is a key passion point for our target audience and the campaign allowed us to meet them where they are.”

The campaign videos have been viewed 192mn times, according to BlackRock.

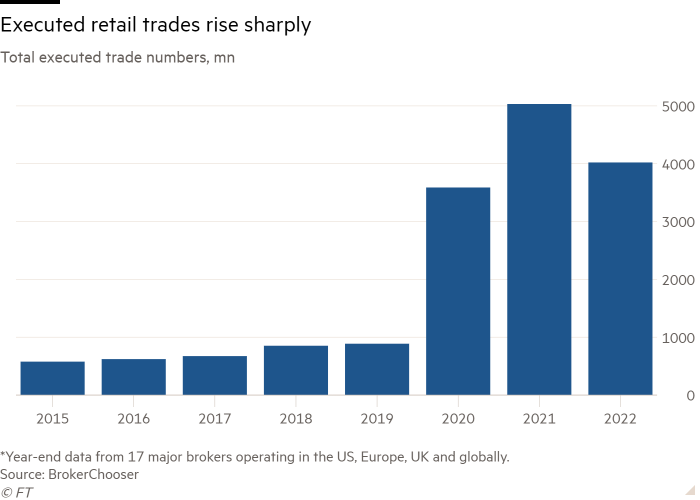

BrokerChooser, a consultancy, has measured new account openings at 17 brokers used by investors in the US, Europe, UK and globally, selected for their size, longevity and transparency of data.

The brokers had about 43mn retail accounts in 2020, but that number had jumped 120 per cent to about 94mn by the end of 2021. Growth has slowed since the end of the pandemic. There were about 121mn retail accounts at the end of the first quarter this year.

Even more striking was the jump in executed trades at these brokers, which rose more than 300 per cent from 887mn in 2019 to 3.6bn in 2020 and peaked at 5bn in 2021 before dropping back during last year’s adverse market conditions.

If qualitative research from the UK’s FCA is anything to go by, that huge growth in retail accounts could point to an urgent need for better education.

The new group of self-directed investors it studied were more than twice as likely to use YouTube and social media for their information than those who have been investing for longer.

But how are investors to trust what they are viewing?

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

Ahmed is very conscious of potential conflicts of interest and warns of the risks that self-directed investors face in consuming social media content.

“If I became a full-time creator, I think that would be a conflict of interest,” he said, adding that he thought in such circumstances it would be hard to stay true to his audience.

He said one tip he could provide on how to avoid unethical content creators on social media would be to steer clear of anyone who tries to convey a sense of urgency.

A general thumb rule might also be to look for transparency on how creators make their money, he said.

But as Paffrath points out, there is little regulation on social media. “As soon as I mention my ETF: ‘Hey check out my ETF, it’s the Pricing Power ETF . . .’ Boom! it has to go to regulation. But until then I’m completely separate and nobody checks anything, which I think is bad. I mean, I try to do my best.”

Comments are closed, but trackbacks and pingbacks are open.