[ad_1]

This article is an on-site version of our Moral Money newsletter. Sign up here to get the newsletter sent straight to your inbox.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

How much should venture capitalists worry about ESG scores and net zero goals when deciding which start-ups to take a punt on?

Not much, according to Michael Liebreich, who founded Bloomberg’s New Energy finance research service and is an angel investor in more than a dozen clean-tech start-ups. These include low-carbon fertiliser business CCm Technologies and ChargePoint, which develops electric charging infrastructure in the US and Europe.

“What start-ups should be doing is looking for pinch points” like technology failings, the expense involved in electrifying heating systems, or the need for reliable nuclear reactors, Liebreich told Moral Money.

Tesla is an example of a successful idea that does not necessarily translate easily into an ESG score. The electric-car maker has an unofficial target of selling 20mn vehicles a year by 2030 but a patchy record on social issues and a high exposure to the mining sector. It was removed from the S&P 500 ESG index last year after it faced racial discrimination allegations and fears around the safety of self-driving cars.

“I don’t know whether Elon Musk buys offsets when he travels, and he’s not a respectful employer from my perspective,” Liebreich said. “But clearly Tesla has moved the electrification of cars forward by decades. No accounting system will account for that.”

Today, Ivan Levingston, European deals reporter for the FT, writes about the latest VC to earn B-corp certification. And in a higher interest rate world, I ask what role venture capital can play in making sure climate start-ups get a reasonable shot at lift-off. (Kenza Bryan)

Venture capital ventures into the B Corp movement

The B Corp movement has been under scrutiny of late, with critics arguing the certification initiative has been letting its standards slip as it seeks to sign up big-name new members.

But it is still seeing fresh demand for its responsible business label from the venture capital industry.

Felix Capital is the latest VC firm to become a B Corp, as funds jostle to differentiate themselves amid a growing emphasis on sustainability across the technology ecosystem.

Founded in 2015, London-based Felix manages $1.2bn of assets and has backed prominent start-ups including the food delivery service Deliveroo and oat drink company Oatly.

It joins about 6,400 companies worldwide with B Corp certification, which requires them to pass an assessment of their sustainability credentials. They also need to make a legally binding commitment to pursue positive social and environmental impact.

Felix’s founder and managing partner Frederic Court sees the programme as a way to advance his firm’s values even while performance remains the priority.

“It’s the right way to be in business,” Court told me. “It’s not a religion; we don’t have to be dogmatic about it, but it means that everything we do, we have to think about how it impacts our status as a B Corp.”

Felix has shifted the way it operates, from altering its own partnership agreement to changing the term sheets it gives entrepreneurs in offering investment, which now come with language around diversity and sustainability.

Those changes have been welcomed by entrepreneurs. “There was zero pushback from founders. They totally embrace it,” Court said.

Felix has donated 1 per cent of carried interest — the profits generated by investment firms — from its third fund to a water charity. It’s also investing in companies such as Effy, a French business that helps people renovate their homes to increase energy efficiency.

Felix chose to pursue B Corp certification over other options like rebranding itself as an impact fund — even though that might have made it easier to raise funds, Court said. “We don’t want to take money from investors by ticking boxes,” he said.

Other VCs that have become B Corps include Obvious Ventures, MMC Ventures and real estate technology investor Fifth Wall, according to the website of B Lab, the non-profit group that runs the certification programme.

“It’s easy to criticise,” Court said, pushing back against the notion that B Corp status is easy to attain. “It’s already harder . . . especially for smaller companies.” (Ivan Levingston).

Climate group mushrooms to welcome VCs

The decision by the world’s biggest climate finance grouping to launch a venture capital arm is the latest sign of the pressure that VCs face to shield their investors from risks around the energy transition.

Smaller energy-focused funds like Energy Impact Partners signed up to Mark Carney’s Glasgow Financial Alliance for Net Zero last month, as did bigger investors with a broad tech focus such as New York-based Tiger Global.

But the launch came in the wake of a mass exodus of major insurers like Munich Re from Gfanz in recent weeks, prompted by fears of a possible backlash against climate collaboration by competition authorities (a risk that has been hammed up by anti-ESG Republican politicians in the US).

The recent headwinds for Gfanz are worth keeping in mind when considering its baby-step approach for its 23 new VC members. They must “encourage and assist” portfolio companies to set net zero carbon emission goals — but can keep investing in potential high emitters while remaining part of the group.

Unlike the banking, insurance and asset management worlds, venture capital does not yet have an established framework for measuring carbon emissions. One of the dilemmas is whether to look at the potential emissions of a start-up over its whole lifetime, as opposed to in its first growth years. As Michael Liebreich highlighted, carbon is not necessarily the best metric for assessing a start-up’s potential to change the world.

Rather than setting a strict decarbonisation goal, the point of Gfanz’s new grouping is to develop ESG tools appropriate to early-stage investments. “Our goal is to bridge the gap between what’s happening in public markets . . . and early-stage innovation,” said Alexandra Harbour, founder and chair of the new group and a principal at San Francisco-based Prelude Ventures.

Market forces are already pushing more VCs towards climate-friendly investments, particularly because the US Inflation Reduction Act and the EU Green Deal Industrial Plan are bringing increasing tailwinds to the space.

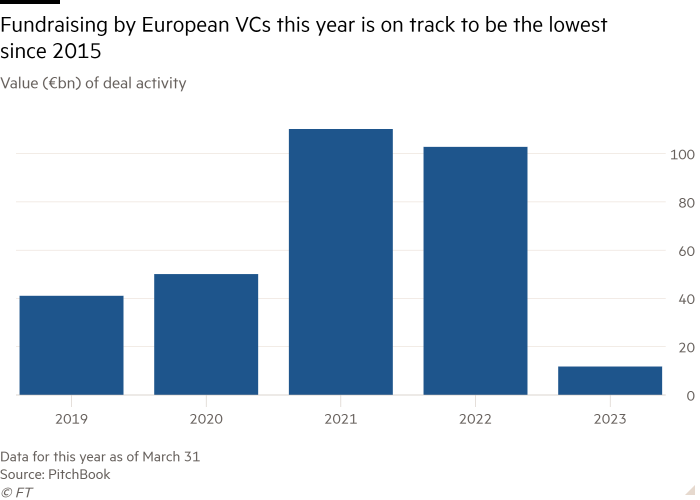

Investments in climate tech were resilient to the broader market downturn in VC dealmaking between January and March, according to data provider PitchBook.

Climate-focused Congruent Ventures closed a $300mn fund last month on the back of what it said was growing interest from institutional investors in later stage climate start-ups. One of its investments, protein start-up Meati, makes vegetarian steaks from mycelium, a network of underground mushroom roots. It is hard to predict exactly how it will reshape the space — its founders originally tried to use mushrooms as a replacement for the energy-intensive graphite in lithium-ion batteries. (Kenza Bryan)

Smart Read

Goldman Sachs has settled a longstanding gender discrimination lawsuit that was scheduled to go to trial in New York next month. Thousands of employees are set to get a payout.

Moral Money Summit Europe

Join us in London, or online, for the third annual Moral Money Summit Europe on May 23-24. Leading investors, corporates and policymakers will come together to discuss what needs to happen next to unlock a more sustainable, equitable and inclusive economy.

[ad_2]

Source link