[ad_1]

Japan’s stocks reached their highest level in 33 years on Tuesday, propelled by growing hopes of higher governance standards and more serious regard for shareholders after decades of lacklustre returns.

The broad Topix index rose almost 0.6 per cent on Tuesday, taking gains so far this year to 13.9 per cent and close to its highest level since Japan’s notorious market bubble burst in the final days of 1989. The Nikkei 225 index has gained more than 16 per cent since the start of the year and is again close to a post-bubble high, making Japan one of the hottest markets in the world.

Foreign investors have ploughed into stocks and futures in the past five weeks, with net inflows during the period reaching nearly $30bn, according to the Tokyo Stock Exchange (TSE), some of the largest inflows of the past decade.

As well as excitement over the potential for a historic rebalancing of corporate priorities, investors also said Japan was benefiting from a “not-China” trade, a perception that Tokyo was a safe way of gaining exposure to Chinese growth but with less geopolitical risk.

The interest in Japan comes after multiple false dawns and years of anaemic returns that persuaded many fund managers to stay clear of Japan and its tricky corporate structures, particularly with rich returns available elsewhere.

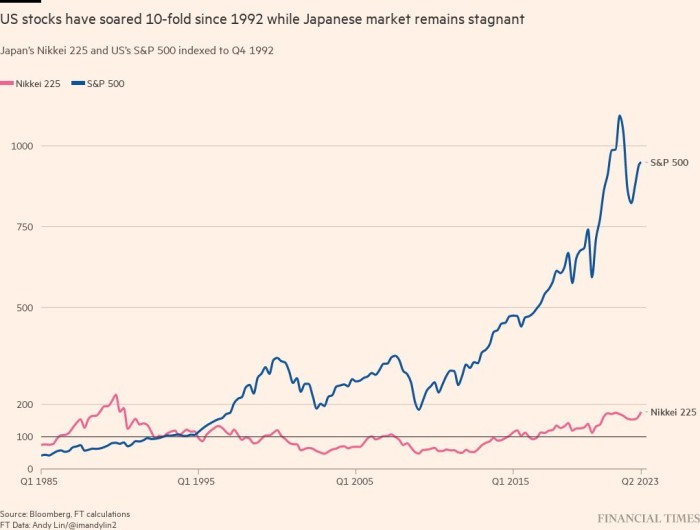

In the time it has taken Japanese stocks to recover from the 1989 crash, US equities have risen more than 10-fold.

However, some are warming to the notion that Tokyo’s stock market is now a trove of high-earning, undervalued stocks, with an accelerating wave of improvements in corporate governance.

Shrikant Kale, Japan equity strategist at Jefferies, said he had not seen so much foreign investor interest in Japan since the early days of the “Abenomics” era in 2012, when Shinzo Abe took office as prime minister and promised market-oriented reforms alongside efforts to pep up the moribund economy.

Adding to the momentum was a rare visit to Japan by Warren Buffett last month, when the US investor made clear he was keen on adding to his portfolio of Japanese investments.

At the same time, Japan stands out as a large developed Asian market that should benefit from China’s economic recovery without the geopolitical risks overshadowing its superpower neighbour, particularly in relation to Taiwan, said multiple fund managers.

Japan may perhaps be “the best not-China option for a global investor”, Kale said.

“Some investors think that Japanese companies have a big exposure to the upside in China but also that you can own them as a hedge against the geopolitical risk,” said Yunosuke Ikeda, chief Japan equity strategist at Nomura Securities.

Many Japanese companies offer exposure to China through exports or because they stand to benefit hugely from Chinese travel to Japan.

Japan’s relatively predictable policymaking also gives it an edge over China, where regulatory crackdowns can be rapid and harmful, said some investors.

“Japan occupies an interesting place geopolitically, and it’s not lost on investors that the rule of law is taken seriously and the corporate governance regime is quite favourable to owners of equities,” said Carl Vine, co-head of the Asia-Pacific equity team at M&G Investments.

Despite the stated optimism of many investors and the momentum behind the current rally, the “buy Japan” theme has yet to produce a sustained reallocation of assets. In Bank of America’s latest survey of global fund managers, released on Tuesday and covering a survey period in early May, respondents were a net 11 per cent underweight Japan, down 1 percentage point from the previous survey.

But evidence of momentum towards improving Japanese companies’ governance and their dealings with shareholders is pulling investment into Japanese stocks.

In recent months, Hiromi Yamaji, the new head of Japan Exchange Group, which controls the TSE, suggested the bourse intended to take a stronger position in pushing companies to raise their corporate value.

Companies need to pay closer attention to their price-to-book ratio, share price and capital cost, he told Japanese media, declaring that he was “not satisfied” with the way many listed companies had implemented the 2015 governance code.

“The [TSE] theme is resonating with a lot of overseas investors and they are starting to see evidence of that on the ground,” said Bruce Kirk, chief Japan equity strategist at Goldman Sachs. Pushed into action by these shifts at the exchange, many companies are buying back shares, untangling often confusing cross-shareholdings and engaging more closely with shareholders before their regular public meetings, Kirk said.

Buybacks announced across corporate Japan surged to an all-time high of ¥9.7tn ($71.4bn) in the financial year that ended in March.

Analysts forecast that companies will set a new record for buybacks by the end of May ahead of an annual meeting season where managements will be under more intense pressure to demonstrate that they are heeding the Tokyo exchange’s recent comments.

Jeff Atherton, head of Japanese equities at hedge fund group Man GLG, said the exchange’s encouragement meant “more has happened with this in the last two years than in the last 30”, creating the biggest single reason for stocks’ upbeat performance.

The exchange “has a determined attitude to driving up returns on equity”, said Atherton. “They want market capitalisations to go up.” Authorities can see that “in the top 500 companies in the world, very, very few are Japanese, and that hurts their ability to compete”, he added.

Buffett’s visit stirred up attention, but overseas investors said it did not change the country’s improving fundamental backdrop.

“It’s not Warren Buffett turning up that makes it interesting. He is observing what others are observing,” said M&G’s Vine. “I’m very excited” by the outlook, he added.

[ad_2]

Source link